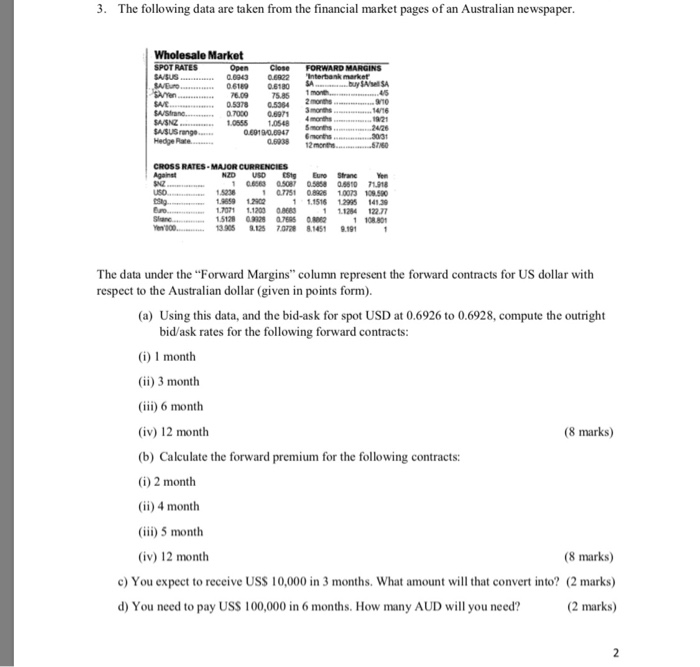

3. The following data are taken from the financial market pages of an Australian newspaper. Wholesale Market FORWARD MARGINS "Interbank market SA.. buy SASA more SPOT RATES SA SUS SAD Saren......... SAVE............... SA Strand SA/SNZ SASUS range Hedge Rate...... Open Close 0.0943 QE22 0.6189 0.6180 76.09 75.85 0.5378 0.5384 0.7000 0.6971 10555 1,0548 0.6919/0.8947 0.0038 3 months Amorth . 132 . months 12 months CROSS RATES-MAJOR CURRENCIES NZDVD Sigure Strane Yen 1 C 0.08 0.5858 0.651074918 15936 1 .7751 0.0006 10073 10.500 109 1 1 1,151612095 141.39 Euro. 1.707111203 A 1 11284 122.77 15128 129 766 0 1 108.801 13.905 0.125 70728 8.1451 2.191 The data under the "Forward Margins" column represent the forward contracts for US dollar with respect to the Australian dollar (given in points form). (a) Using this data, and the bid-ask for spot USD at 0.6926 to 0.6928, compute the outright bid/ask rates for the following forward contracts: (i) 1 month (ii) 3 month (iii) 6 month (iv) 12 month (8 marks) (b) Calculate the forward premium for the following contracts: (i) 2 month (ii) 4 month (iii) 5 month (iv) 12 month (8 marks) c) You expect to receive US$ 10,000 in 3 months. What amount will that convert into? (2 marks) d) You need to pay USS 100,000 in 6 months. How many AUD will you need? (2 marks) 3. The following data are taken from the financial market pages of an Australian newspaper. Wholesale Market FORWARD MARGINS "Interbank market SA.. buy SASA more SPOT RATES SA SUS SAD Saren......... SAVE............... SA Strand SA/SNZ SASUS range Hedge Rate...... Open Close 0.0943 QE22 0.6189 0.6180 76.09 75.85 0.5378 0.5384 0.7000 0.6971 10555 1,0548 0.6919/0.8947 0.0038 3 months Amorth . 132 . months 12 months CROSS RATES-MAJOR CURRENCIES NZDVD Sigure Strane Yen 1 C 0.08 0.5858 0.651074918 15936 1 .7751 0.0006 10073 10.500 109 1 1 1,151612095 141.39 Euro. 1.707111203 A 1 11284 122.77 15128 129 766 0 1 108.801 13.905 0.125 70728 8.1451 2.191 The data under the "Forward Margins" column represent the forward contracts for US dollar with respect to the Australian dollar (given in points form). (a) Using this data, and the bid-ask for spot USD at 0.6926 to 0.6928, compute the outright bid/ask rates for the following forward contracts: (i) 1 month (ii) 3 month (iii) 6 month (iv) 12 month (8 marks) (b) Calculate the forward premium for the following contracts: (i) 2 month (ii) 4 month (iii) 5 month (iv) 12 month (8 marks) c) You expect to receive US$ 10,000 in 3 months. What amount will that convert into? (2 marks) d) You need to pay USS 100,000 in 6 months. How many AUD will you need? (2 marks)