Answered step by step

Verified Expert Solution

Question

1 Approved Answer

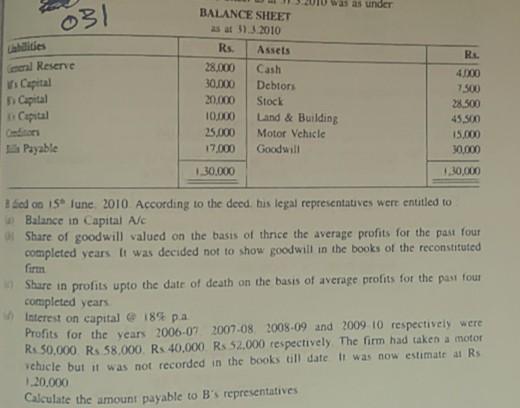

nnnnm was as under 031 BALANCE SHEET 25 at 31.3.2010 Aides Rs. Assets R. eral Reserve 4.000 Capital Capital 28.000 30.000 20.000 10.000 25.000 17.000

nnnnm

was as under 031 BALANCE SHEET 25 at 31.3.2010 Aides Rs. Assets R. eral Reserve 4.000 Capital Capital 28.000 30.000 20.000 10.000 25.000 17.000 Cash Debtors Stock Land & Building Motor Vehicle Goodwill 7.500 28.500 45.500 15.000 Payable 30.000 1:30.000 130,000 sed on 15 lune 2010 According to the deed his legal representatives were entitled to Balance in Capital Alc Share of goodwill valued on the basis of thrice the average profits for the past four completed years It was decided not to show goodwill in the books of the reconstituted firm Share in profits upto the date of death on the basis of average profits for the past four completed years Interest on capital @ 18% pa Profits for the years 2006-07 2007.08 2008-09 and 2009 10 respectively were R: 50,000 Rs 58.000Rs 40,000 Rs 52.000 respectively. The firm had taken a motor chicle but it was not recorded in the books till date it was now estimate at Rs 120.000 Calculate the amount payable to B's representativesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started