Answered step by step

Verified Expert Solution

Question

1 Approved Answer

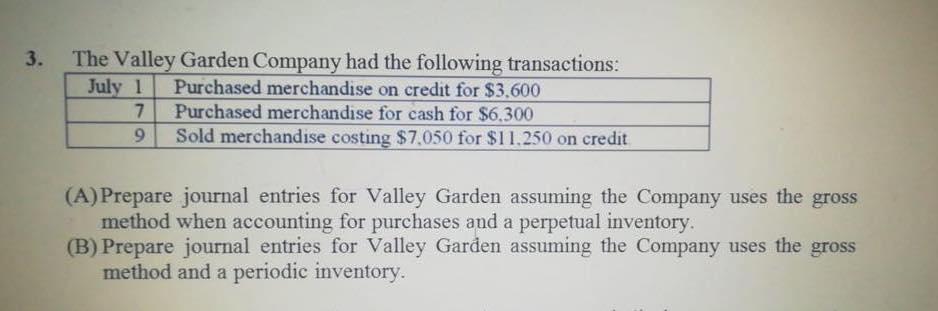

3. The Valley Garden Company had the following transactions: July 1 Purchased merchandise on credit for $3,600 7 Purchased merchandise for cash for $6.300

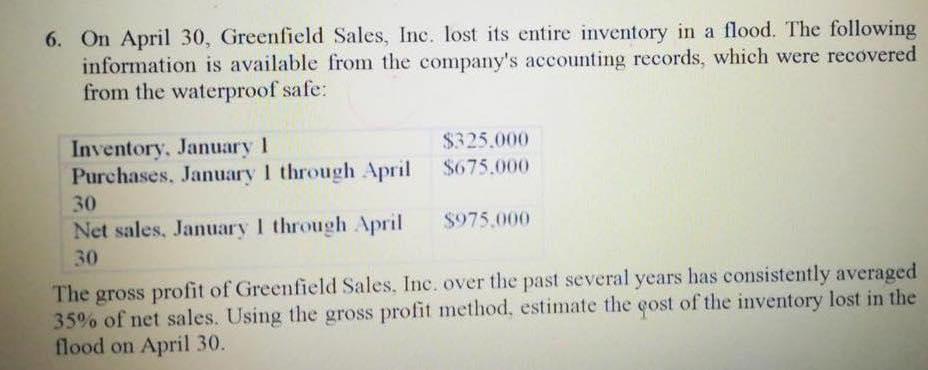

3. The Valley Garden Company had the following transactions: July 1 Purchased merchandise on credit for $3,600 7 Purchased merchandise for cash for $6.300 9 Sold merchandise costing $7,050 for $11.250 on credit (A) Prepare journal entries for Valley Garden assuming the Company uses the gross method when accounting for purchases and a perpetual inventory. (B) Prepare journal entries for Valley Garden assuming the Company uses the gross method and a periodic inventory. 6. On April 30, Greenfield Sales, Inc. lost its entire inventory in a flood. The following information is available from the company's accounting records, which were recovered from the waterproof safe: Inventory, January 1 $325.000 $675.000 Purchases, January 1 through April 30 Net sales, January 1 through April $975.000 30 The gross profit of Greenfield Sales, Inc. over the past several years has consistently averaged 35% of net sales. Using the gross profit method, estimate the cost of the inventory lost in the flood on April 30.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Q A Prepare journal entries for Valley Garden assuming the Company uses the gross method when accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started