Question

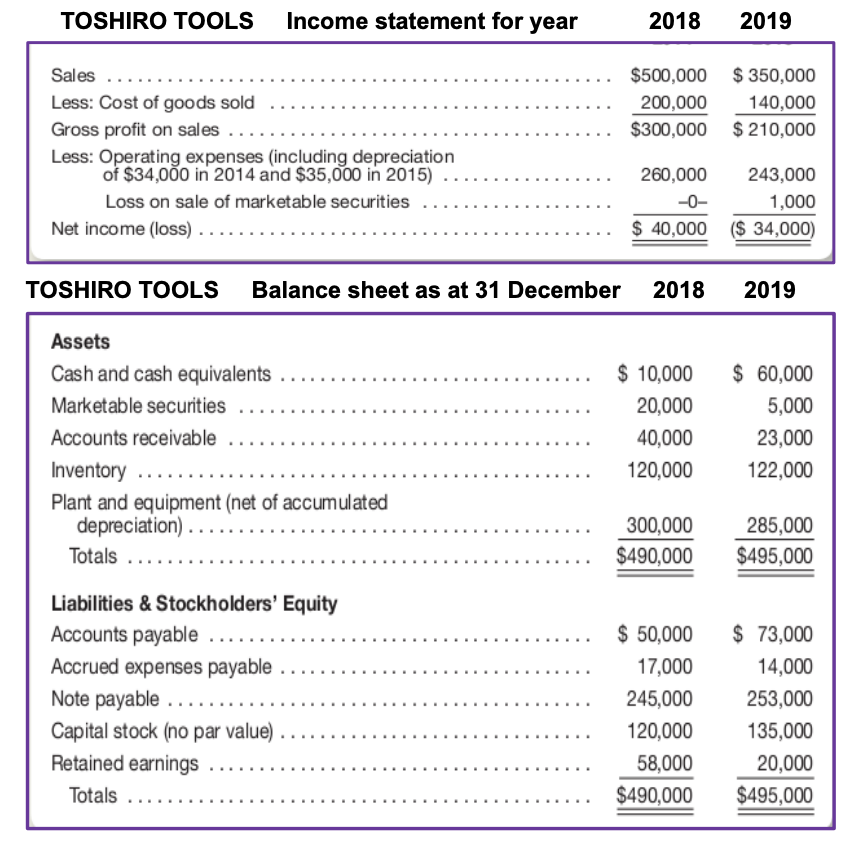

3) Toshiro Tools Ltd sells car parts through an online platform. Mkyta a very bright graduate from EU has been given comparative income statements and

3) Toshiro Tools Ltd sells car parts through an online platform. Mkyta a very bright graduate from EU has been given comparative income statements and balance sheets for the past two years so that he can prepare a cash flow statement. He has also been given following additional information. ADDITIONAL INFORMATION regarding the companys operations in 2019 is available from the companys accounting records: a)Early in the year the company declared and paid a $4,000 cash dividend. b)During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 non operating loss. c)The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance. d)During the year the company repaid a $10,000 note payable, but incurred an additional $18,000 in long-term debt as described in point c). e)The owners invested $15,000 cash in the business as a condition of the new loans described in point d).

a) Prepare a formal statement of cash flows for 2015 to be presented by the indirect method. Please show workings. You may use template provided.

b) Explain how Toshiro tools Ltd., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

TOSHIRO TOOLS Income statement for year 2018 2019 $500,000 $350,000 200,000 140,000 $300,000 $ 210,000 Sales Less: Cost of goods sold Gross profit on sales .. Less: Operating expenses (including depreciation of $34,000 in 2014 and $35,000 in 2015) Loss on sale of marketable securities Net income (loss) .... 260,000 243,000 1,000 $ 40,000 ($ 34,000) TOSHIRO TOOLS Balance sheet as at 31 December 2018 2019 Assets Cash and cash equivalents Marketable securities Accounts receivable Inventory Plant and equipment (net of accumulated depreciation)... Totals ... $ 10,000 20,000 40,000 120,000 $ 60,000 5,000 23,000 122,000 300,000 $490,000 285,000 $495,000 Liabilities & Stockholders' Equity Accounts payable Accrued expenses payable Note payable .. Capital stock (no par value) Retained earnings Totals $ 50,000 17,000 245,000 120,000 58,000 $490,000 $ 73,000 14,000 253,000 135,000 20,000 $495,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started