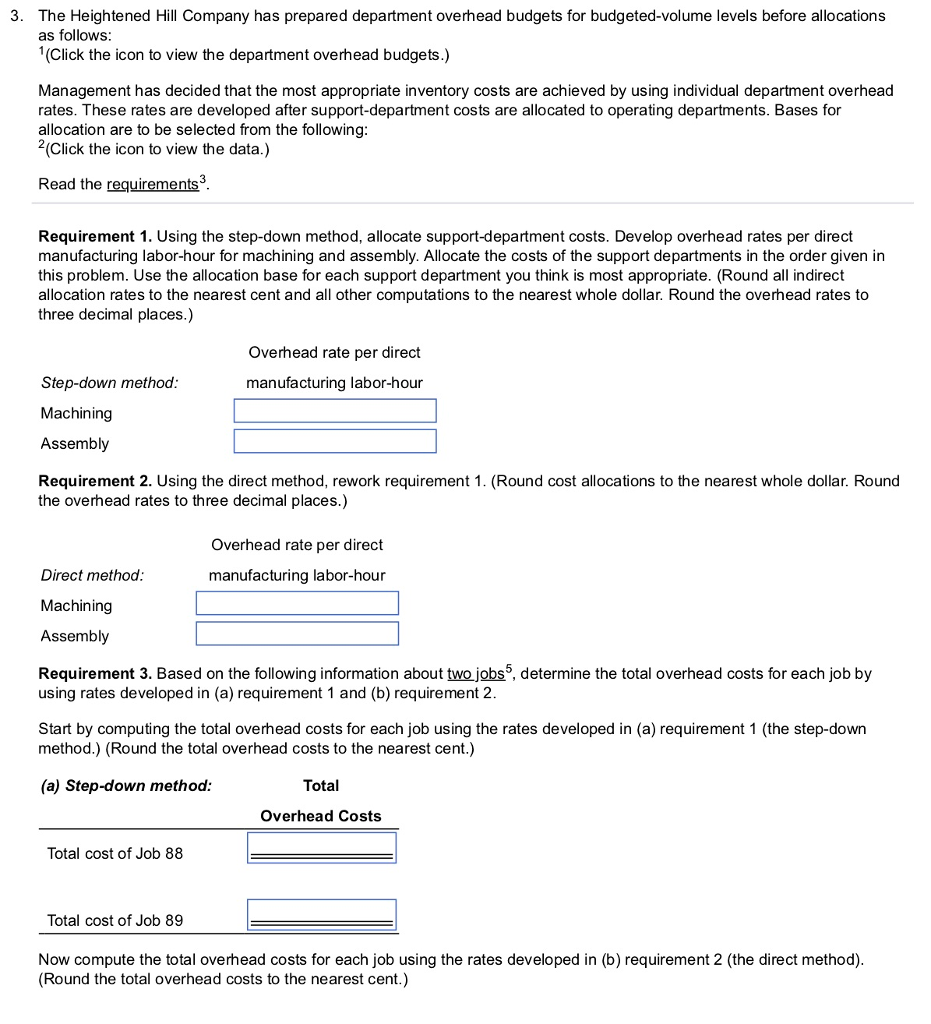

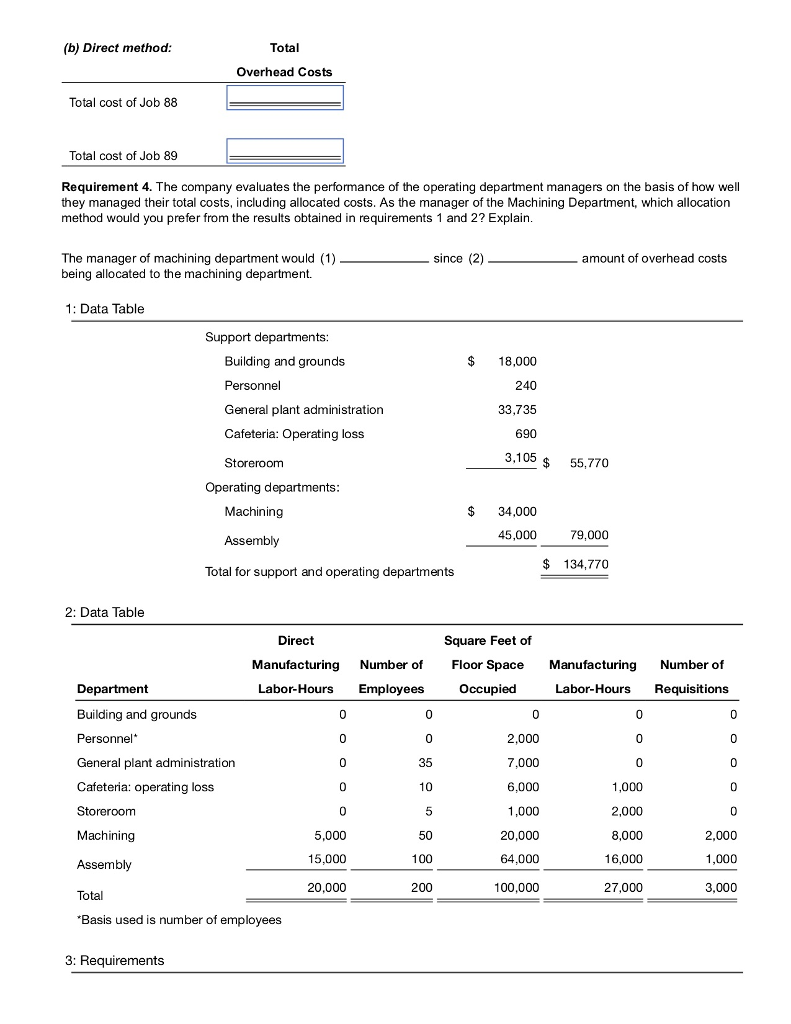

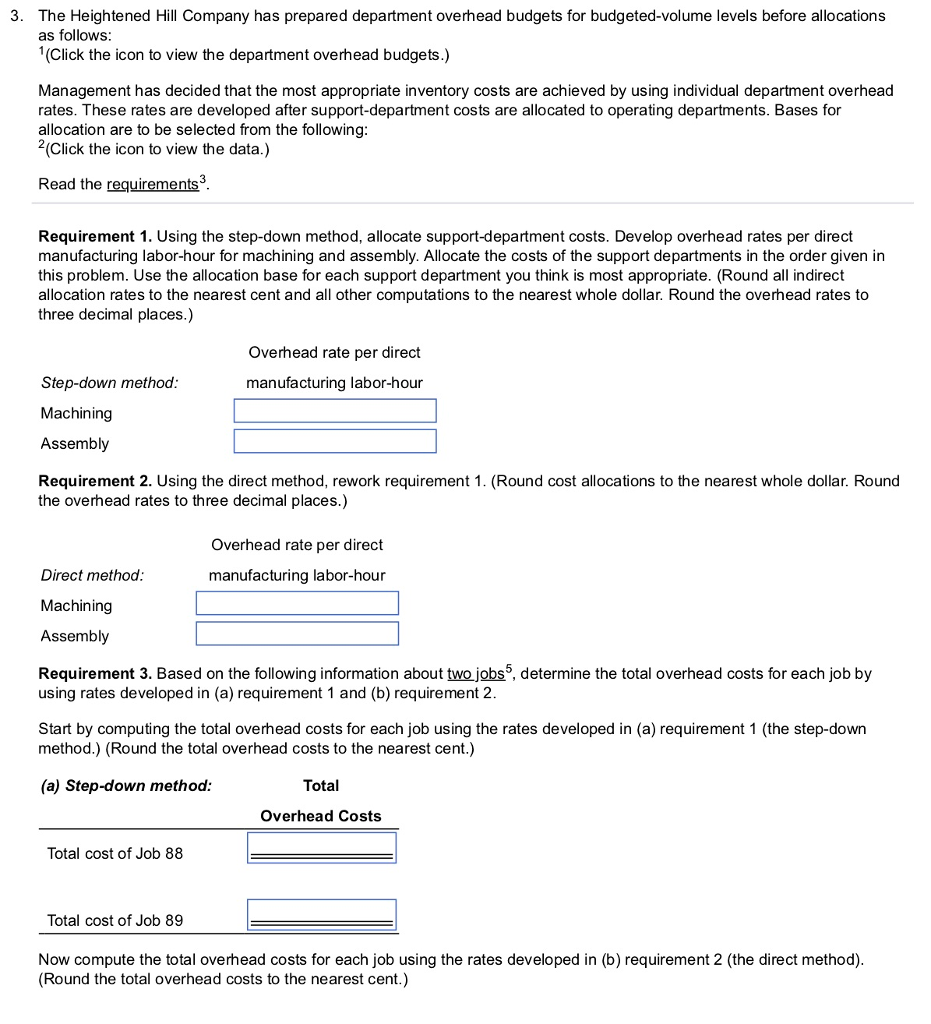

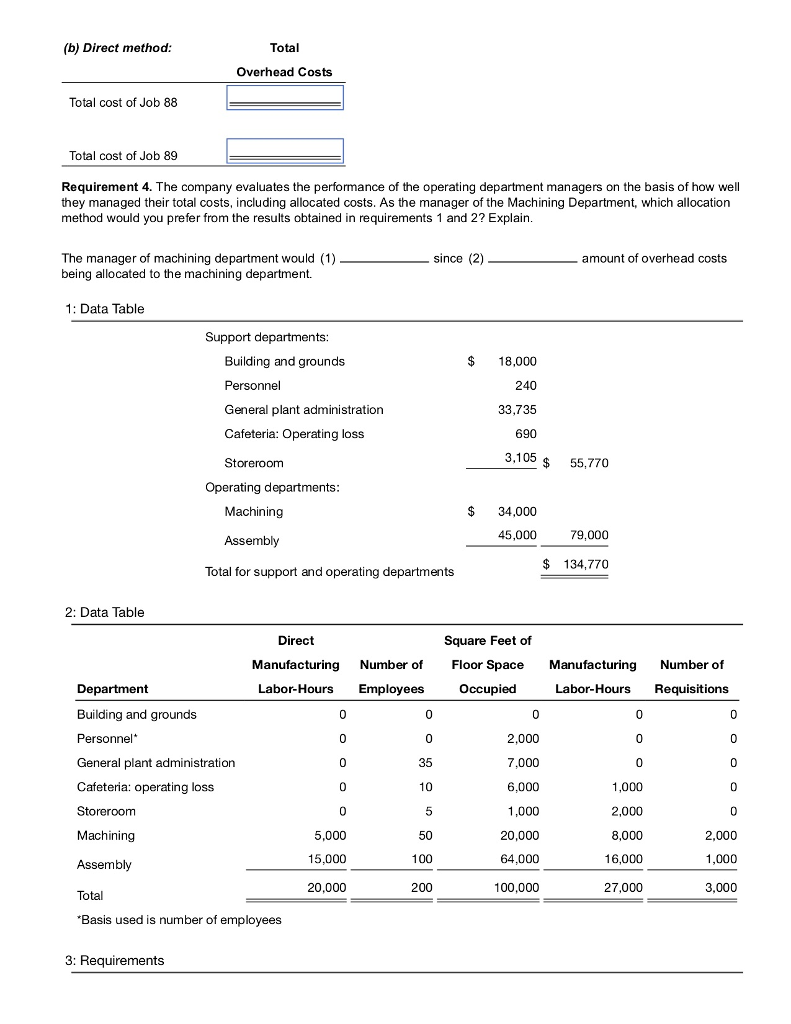

3. The Heightened Hill Company has prepared department overhead budgets for budgeted-volume levels before allocations as follows (Click the icon to view the department overhead budgets.) Management has decided that the most appropriate inventory costs are achieved by using individual department overhead rates. These rates are developed after support-department costs are allocated to operating departments. Bases for allocation are to be selected from the following (Click the icon to view the data.) Read the requirements Requirement 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate. (Round all indirect allocation rates to the nearest cent and all other computations to the nearest whole dollar. Round the overhead rates to three decimal places.) Overhead rate per direct Step-down methoo Machining Assembly Requirement 2. Using the direct method, rework requirement 1. (Round cost allocations to the nearest whole dollar. Round manufacturing labor-hour the overhead rates to three decimal places.) Overhead rate per