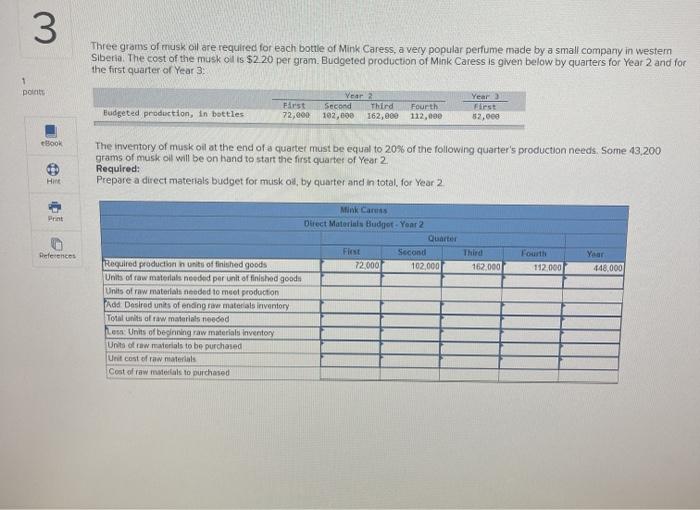

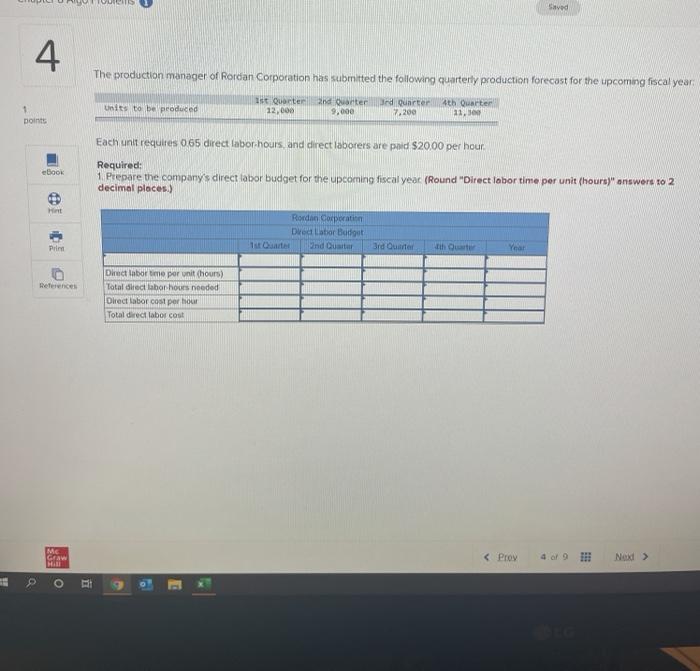

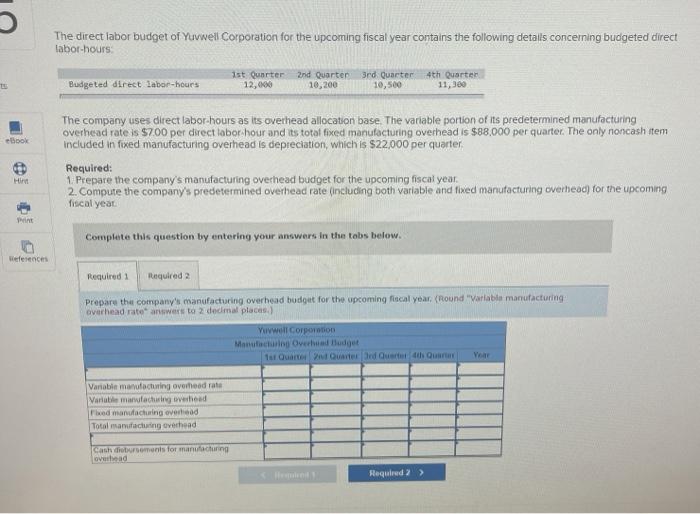

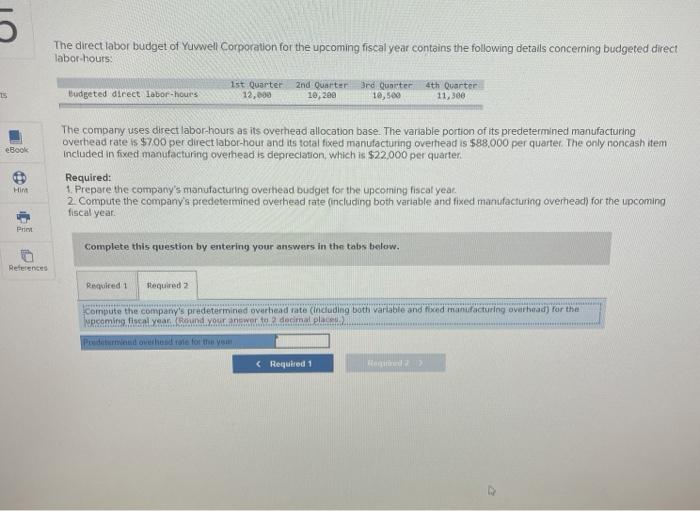

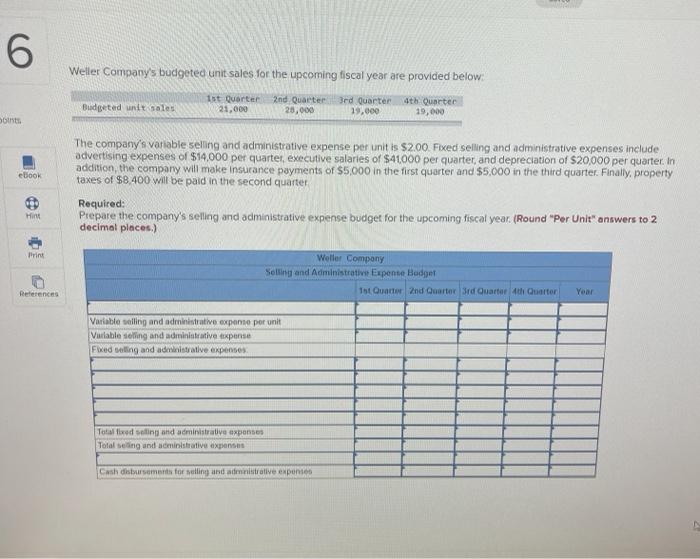

3 Three grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $2.20 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: 1 port Budgeted production, in bottles Year 2 First Second Third Fourth 72,200 102,000 162,000 112,000 Year First $2,000 BOOK The inventory of musk oil at the end of a quartet must be equal to 20% of the following quarter's production needs. Some 43,200 grams of musk oil will be on hand to start the first quarter of Year 2 Required: Prepare a direct materials budget for musk ol, by quarter and in total, for Year 2 Hint Print References Third 162.000 FON 112.000 Your 448.000 Mink Cars Direct Materials Budget - Year 2 Quarter Fiest Second Required production in units of finished goods 72000 102,000 Units of raw materials needed per unit of finished good Units of raw materials needed to meet production Add Desired units of ending raw materials inventory Total units of raw materials needed Les Units of beginning raw materials inventory Units of raw materials to be purchased Unit cost of raw materials Cost of raw materals to purchased Saved 4 The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year Units to be produced 1 points 1st Quarterl2nd Quarter 12,000 9,000 od Quarter 7.200 4th Quarter 11.30 Each unit requires 065 direct labor hours and direct laborers are paid $20,00 per hour ebook Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year (Round "Direct lobortime per unit (hours)"answers to 2 decimal places.) Rond Corporation Dved Labor Badget 2nd Quitar Prim TO 3rd Quarter Year References Direct laborime per unit hours) Tatal de labor hours