Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. The property was let on 1 July 2019 at a rent of 3,600 per month payal monthly in advanced on 1st day of

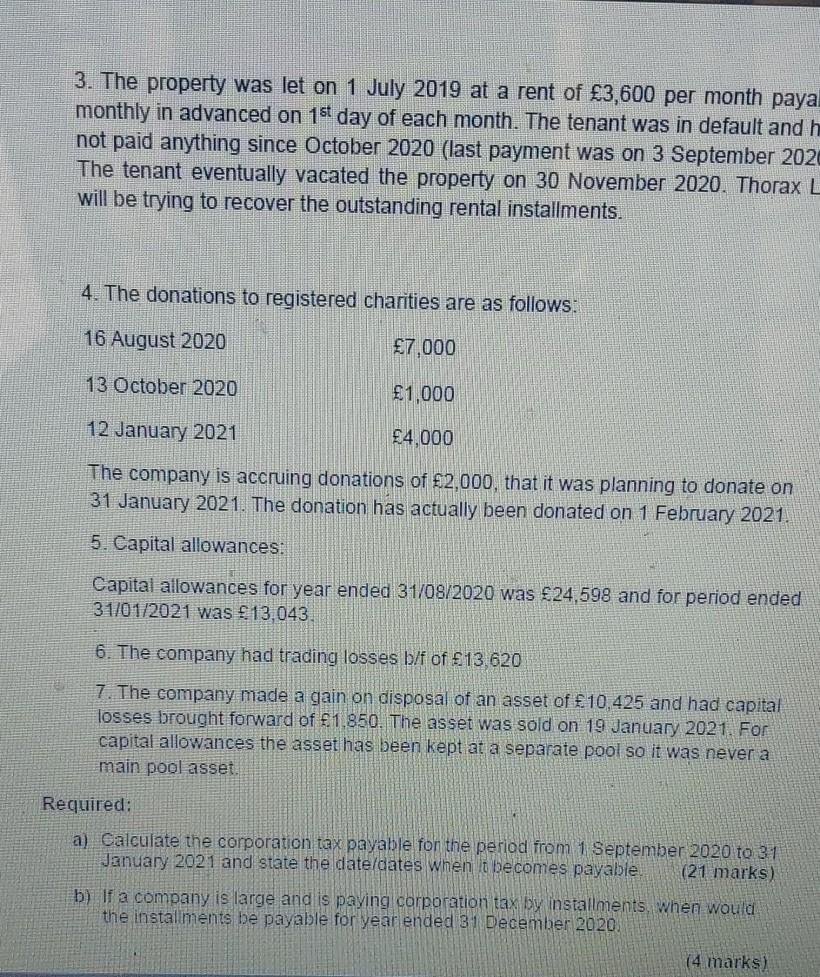

3. The property was let on 1 July 2019 at a rent of 3,600 per month payal monthly in advanced on 1st day of each month. The tenant was in default and h not paid anything since October 2020 (last payment was on 3 September 2020 The tenant eventually vacated the property on 30 November 2020. Thorax L will be trying to recover the outstanding rental installments. 4. The donations to registered charities are as follows: 16 August 2020 7,000 13 October 2020 1,000 12 January 2021 4,000 The company is accruing donations of 2,000, that it was planning to donate on 31 January 2021. The donation has actually been donated on 1 February 2021. 5. Capital allowances: Capital allowances for year ended 31/08/2020 was 24,598 and for period ended 31/01/2021 was 13,043. 6. The company had trading losses b/f of 13,620 7. The company made a gain on disposal of an asset of 10,425 and had capital losses brought forward of 1,850. The asset was sold on 19 January 2021, For capital allowances the asset has been kept at a separate pool so it was never a main pool asset. Required: a) Calculate the corporation tax payable for the period from 1 September 2020 to 31 January 2021 and state the date/dates when it becomes payable. (21 marks) when would b) If a company is large and is paying corporation tax by installments, the installments be payable for year ended 31 December 2020. (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The corporation tax payable for the period from 1 Se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started