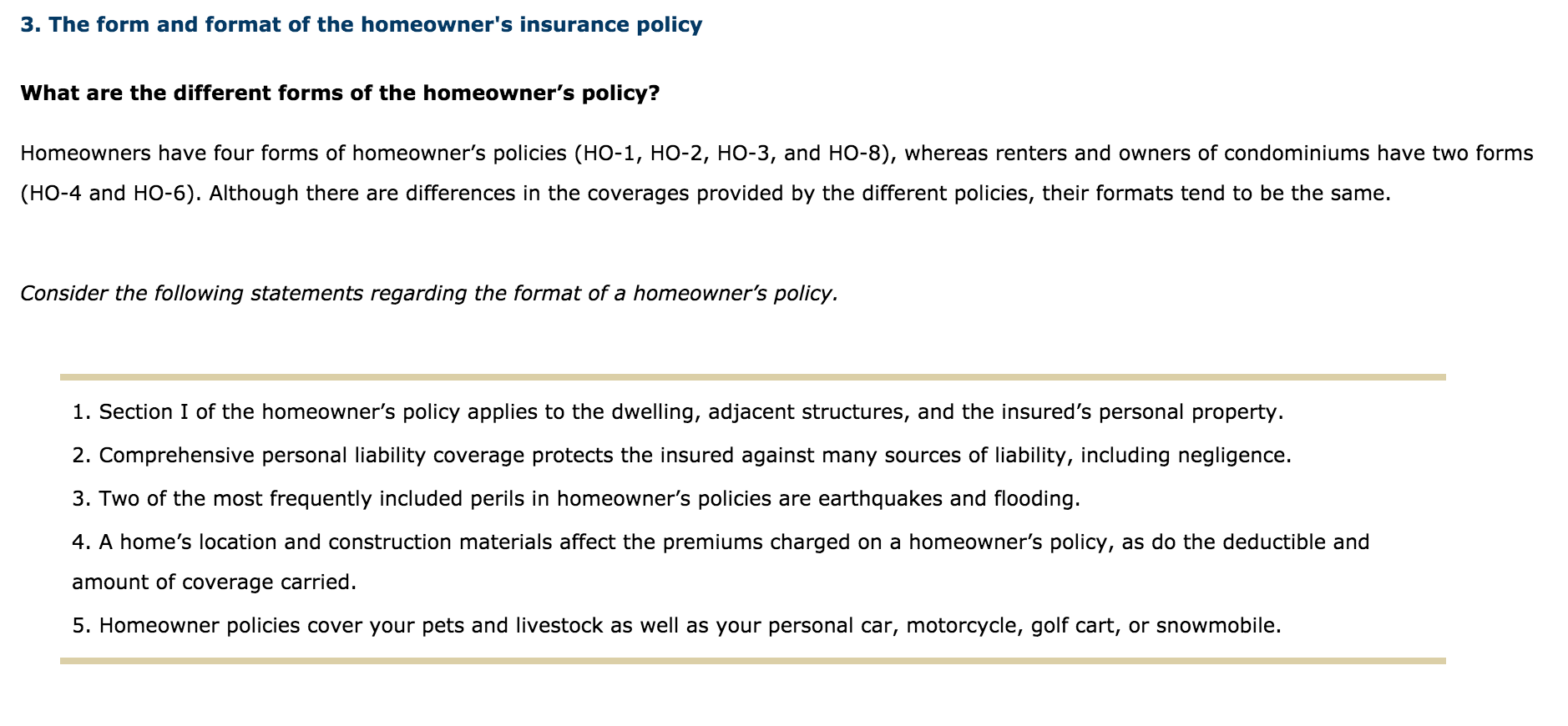

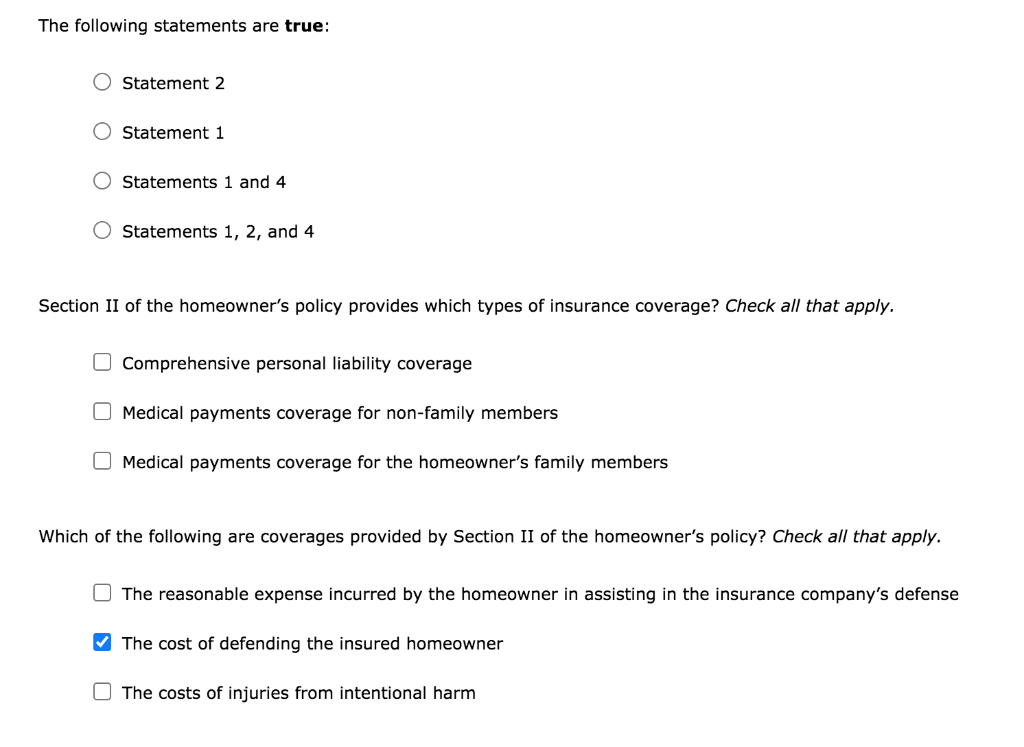

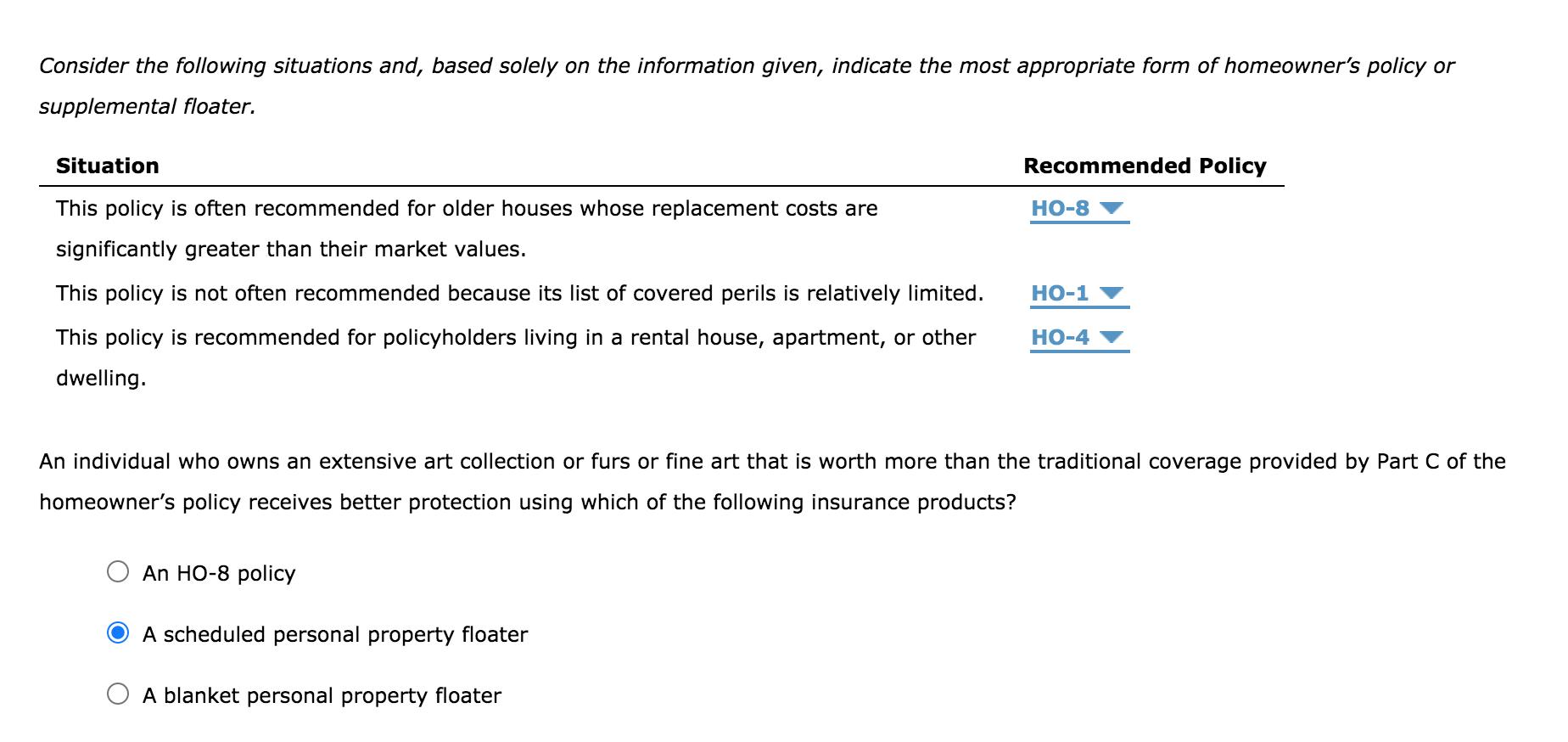

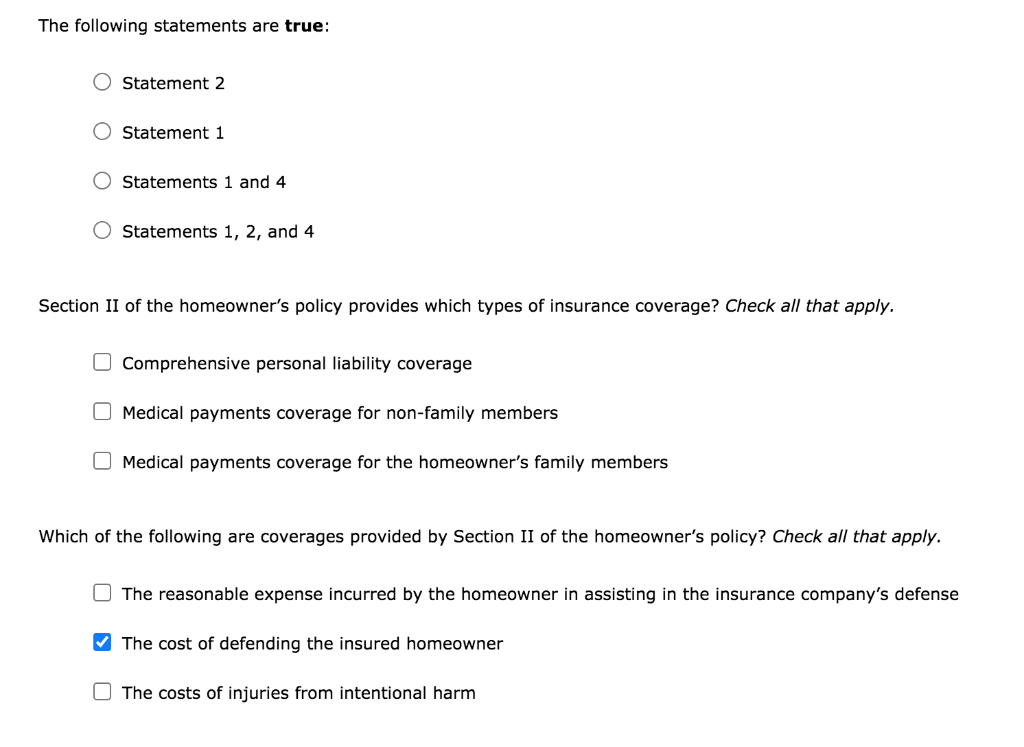

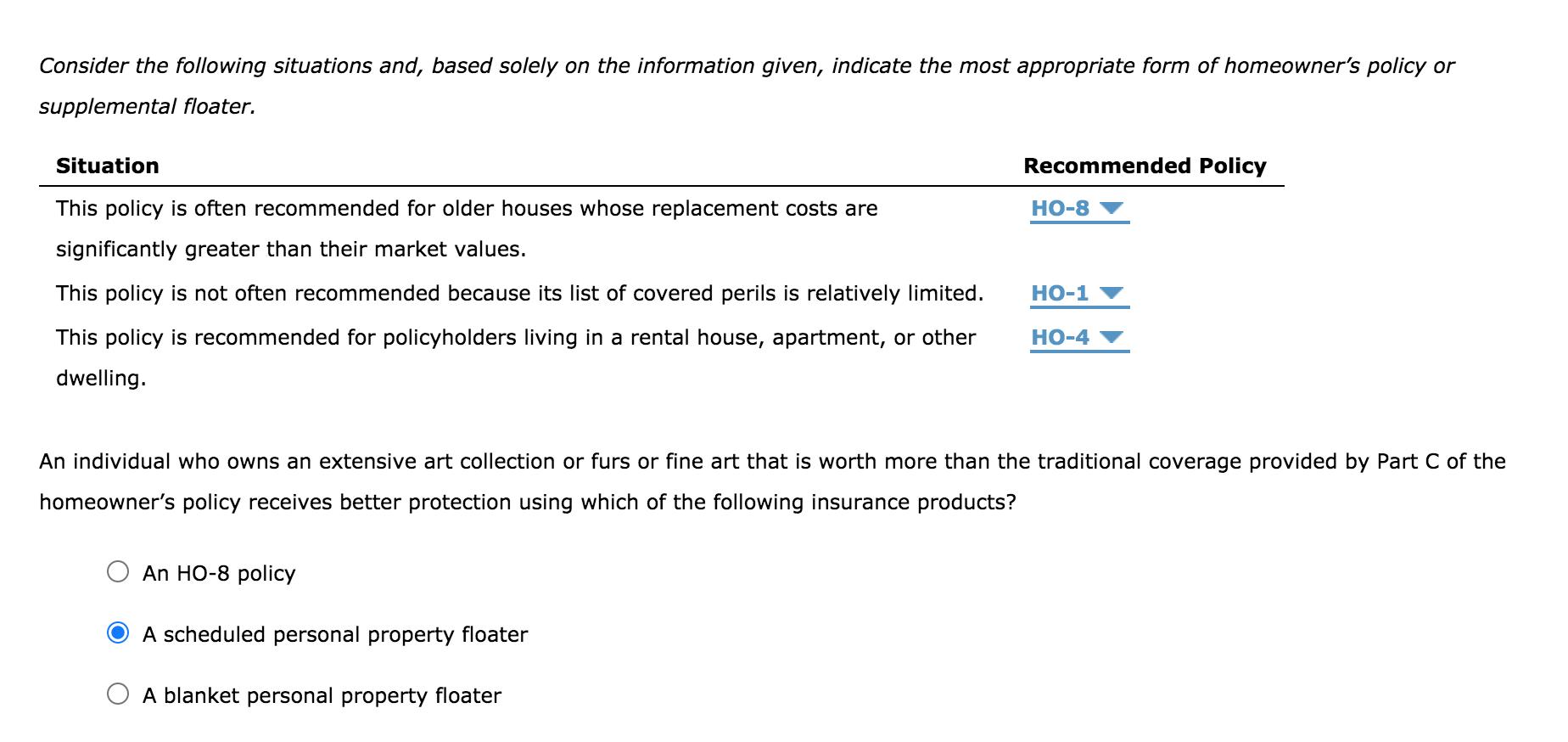

3. The form and format of the homeowner's insurance policy What are the different forms of the homeowner's policy? Homeowners have four forms of homeowner's policies (HO-1, HO-2, HO-3, and HO-8), whereas renters and owners of condominiums have two forms (HO-4 and HO-6). Although there are differences in the coverages provided by the different policies, their formats tend to be the same. Consider the following statements regarding the format of a homeowner's policy. 1. Section I of the homeowner's policy applies to the dwelling, adjacent structures, and the insured's personal property. 2. Comprehensive personal liability coverage protects the insured against many sources of liability, including negligence. 3. Two of the most frequently included perils in homeowner's policies are earthquakes and flooding. 