Answered step by step

Verified Expert Solution

Question

1 Approved Answer

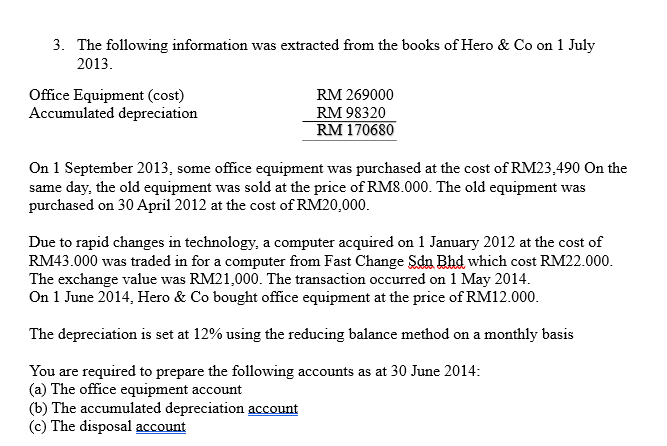

3. The following information was extracted from the books of Hero & Co on 1 July 2013. Office Equipment (cost) Accumulated depreciation RM 269000

3. The following information was extracted from the books of Hero & Co on 1 July 2013. Office Equipment (cost) Accumulated depreciation RM 269000 RM 98320 RM 170680 On 1 September 2013, some office equipment was purchased at the cost of RM23,490 On the same day, the old equipment was sold at the price of RM8.000. The old equipment was purchased on 30 April 2012 at the cost of RM20,000. Due to rapid changes in technology, a computer acquired on 1 January 2012 at the cost of RM43.000 was traded in for a computer from Fast Change Sdn Bhd which cost RM22.000. The exchange value was RM21,000. The transaction occurred on 1 May 2014. On 1 June 2014, Hero & Co bought office equipment at the price of RM12.000. The depreciation is set at 12% using the reducing balance method on a monthly basis You are required to prepare the following accounts as at 30 June 2014: (a) The office equipment account (b) The accumulated depreciation account (c) The disposal account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The office equipment account as at 30 June 2014 RM 1 July 2013 Cost 269000 1 Sep 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started