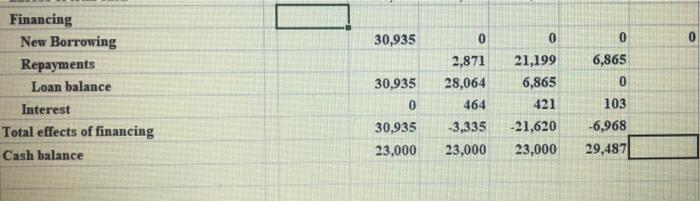

3. The PDC Company was described during the early part of this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2017 Hints from PDC text: PDC expects to pay miscellaneous cash expenses equal to 5% of the current sales and rant of $4,600 per month, and it records insurance expense of $460 per month, although it writes a check to the insurance company for a year at a time. PDC plans to draw the prepaid insurance account balance down to So before cutting the next check to the insurance company. Depreciation expense is $1,150 per month, including the truck purchased on april I for $6,900 cash. PDC anticipates a 0% tax rate. Wages are paid twice a month with $5,750 per month fixed and 15% of sales as a variable commission. Wages are paid a half month after they are earned. PDC inventory policy is to begin each month with sufficient inventory to cover 80% of the sales for the current month plus a $46,000 safety stock. The cost of goods sold is 70% of sales. PDC takes all deliveries on account and pays half in the current month and half in the following month. PDC sales are 00% cash and 40% on accounts receivable credit collected the following month. It has no currently overdue accounts and does not anticipate any in the future. PDC's credit line carries a 1.5% interest cost per month for the next two years. The loan agreement requires a $23,000 minimum cash balance in the checking account. 30,935 0 0 0 Financing New Borrowing Repayments Loan balance Interest Total effects of financing Cash balance 30,935 0 2,871 28,064 464 -3,335 23,000 21,199 6,865 421 -21,620 23,000 6,865 0 103 -6,968 29,487 30,935 23,000 3. The PDC Company was described during the early part of this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2017 Hints from PDC text: PDC expects to pay miscellaneous cash expenses equal to 5% of the current sales and rant of $4,600 per month, and it records insurance expense of $460 per month, although it writes a check to the insurance company for a year at a time. PDC plans to draw the prepaid insurance account balance down to So before cutting the next check to the insurance company. Depreciation expense is $1,150 per month, including the truck purchased on april I for $6,900 cash. PDC anticipates a 0% tax rate. Wages are paid twice a month with $5,750 per month fixed and 15% of sales as a variable commission. Wages are paid a half month after they are earned. PDC inventory policy is to begin each month with sufficient inventory to cover 80% of the sales for the current month plus a $46,000 safety stock. The cost of goods sold is 70% of sales. PDC takes all deliveries on account and pays half in the current month and half in the following month. PDC sales are 00% cash and 40% on accounts receivable credit collected the following month. It has no currently overdue accounts and does not anticipate any in the future. PDC's credit line carries a 1.5% interest cost per month for the next two years. The loan agreement requires a $23,000 minimum cash balance in the checking account. 30,935 0 0 0 Financing New Borrowing Repayments Loan balance Interest Total effects of financing Cash balance 30,935 0 2,871 28,064 464 -3,335 23,000 21,199 6,865 421 -21,620 23,000 6,865 0 103 -6,968 29,487 30,935 23,000