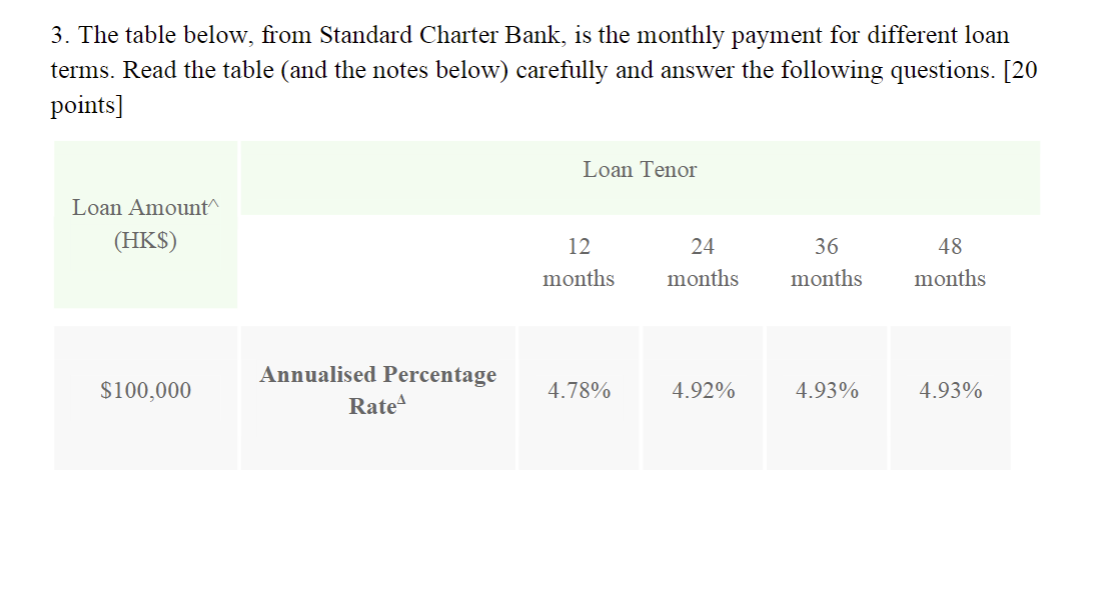

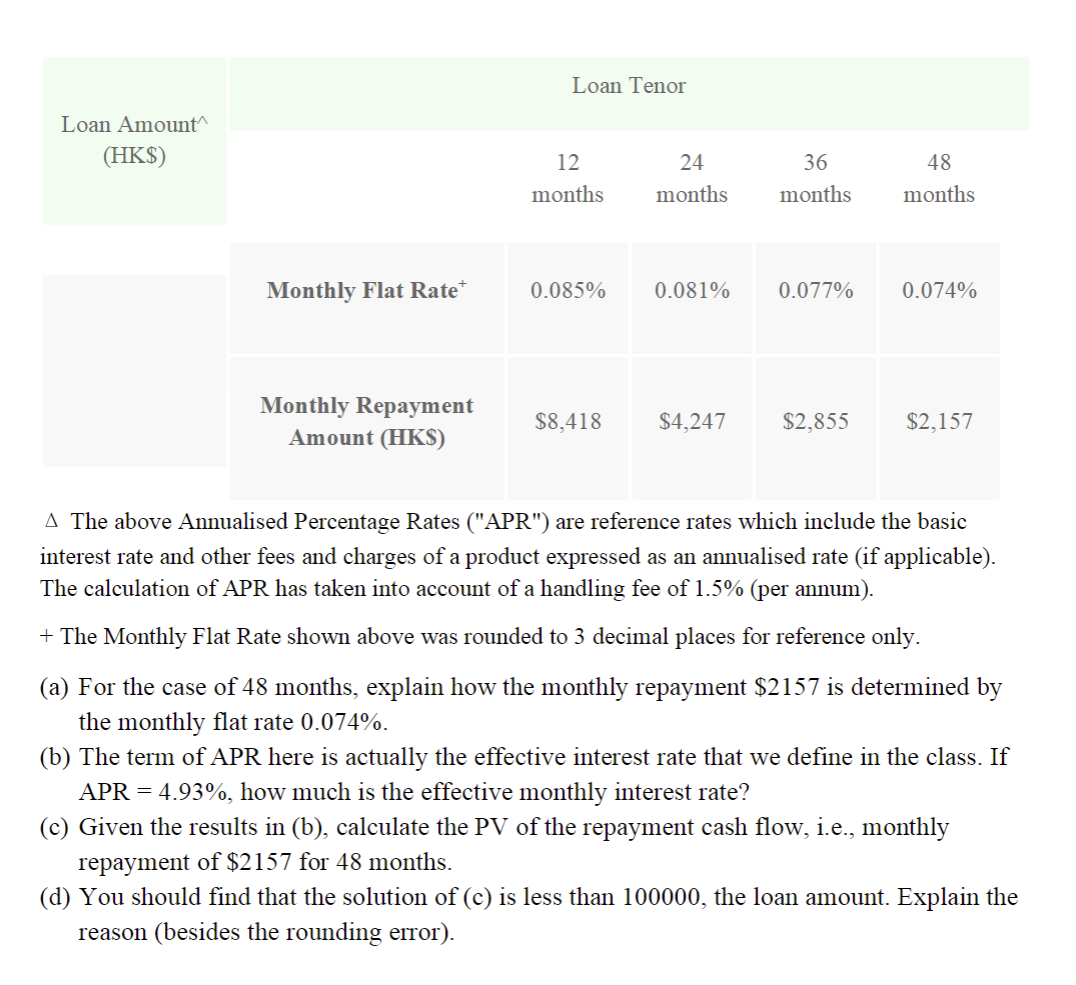

3. The table below, from Standard Charter Bank, is the monthly payment for different loan terms. Read the table (and the notes below) carefully and answer the following questions. [20 points] The above Annualised Percentage Rates ("APR") are reference rates which include the basic interest rate and other fees and charges of a product expressed as an annualised rate (if applicable). The calculation of APR has taken into account of a handling fee of 1.5% (per annum). + The Monthly Flat Rate shown above was rounded to 3 decimal places for reference only. (a) For the case of 48 months, explain how the monthly repayment $2157 is determined by the monthly flat rate 0.074%. (b) The term of APR here is actually the effective interest rate that we define in the class. If APR=4.93%, how much is the effective monthly interest rate? (c) Given the results in (b), calculate the PV of the repayment cash flow, i.e., monthly repayment of $2157 for 48 months. (d) You should find that the solution of (c) is less than 100000, the loan amount. Explain the reason (besides the rounding error). 3. The table below, from Standard Charter Bank, is the monthly payment for different loan terms. Read the table (and the notes below) carefully and answer the following questions. [20 points] The above Annualised Percentage Rates ("APR") are reference rates which include the basic interest rate and other fees and charges of a product expressed as an annualised rate (if applicable). The calculation of APR has taken into account of a handling fee of 1.5% (per annum). + The Monthly Flat Rate shown above was rounded to 3 decimal places for reference only. (a) For the case of 48 months, explain how the monthly repayment $2157 is determined by the monthly flat rate 0.074%. (b) The term of APR here is actually the effective interest rate that we define in the class. If APR=4.93%, how much is the effective monthly interest rate? (c) Given the results in (b), calculate the PV of the repayment cash flow, i.e., monthly repayment of $2157 for 48 months. (d) You should find that the solution of (c) is less than 100000, the loan amount. Explain the reason (besides the rounding error)