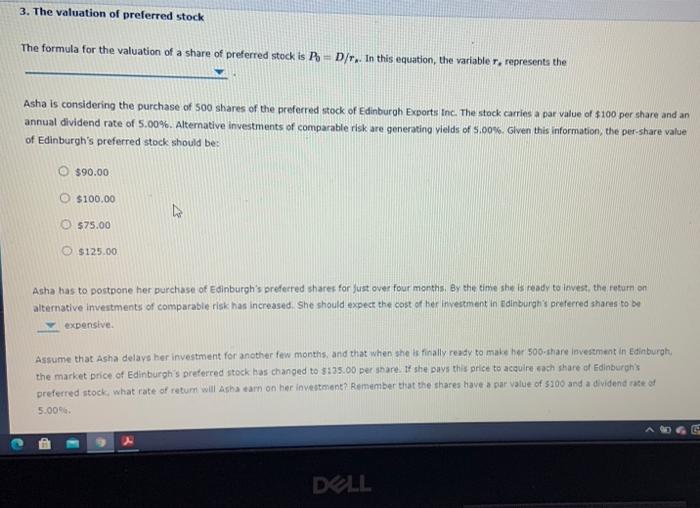

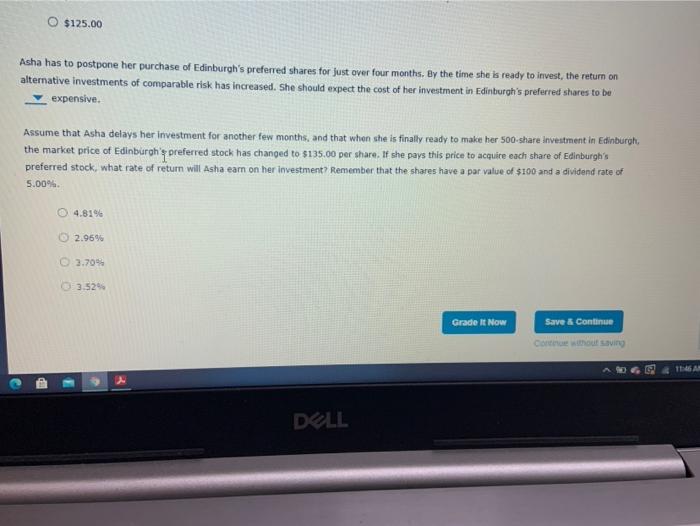

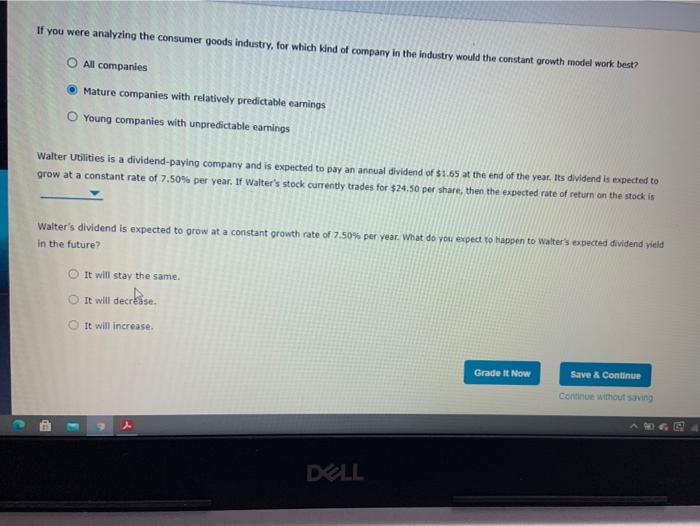

3. The valuation of preferred stock The formula for the valuation of a share of preferred stock is P-D/r. In this equation, the variable, represents the Asha is considering the purchase of 500 shares of the preferred stock of Edinburgh Exports Inc. The stock carries a par value of $100 per share and an annual dividend rate of 5.00%. Alternative investments of comparable risk are generating vields of 5.00%. Given this information, the per-share value of Edinburgh's preferred stock should be: $90.00 $100.00 575.00 $125.00 Asha has to postpone her purchase of Edinburgh's preferred shares for just over four months. By the time she is ready to invest, the return on alternative Investments of comparable risk has increased. She should expect the cost of her investment in Edinburgh's preferred shares to be expensive. Assume that Asha delays her investment for another few months, and that when she is finally ready to make her 500 share investment in Edinburgh, the market price of Edinburgh's preferred stock has changed to $35.00 per share. If she pave this price to acquire each share of Edinburgh's preferred stock, what rate of return will Asha carn on her investment? Remember that the shares have a par value of $100 and a dividend rate of 5.00% DELL O $125.00 Asha has to postpone her purchase of Edinburgh's preferred shares for just over four months. By the time she is ready to invest, the return on alternative investments of comparable risk has increased. She should expect the cost of her investment in Edinburgh's preferred shares to be expensive. Assume that Asha delays her investment for another few months, and that when she is finally ready to make her 500 share investment in Edinburgh the market price of Edinburgh' preferred stock has changed to $135.00 per share. It she pays this price to acquire each share of Edinburgh's preferred stock, what rate of return will Asha earn on her investment? Remember that the shares have a par value of $100 and a dividend rate of 5.00% 0 4.8194 2.96% 3.70% 3.52 Grade it Now Save & Continue Conte of saving TM DELL If you were analyzing the consumer goods industry, for which kind of company in the industry would the constant growth model work best? O All companies Mature companies with relatively predictable earnings Young companies with unpredictable earnings Walter Utilities is a dividend paying company and is expected to pay an annual dividend of $1.65 at the end of the year. Its dividend is expected to grow at a constant rate of 7.50% per year. If Walter's stock currently trades for $24.50 per share, then the expected rate of return on the stock is Walter's dividend is expected to grow at a constant growth rate of 7.50% per year. What do you expect to happen to Walter's spected dividend yield in the future? It will stay the same. It will decrease It will increase Grade It Now Save & Continue Continue without saving DELL