4. A home's location and construction materials affect the premiums charged on a homeowner's policy, as do the deductible and amount of coverage carried. 5. Homeowner policies cover your pets and livestock as well as your personal car, motorcycle, golf cart, or snowmobile. The following statements are true: Statement 2 Statement 1 Statements 1 and 4 O Statements 1, 2, and 4 Section II of the homeowner's policy provides which types of insurance coverage? Check all that apply. O Comprehensive personal liability coverage Medical payments coverage for non-family members Medical payments coverage for the homeowner's family members Which of the following are coverages provided by Section II of the homeowner's policy? Check all that apply. The reasonable expense incurred by the homeowner in assisting in the insurance company's defense The cost of defending the insured homeowner The costs of injuries from intentional harm Consider the following situations and, based solely on the information given, indicate the most appropriate form of homeowner's policy or supplemental floater. Situation Recommended Policy HO-8 This policy is often recommended for older houses whose replacement costs are significantly greater than their market values. HO-1 This policy is not often recommended because its list of covered perils is relatively limited. This policy is recommended for policyholders living in a rental house, apartment, or other dwelling. HO-4 An individual who owns an extensive art collection or furs or fine art that is worth more than the traditional coverage provided by Part C of the homeowner's policy receives better protection using which of the following insurance products? An HO-8 policy O A scheduled personal property floater O A blanket personal property floater 3. The form and format of the homeowner's insurance policy What are the different forms of the homeowner's policy? Homeowners have four forms of homeowner's policies (HO-1, HO-2, HO-3, and HO-8), whereas renters and owners of condominiums have two forms (HO-4 and HO-6). Although there are differences in the coverages provided by the different policies, their formats tend to be the same. Consider the following statements regarding the format of a homeowner's policy. 