Answered step by step

Verified Expert Solution

Question

1 Approved Answer

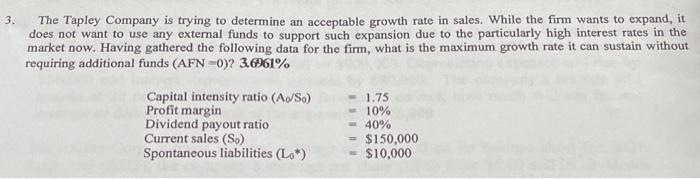

3. The Tapley Company is trying to determine an acceptable growth rate in sales. While the firm wants to expand, it does not want to

3. The Tapley Company is trying to determine an acceptable growth rate in sales. While the firm wants to expand, it does not want to use any external funds to support such expansion due to the particularly high interest rates in the market now. Having gathered the following data for the firm, what is the maximum growth rate it can sustain without requiring additional funds (AFN =0)? 3.6961% Capital intensity ratio (Ao/So) Profit margin Dividend payout ratio Current sales (So) Spontaneous liabilities (Lo*) = 1.75 = 10% 40% $150,000 = = = $10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started