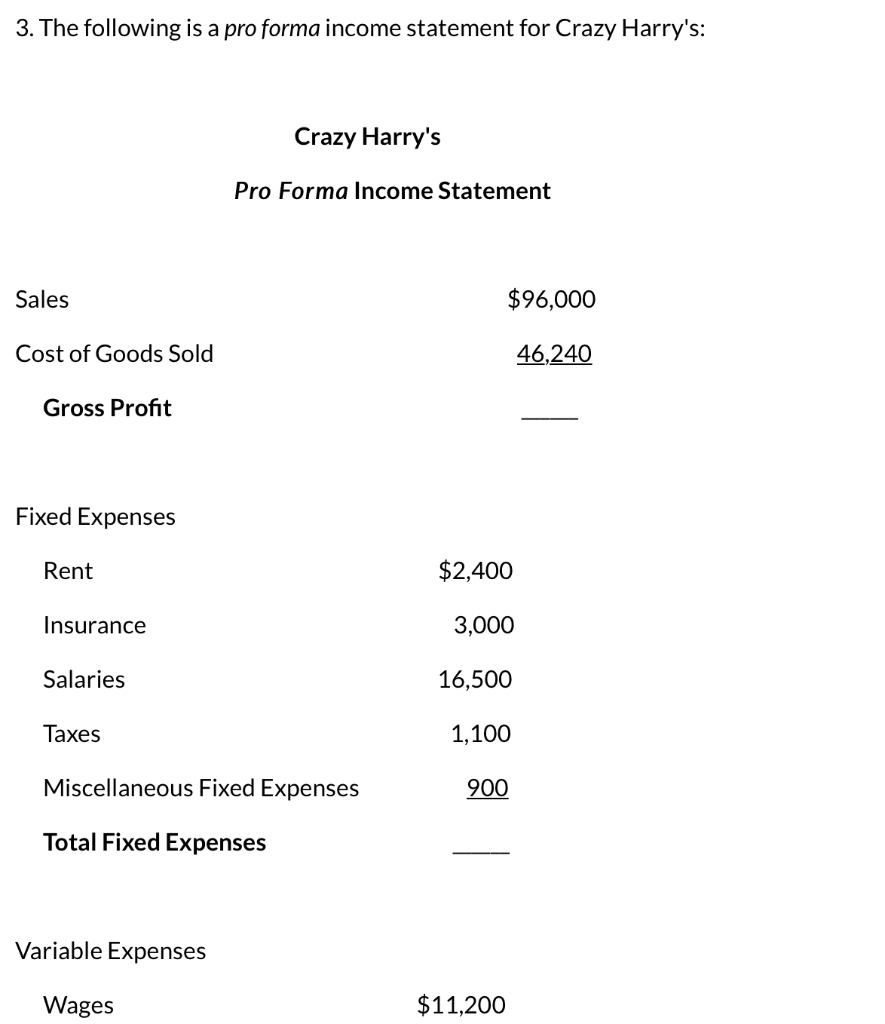

3. The following is a pro forma income statement for Crazy Harry's: Sales Cost of Goods Sold Gross Profit Fixed Expenses Rent Crazy Harry's

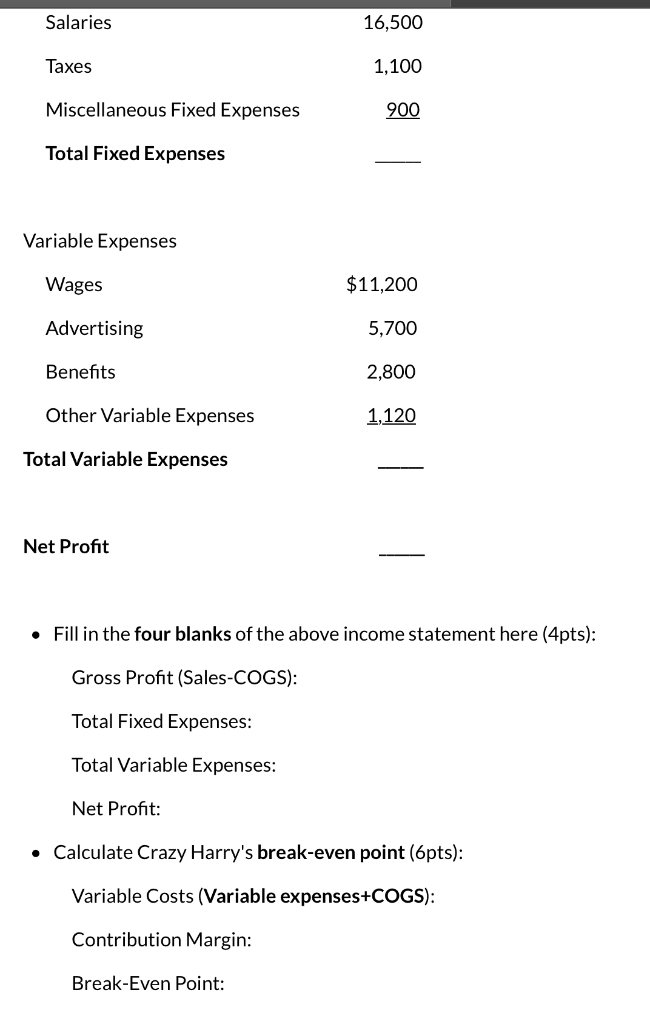

3. The following is a pro forma income statement for Crazy Harry's: Sales Cost of Goods Sold Gross Profit Fixed Expenses Rent Crazy Harry's Pro Forma Income Statement $2,400 Insurance 3,000 Salaries 16,500 Taxes 1,100 Miscellaneous Fixed Expenses 900 Total Fixed Expenses Variable Expenses Wages $11,200 $96,000 46,240 Salaries Taxes Miscellaneous Fixed Expenses Total Fixed Expenses 16,500 1,100 900 Variable Expenses Wages $11,200 Advertising 5,700 Benefits 2,800 Other Variable Expenses 1,120 Total Variable Expenses Net Profit Fill in the four blanks of the above income statement here (4pts): Gross Profit (Sales-COGS): Total Fixed Expenses: Total Variable Expenses: Net Profit: Calculate Crazy Harry's break-even point (6pts): Variable Costs (Variable expenses+COGS): Contribution Margin: Break-Even Point:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets fill in the blanks from the given pro forma income statement for Crazy Harrys and calculate the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started