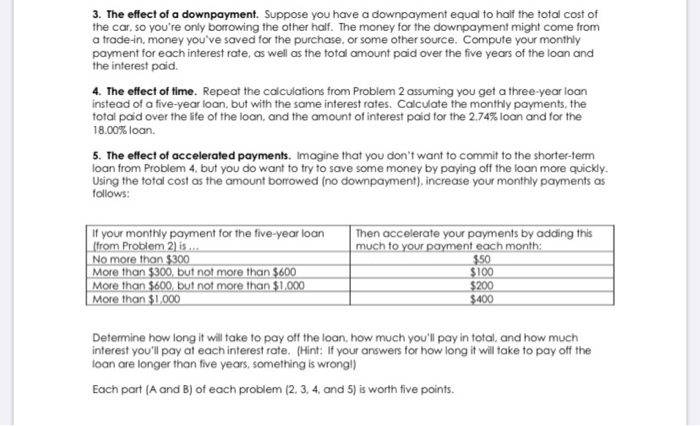

3. The effect of a downpayment. Suppose you have a downpayment equal to half the total cost of the car, so you're only borrowing the other half. The money for the downpayment might come from a trade-in, money you've saved for the purchase, or some other source. Compute your monthly payment for each interest rate, as well as the total amount paid over the five years of the loan and the interest paid. 4. The effect of time. Repeat the calculations from Problem 2 assuming you get a three-year loan instead of a five-year loan, but with the same interest rates Calculate the monthly payments, the total paid over the life of the loan and the amount of interest paid for the 2.74% loan and for the 18.00% loan 5. The effect of accelerated payments. Imagine that you don't want to commit to the shorter-term loan from Problem 4, but you do want to try to save some money by paying off the loan more quickly. Using the total cost as the amount borrowed (no downpayment), increase your monthly payments as follows: if your monthly payment for the five-year loan (from Problem 2) is. No more than $300 More than $300, but not more than $600 More than $600, but not more than $1,000 More than $1,000 Then accelerate your payments by adding this much to your payment each month: $50 $100 $200 $400 Determine how long it will take to pay off the loan, how much you'll pay in total, and how much interest you'll pay at each interest rate. (Hint: If your answers for how long it will take to pay off the loan are longer than five years, something is wrong!) Each port (A and B) of each problem (2.3, 4 and 5) is worth five points. 3. The effect of a downpayment. Suppose you have a downpayment equal to half the total cost of the car, so you're only borrowing the other half. The money for the downpayment might come from a trade-in, money you've saved for the purchase, or some other source. Compute your monthly payment for each interest rate, as well as the total amount paid over the five years of the loan and the interest paid. 4. The effect of time. Repeat the calculations from Problem 2 assuming you get a three-year loan instead of a five-year loan, but with the same interest rates Calculate the monthly payments, the total paid over the life of the loan and the amount of interest paid for the 2.74% loan and for the 18.00% loan 5. The effect of accelerated payments. Imagine that you don't want to commit to the shorter-term loan from Problem 4, but you do want to try to save some money by paying off the loan more quickly. Using the total cost as the amount borrowed (no downpayment), increase your monthly payments as follows: if your monthly payment for the five-year loan (from Problem 2) is. No more than $300 More than $300, but not more than $600 More than $600, but not more than $1,000 More than $1,000 Then accelerate your payments by adding this much to your payment each month: $50 $100 $200 $400 Determine how long it will take to pay off the loan, how much you'll pay in total, and how much interest you'll pay at each interest rate. (Hint: If your answers for how long it will take to pay off the loan are longer than five years, something is wrong!) Each port (A and B) of each problem (2.3, 4 and 5) is worth five points