direct manufacturing labor-hour Direct method Machining Assembly Requirement 3. Based on the following information about two jobs5, determine the total overhead costs for each job by using rates developed in (a) requirement 1 and (b) requirement 2 Start by computing the total overhead costs for each job using the rates developed in (a) requirement 1 (the step-down method.) (Round the total overhead costs to the nearest cent.) (a) Step-down method Total Overhead Costs Total cost of Job 88 Total cost of Job 89 Now compute the total overhead costs for each job using the rates developed in (b) requirement 2 (the direct method) (Round the total overhead costs to the nearest cent.) 3. The Heightened Hill Company has prepared department overhead budgets for budgeted-volume levels before allocations as follows (Click the icon to view the department overhead budgets.) Management has decided that the most appropriate inventory costs are achieved by using individual department overhead rates. These rates are developed after support-department costs are allocated to operating departments. Bases for allocation are to be selected from the following (Click the icon to view the data.) Read the requirements Requirement 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate. (Round all indirect allocation rates to the nearest cent and all other computations to the nearest whole dollar. Round the overhead rates to three decimal places.) Overhead rate per direct Step-down methoo Machining Assembly Requirement 2. Using the direct method, rework requirement 1. (Round cost allocations to the nearest whole dollar. Round manufacturing labor-hour the overhead rates to three decimal places.) Overhead rate per direct manufacturing labor-hour Direct method Machining Assembly Requirement 3. Based on the following information about two jobs5, determine the total overhead costs for each job by using rates developed in (a) requirement 1 and (b) requirement 2 Start by computing the total overhead costs for each job using the rates developed in (a) requirement 1 (the step-down method.) (Round the total overhead costs to the nearest cent.) (a) Step-down method Total Overhead Costs Total cost of Job 88 Total cost of Job 89 Now compute the total overhead costs for each job using the rates developed in (b) requirement 2 (the direct method) (Round the total overhead costs to the nearest cent.)