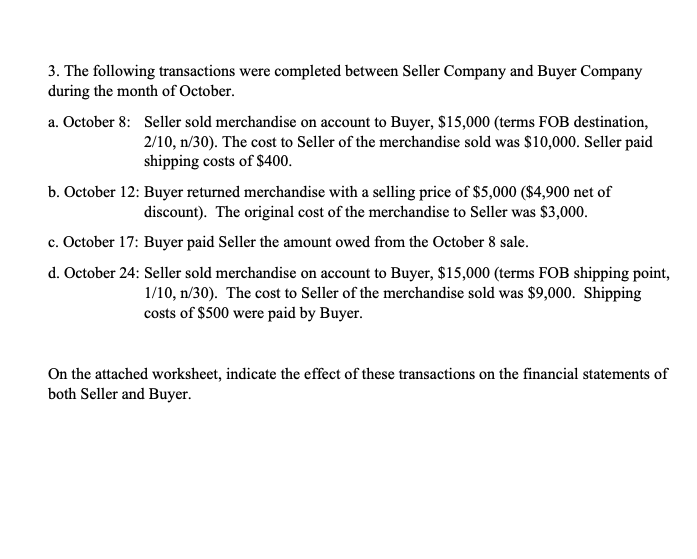

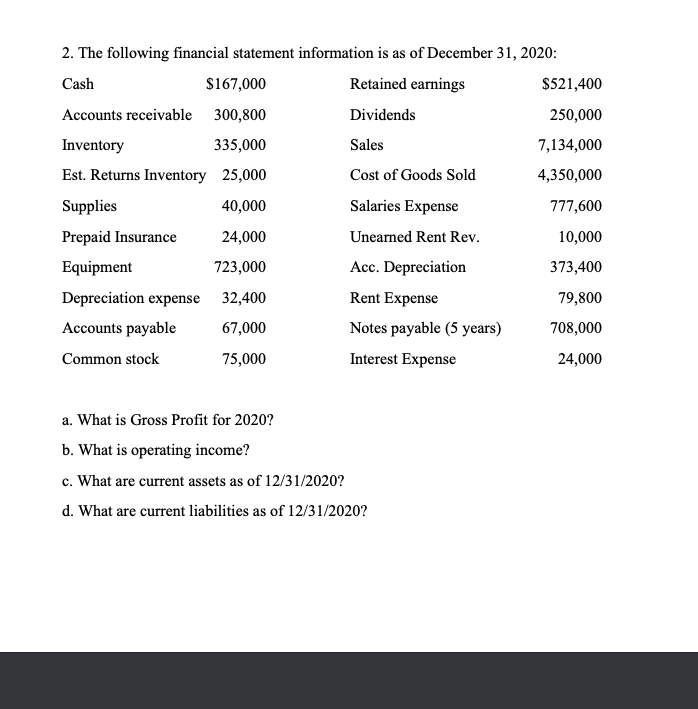

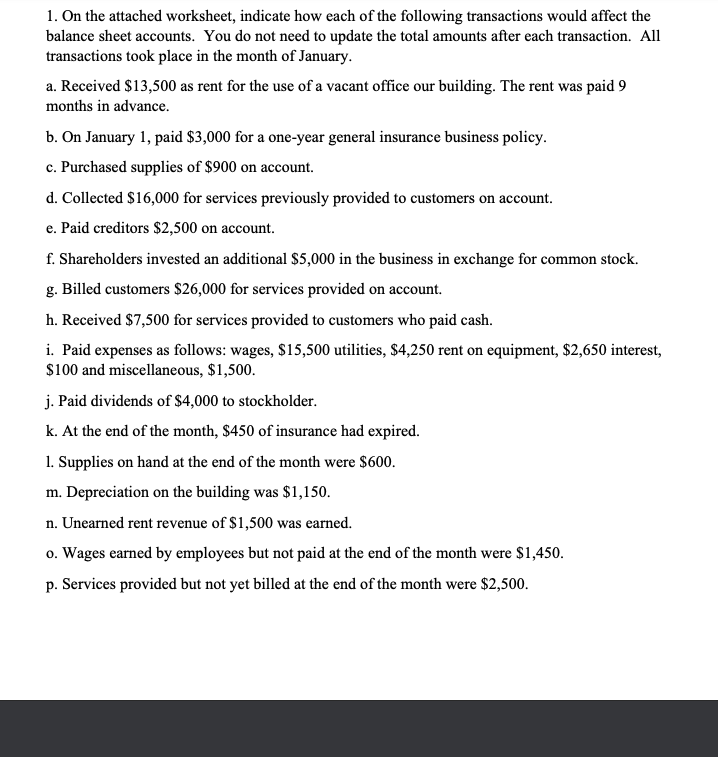

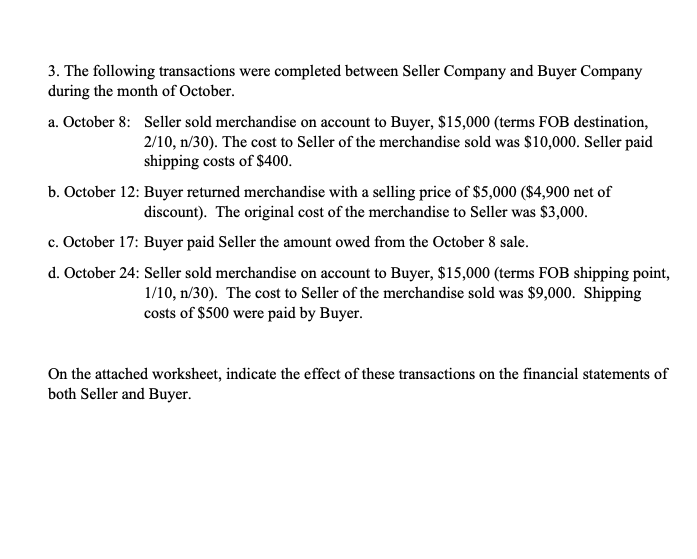

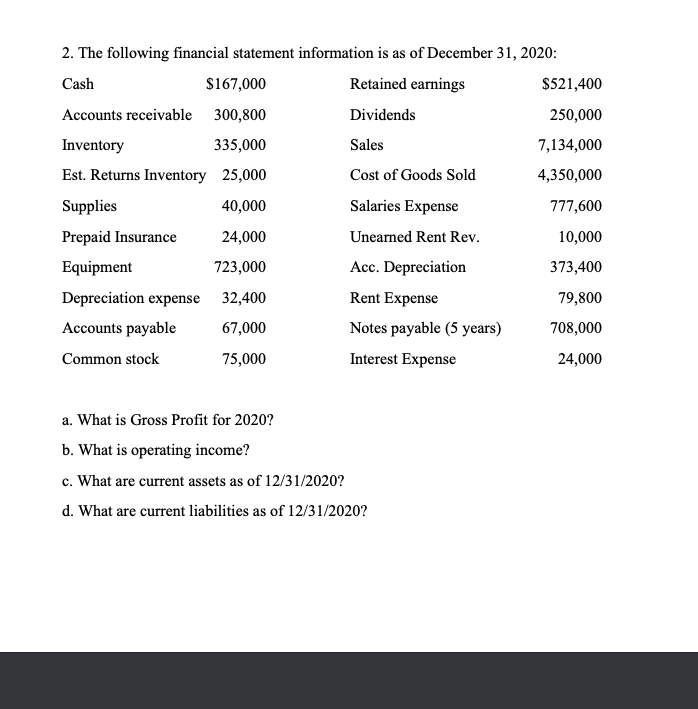

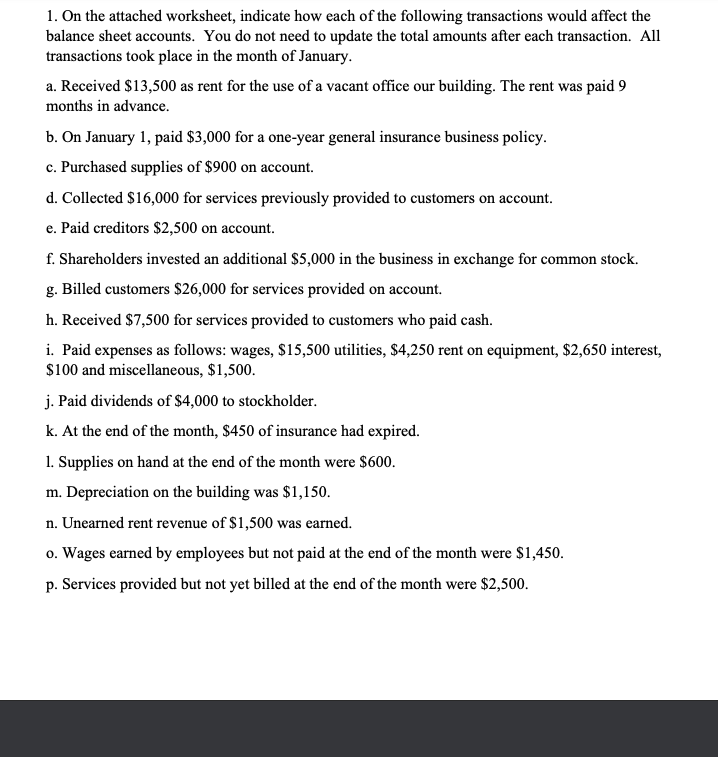

3. The following transactions were completed between Seller Company and Buyer Company during the month of October. a. October 8: Seller sold merchandise on account to Buyer, $15,000 (terms FOB destination, 2/10, n/30). The cost to Seller of the merchandise sold was $10,000. Seller paid shipping costs of $400. b. October 12: Buyer returned merchandise with a selling price of $5,000 ($4,900 net of discount). The original cost of the merchandise to Seller was $3,000. c. October 17: Buyer paid Seller the amount owed from the October 8 sale. d. October 24: Seller sold merchandise on account to Buyer, $15,000 (terms FOB shipping point, 1/10, n/30). The cost to Seller of the merchandise sold was $9,000. Shipping costs of $500 were paid by Buyer. On the attached worksheet, indicate the effect of these transactions on the financial statements of both Seller and Buyer. 