1. Section I of the homeowner's policy applies to the dwelling, adjacent structures, and the insured's personal property. 2. Comprehensive personal liability coverage protects the insured against many sources of liability, including negligence. 3. Two of the most frequently included perils in homeowner's policies are earthquakes and flooding. 4. A home's location and construction materials affect the premiums charged on a homeowner's policy, as do the deductible and amount of coverage carried. 5. Homeowner policies cover your pets and livestock as well as your personal car, motorcycle, golf cart, or snowmobile. The following statements are true: Statement 2 Statement 1 Statements 1 and 4 O Statements 1, 2, and 4 Section II of the homeowner's policy provides which types of insurance coverage? Check all that apply. O Comprehensive personal liability coverage Medical payments coverage for non-family members Medical payments coverage for the homeowner's family members Which of the following are coverages provided by Section II of the homeowner's policy? Check all that apply. The reasonable expense incurred by the homeowner in assisting in the insurance company's defense The cost of defending the insured homeowner The costs of injuries from intentional harm Consider the following situations and, based solely on the information given, indicate the most appropriate form of homeowner's policy or supplemental floater. Situation Recommended Policy HO-8 This policy is often recommended for older houses whose replacement costs are significantly greater than their market values. HO-1 This policy is not often recommended because its list of covered perils is relatively limited. This policy is recommended for policyholders living in a rental house, apartment, or other dwelling. HO-4 An individual who owns an extensive art collection or furs or fine art that is worth more than the traditional coverage provided by Part C of the homeowner's policy receives better protection using which of the following insurance products? An HO-8 policy O A scheduled personal property floater O A blanket personal property floater