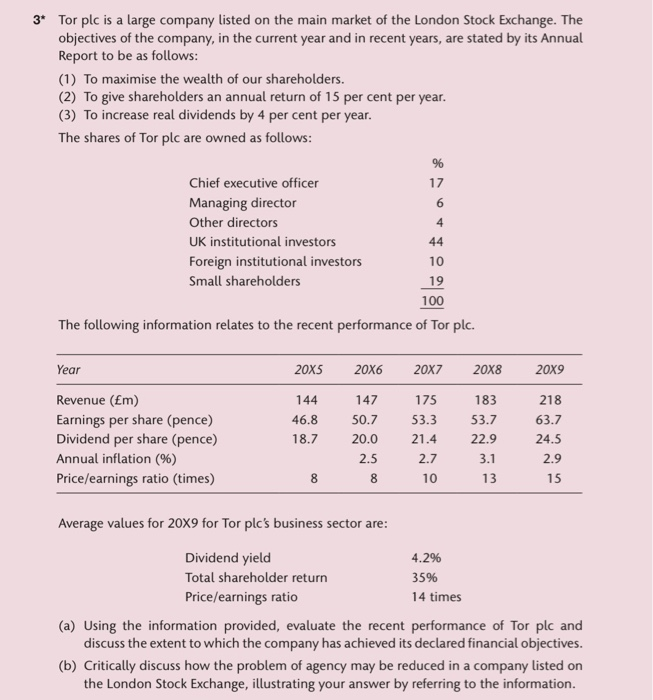

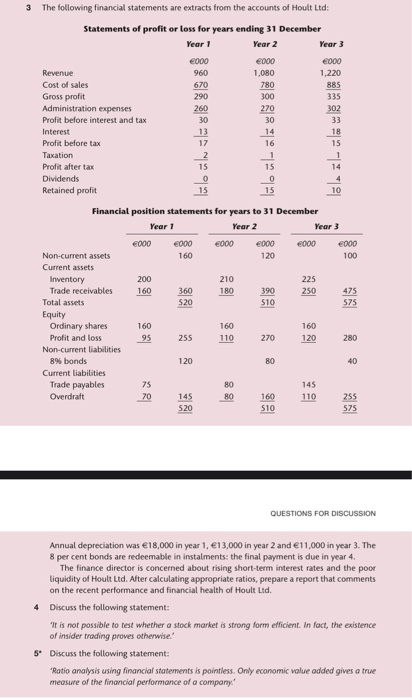

3* Tor plc is a large company listed on the main market of the London Stock Exchange. The objectives of the company, in the current year and in recent years, are stated by its Annual Report to be as follows: (1) To maximise the wealth of our shareholders. (2) To give shareholders an annual return of 15 per cent per year. (3) To increase real dividends by 4 per cent per year. The shares of Tor plc are owned as follows: Chief executive officer Managing director Other directors UK institutional investors Foreign institutional investors Small shareholders 19 100 The following information relates to the recent performance of Tor plc. Year 20x5 20x620x7 2088 2089 Revenue (m) Earnings per share (pence) Dividend per share (pence) Annual inflation (%) Price/earnings ratio (times) 144 46.8 18.7 147 50.7 20.0 2.5 8 175 53.3 21.4 2.7 10 183 53.7 22.9 3.1 13 218 63.7 24.5 2.9 15 8 Average values for 20x9 for Tor plc's business sector are: Dividend yield Total shareholder return Price/earnings ratio 4.2% 35% 14 times (a) Using the information provided, evaluate the recent performance of Tor plc and discuss the extent to which the company has achieved its declared financial objectives. (b) Critically discuss how the problem of agency may be reduced in a company listed on the London Stock Exchange, illustrating your answer by referring to the information. 3 The following financial statements are extracts from the accounts of Hoult Ltd Statements of profit or loss for years ending 31 December Year 1 Year 2 Year 3 e000 960 6000 1,080 780 300 670 6000 1.220 885 335 302 290 260 270 30 Revenue Cost of sales Gross profit Administration expenses Profit before interest and tax Interest Profit before tax Taxation Profit after tax Dividends Retained profit 14 16 lalo nln alus 1979 6000 120 200 Financial position statements for years to 31 December Year 1 Year 2 Year 3 6000 000 6000 6000 Non-current assets 160 100 Current assets Inventory Trade receivables 160 Total assets Equity Ordinary shares 160 Profit and loss Non-current liabilities 8% bonds 80 Current liabilities Trade payables 80 Overdraft 145 80 QUESTIONS FOR DISCUSSION Annual depreciation was 18,000 in year 1, 13,000 in year 2 and 11,000 in year 3. The 8 per cent bonds are redeemable in instalments: the final payment is due in year 4. The finance director is concerned about rising short-term interest rates and the poor liquidity of Hoult Ltd. After calculating appropriate ratios, prepare a report that comments on the recent performance and financial health of Hoult Ltd. 4 Discuss the following statement: It is not possible to test whether a stock market is strong form efficient. In fact, the existence of insider trading proves otherwise.' 5* Discuss the following statement: "Ratio analysis using financial statements is pointless. Only economic value added gives a true measure of the financial performance of a company