Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#3 There are many reasons why people don't save: I don't have any extra money. I promise to start next year. I have $100... what

#3

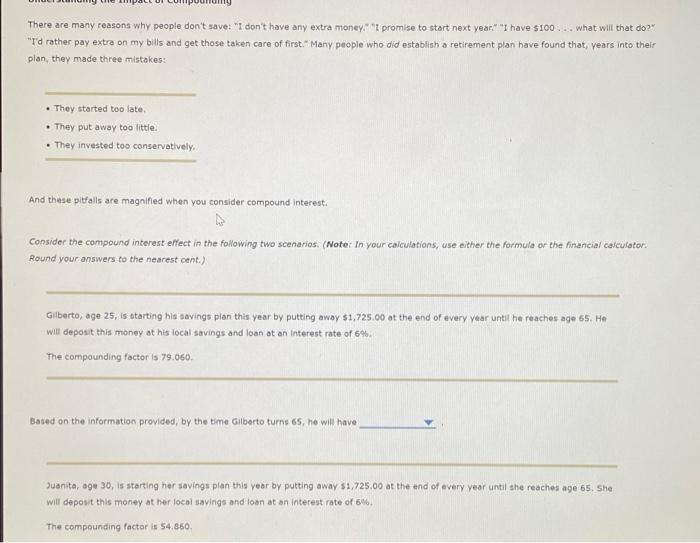

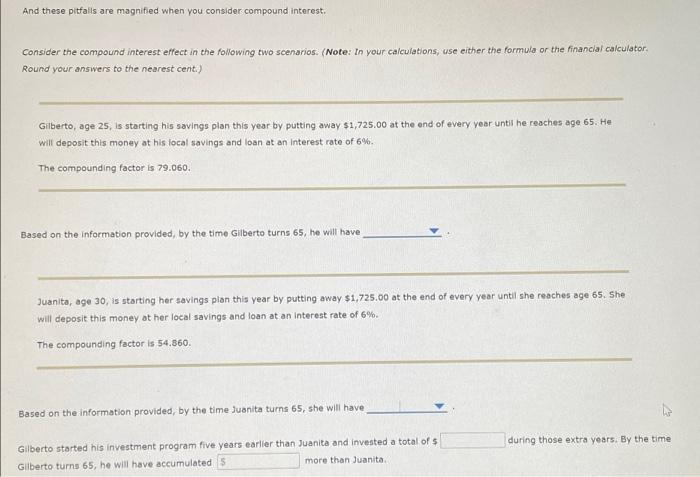

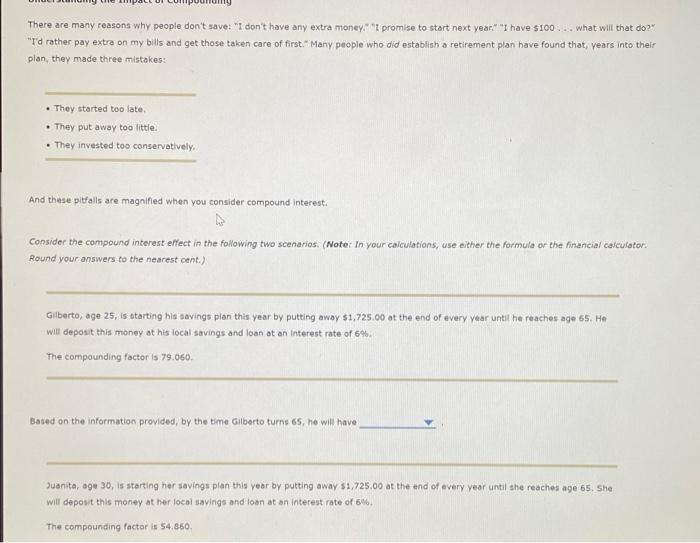

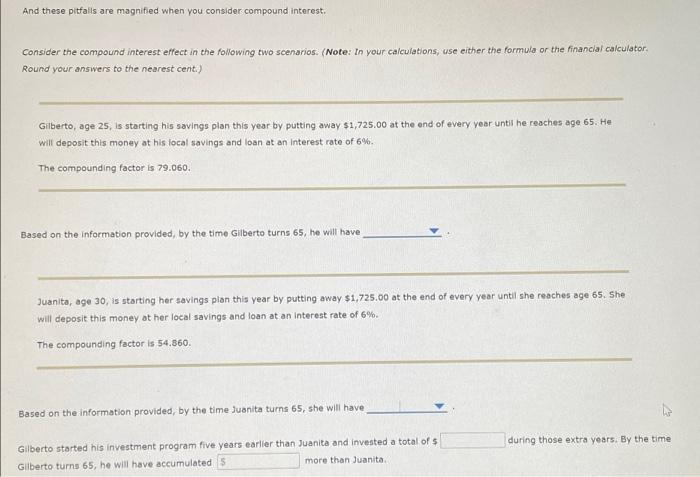

There are many reasons why people don't save: "I don't have any extra money. I promise to start next year." "I have $100... what will that do?" "I'd rather pay extra on my bills and get those taken care of first. Many people who did establish a retirement plan have found that years into their plan, they made three mistakes They started too late They put away too little. They invested to conservatively. And these pitfalls are magnified when you consider compound interest Consider the compound interest effect in the following two scenarios. (Note: In your calculations, use either the formula or the financial calculator. Round your answers to the nearest cent.) Gilberto, age 25, is starting his savings plan this year by putting away $1,725.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an Interest rate of 6% The compounding factor is 79.060 Based on the information provided, by the time Gilberto turns 65, he will have Juanita, age 30, is starting her savings plan this year by putting away 51,725.00 at the end of every year until she reaches age 65. She will deposit this money at her local savings and loan at an interest rate of 6% The compounding factor is 54.860 And these pitfalls are magnified when you consider compound interest. Consider the compound interest effect in the following two scenarios. (Note: In your calculations, use either the formula or the financial calculator, Round your answers to the nearest cent.) Gilberto, age 25, is starting his savings plan this year by putting away $1,725.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6%. The compounding factor is 79.060. Based on the information provided by the time Gilberto turns 65, he will have Juanita, age 30, is starting her savings plan this year by putting away $1,725.00 at the end of every year until she reaches age 65. She will deposit this money at her local savings and loan at an interest rate of 6%. The compounding factor is 54.860 Based on the information provided, by the time Juanita turns 65, she will have during those extra years. By the time Gilberto started his investment program five years earlier than Juanita and invested a total of $ Gilberto turns 65, he will have accumulated more than Juanita

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started