needed Direct labor cost per hour Total direct labor cost ME GEAW o RE The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor hours 4th Quarter Budgeted direct labor-hours 1st Quarter 12,000 2nd Quarter 10,200 3rd Quarter 10,500 11,300 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $7.00 per direct labor hour and its total fixed manufacturing overhead is $88,000 per quarter. The only noncash ftem included in fixed manufacturing overhead is depreciation, which is $22,000 per quarter Required: Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead for the upcoming fiscal year Hint Complete this question by entering your answers in the tabs below. Weferences Required 1 Required 2 Prepare the company's manufacturing overhead budget for the upcoming fiscal year (Round "Variable manufacturing overhead rato answers to 2 decimal places) Yuwwelt Corportion Manufacturing Overhead Budget 1st Quartet Quarter and Quartet Quir You Variable manufacturing overhead rata Variable marvutacturing overhead bed manufacturing over Total manufacturing overhead cash direments for manufacturing overhead Required 2 > The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st Quarter 12,000 Budgeted direct labor-hours 2nd Quarter 10, 200 3rd Quarter 10,500 75 4th Quarter 11,300 eBook The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $700 per direct labor-hour and its total fixed manufacturing overhead is $88,000 per quarter. The only noncash item Included in fixed manufacturing overhead is depreciation, which is $22.000 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2 Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year Hint Pret Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the Npcoming fiscal year (und your answer to decimal place Predamend overhand tale for the yem