Answered step by step

Verified Expert Solution

Question

1 Approved Answer

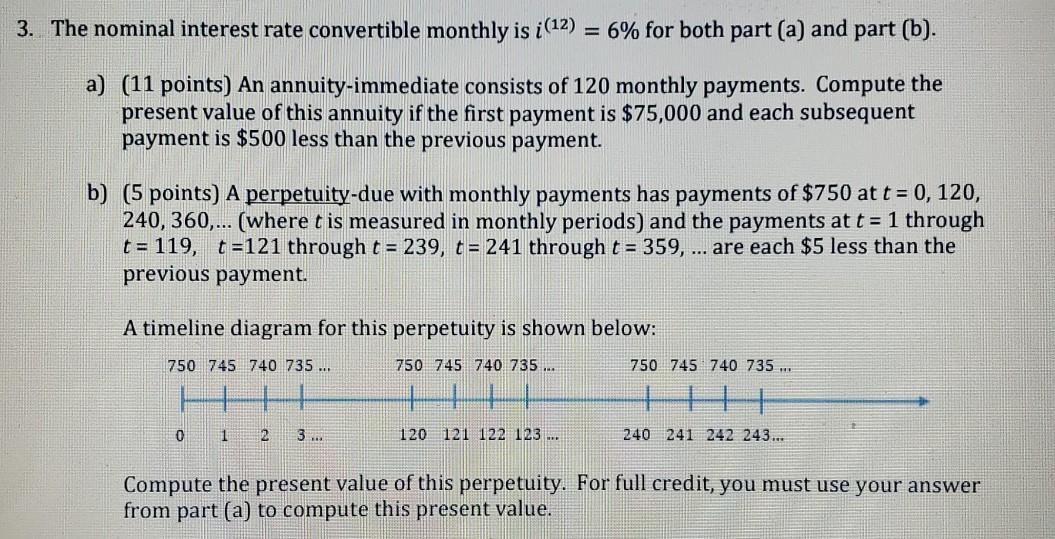

3. The nominal interest rate convertible monthly is i(12) 6% for both part (a) and part(b). a) (11 points) An annuity-immediate consists of 120 monthly

3. The nominal interest rate convertible monthly is i(12) 6% for both part (a) and part(b). a) (11 points) An annuity-immediate consists of 120 monthly payments. Compute the present value of this annuity if the first payment is $75,000 and each subsequent payment is $500 less than the previous payment. b) (5 points) A perpetuity-due with monthly payments has payments of $750 at t = 0, 120, 240, 360,... (where t is measured in monthly periods) and the payments at t = 1 through t = 119, t=121 through t = 239, t = 241 through t = 359, ... are each $5 less than the previous payment. A timeline diagram for this perpetuity is shown below: 750 745 740 735 ... 750 745 740 735 ... 750 745 740 735 ... 0 1 2 3... 120 121 122 123 ... 240 241 242 243... Compute the present value of this perpetuity. For full credit, you must use your answer from part (a) to compute this present value. 3. The nominal interest rate convertible monthly is i(12) 6% for both part (a) and part(b). a) (11 points) An annuity-immediate consists of 120 monthly payments. Compute the present value of this annuity if the first payment is $75,000 and each subsequent payment is $500 less than the previous payment. b) (5 points) A perpetuity-due with monthly payments has payments of $750 at t = 0, 120, 240, 360,... (where t is measured in monthly periods) and the payments at t = 1 through t = 119, t=121 through t = 239, t = 241 through t = 359, ... are each $5 less than the previous payment. A timeline diagram for this perpetuity is shown below: 750 745 740 735 ... 750 745 740 735 ... 750 745 740 735 ... 0 1 2 3... 120 121 122 123 ... 240 241 242 243... Compute the present value of this perpetuity. For full credit, you must use your answer from part (a) to compute this present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started