2. The following financial statement information is as of December 31, 2020: Cash $167,000 Retained earnings $521,400 Accounts receivable 300,800 Dividends 250,000 Inventory 335,000 Sales 7,134,000 Est. Returns Inventory 25,000 Cost of Goods Sold 4,350,000 Supplies 40,000 Salaries Expense 777,600 Prepaid Insurance 24,000 Unearned Rent Rev. 10,000 Equipment 723,000 Acc. Depreciation 373,400 Depreciation expense 32,400 Rent Expense 79,800 Accounts payable 67,000 Notes payable (5 years) 708,000 Common stock 75,000 Interest Expense 24,000 a. What is Gross Profit for 2020? b. What is operating income? c. What are current assets as of 12/31/2020? d. What are current liabilities as of 12/31/2020? 1. On the attached worksheet, indicate how each of the following transactions would affect the balance sheet accounts. You do not need to update the total amounts after each transaction. All transactions took place in the month of January. a. Received $13,500 as rent for the use of a vacant office our building. The rent was paid 9 months in advance. b. On January 1, paid $3,000 for a one-year general insurance business policy. c. Purchased supplies of $900 on account. d. Collected $16,000 for services previously provided to customers on account. e. Paid creditors $2,500 on account. f. Shareholders invested an additional $5,000 in the business in exchange for common stock. g. Billed customers $26,000 for services provided on account. h. Received $7,500 for services provided to customers who paid cash. i. Paid expenses as follows: wages, $15,500 utilities, $4,250 rent on equipment, $2,650 interest, $100 and miscellaneous, $1,500. j. Paid dividends of $4,000 to stockholder. k. At the end of the month, $450 of insurance had expired. 1. Supplies on hand at the end of the month were $600. m. Depreciation on the building was $1,150. n. Unearned rent revenue of $1,500 was earned. 0. Wages earned by employees but not paid at the end of the month were $1,450. p. Services provided but not yet billed at the end of the month were $2,500