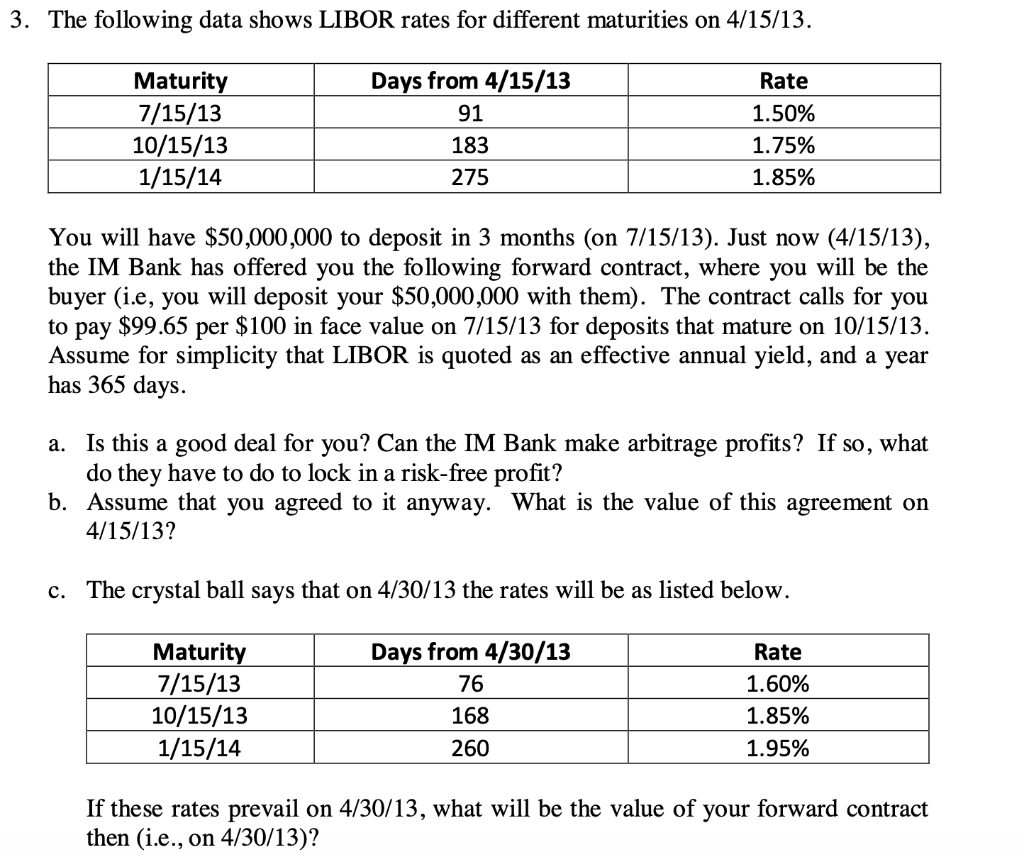

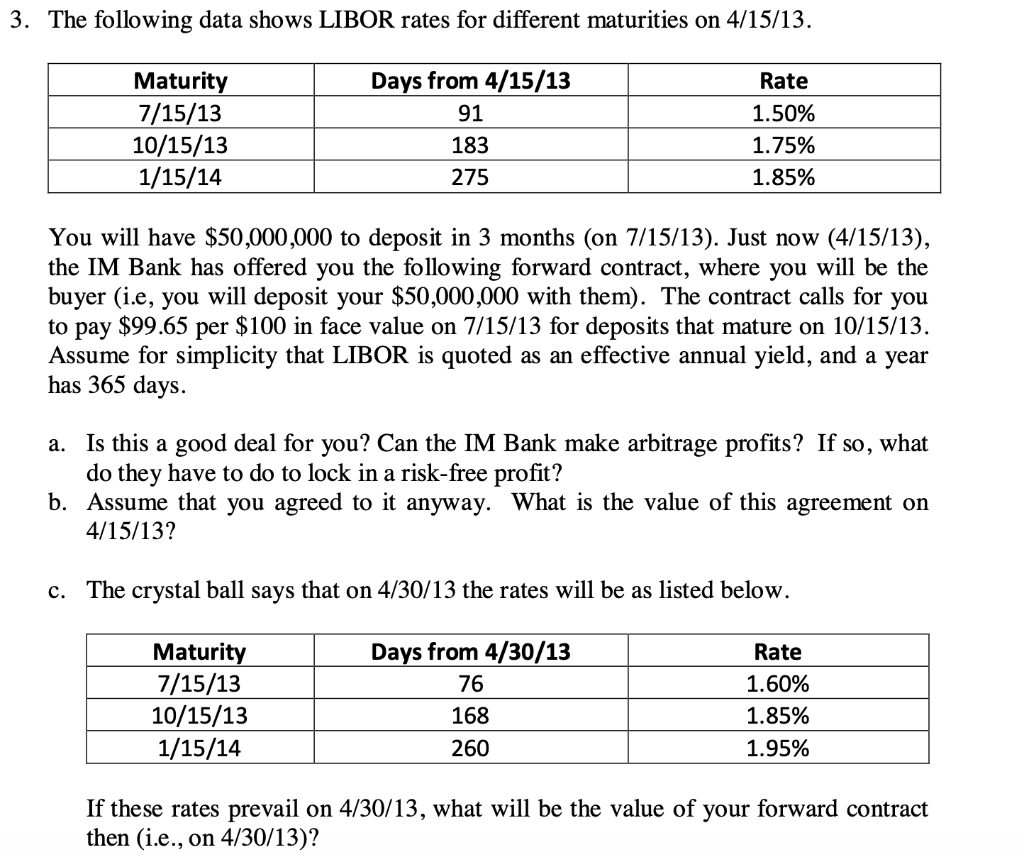

3. The following data shows LIBOR rates for different maturities on 4/15/13. Maturity 7/15/13 10/15/13 1/15/14 Days from 4/15/13 91 183 275 Rate 1.50% 1.75% 1.85% You will have $50,000,000 to deposit in 3 months (on 7/15/13). Just now (4/15/13), the IM Bank has offered you the following forward contract, where you will be the buyer (i.e, you will deposit your $50,000,000 with them). The contract calls for you to pay $99.65 per $100 in face value on 7/15/13 for deposits that mature on 10/15/13 Assume for simplicity that LIBOR is quoted as an effective annual yield, and a year has 365 days. a. Is this a good deal for you? Can the IM Bank make arbitrage profits? If so, what do they have to do to lock in a risk-free profit? b. Assume that you agreed to it anyway. What is the value of this agreement on 4/15/13? c. The crystal ball says that on 4/30/13 the rates will be as listed below. D . Maturity 7/15/13 10/15/13 1/15/14 Days from 4/30/13 76 168 260 Rate 1.60% 1.85% 1.95% If these rates prevail on 4/30/13, what will be the value of your forward contract then (i.e., on 4/30/13)? 3. The following data shows LIBOR rates for different maturities on 4/15/13. Maturity 7/15/13 10/15/13 1/15/14 Days from 4/15/13 91 183 275 Rate 1.50% 1.75% 1.85% You will have $50,000,000 to deposit in 3 months (on 7/15/13). Just now (4/15/13), the IM Bank has offered you the following forward contract, where you will be the buyer (i.e, you will deposit your $50,000,000 with them). The contract calls for you to pay $99.65 per $100 in face value on 7/15/13 for deposits that mature on 10/15/13 Assume for simplicity that LIBOR is quoted as an effective annual yield, and a year has 365 days. a. Is this a good deal for you? Can the IM Bank make arbitrage profits? If so, what do they have to do to lock in a risk-free profit? b. Assume that you agreed to it anyway. What is the value of this agreement on 4/15/13? c. The crystal ball says that on 4/30/13 the rates will be as listed below. D . Maturity 7/15/13 10/15/13 1/15/14 Days from 4/30/13 76 168 260 Rate 1.60% 1.85% 1.95% If these rates prevail on 4/30/13, what will be the value of your forward contract then (i.e., on 4/30/13)