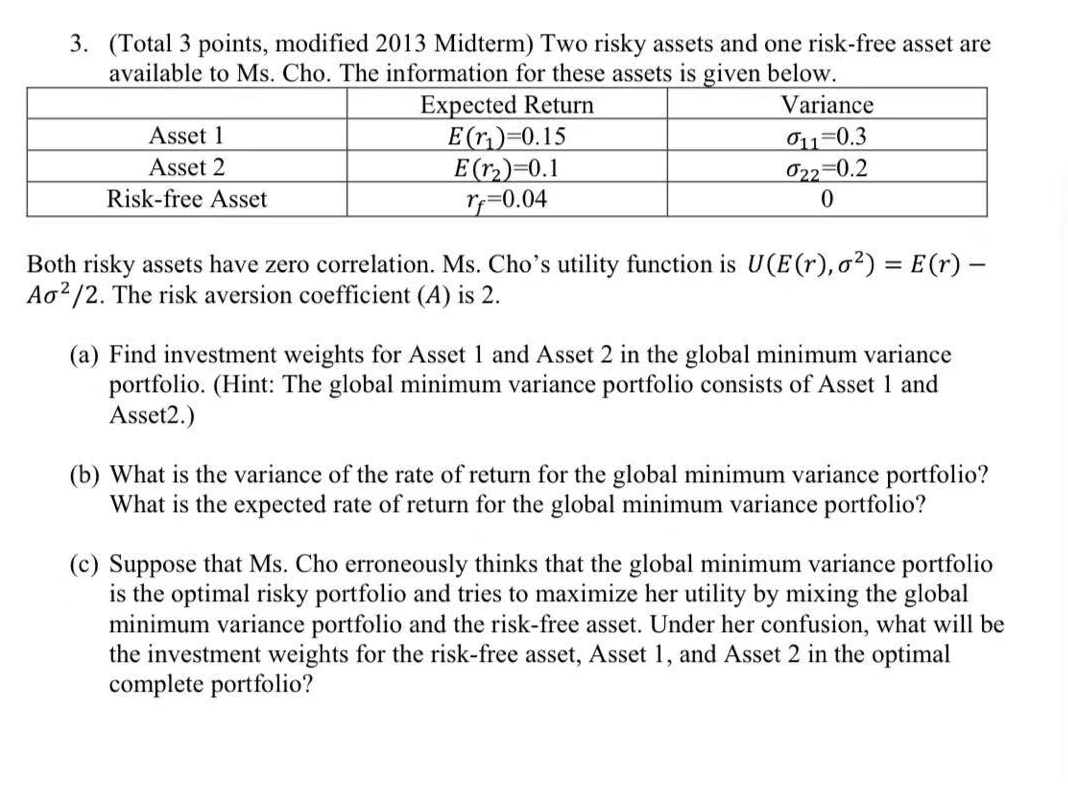

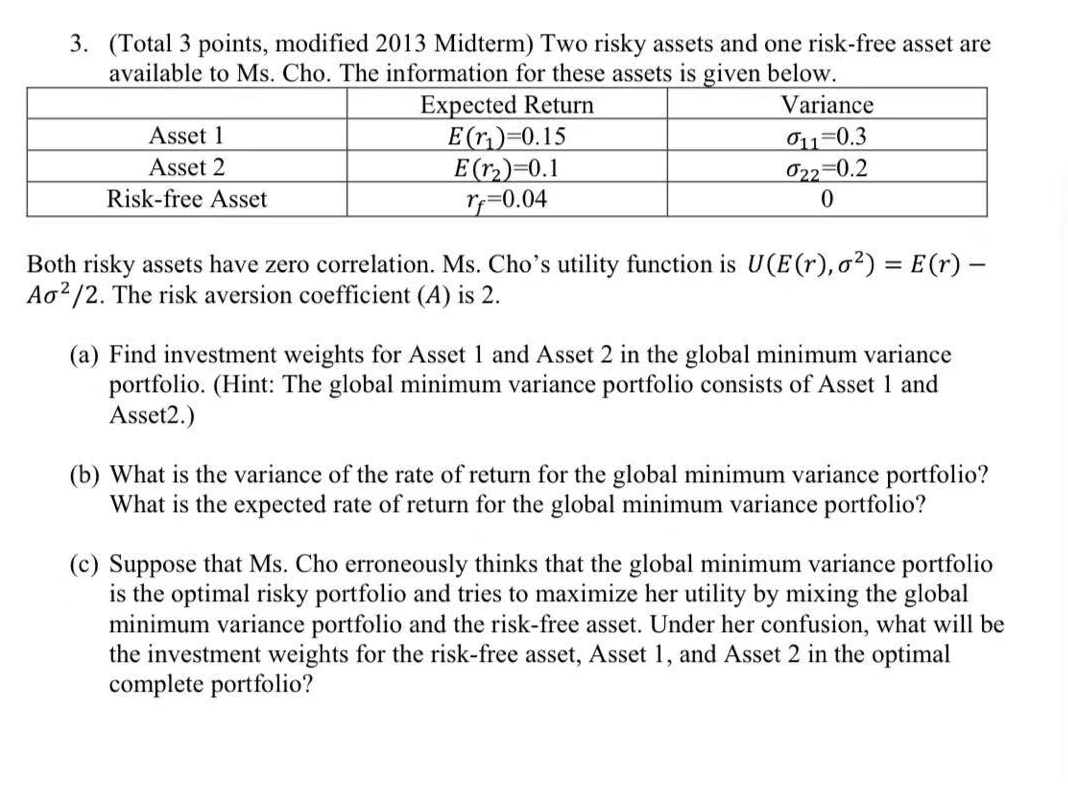

3. (Total 3 points, modified 2013 Midterm) Two risky assets and one risk-free asset are available to Ms. Cho. The information for these assets is given below. Expected Return Variance Asset 1 E(r)=0.15 Ou=0.3 Asset 2 E (12)=0.1 022=0.2 Risk-free Asset re=0.04 0 Both risky assets have zero correlation. Ms. Cho's utility function is U(E(r), 02) = E(r) - Ag2/2. The risk aversion coefficient (A) is 2. (a) Find investment weights for Asset 1 and Asset 2 in the global minimum variance portfolio. (Hint: The global minimum variance portfolio consists of Asset 1 and Asset2.) (b) What is the variance of the rate of return for the global minimum variance portfolio? What is the expected rate of return for the global minimum variance portfolio? (C) Suppose that Ms. Cho erroneously thinks that the global minimum variance portfolio is the optimal risky portfolio and tries to maximize her utility by mixing the global minimum variance portfolio and the risk-free asset. Under her confusion, what will be the investment weights for the risk-free asset, Asset 1, and Asset 2 in the optimal complete portfolio? 3. (Total 3 points, modified 2013 Midterm) Two risky assets and one risk-free asset are available to Ms. Cho. The information for these assets is given below. Expected Return Variance Asset 1 E(r)=0.15 Ou=0.3 Asset 2 E (12)=0.1 022=0.2 Risk-free Asset re=0.04 0 Both risky assets have zero correlation. Ms. Cho's utility function is U(E(r), 02) = E(r) - Ag2/2. The risk aversion coefficient (A) is 2. (a) Find investment weights for Asset 1 and Asset 2 in the global minimum variance portfolio. (Hint: The global minimum variance portfolio consists of Asset 1 and Asset2.) (b) What is the variance of the rate of return for the global minimum variance portfolio? What is the expected rate of return for the global minimum variance portfolio? (C) Suppose that Ms. Cho erroneously thinks that the global minimum variance portfolio is the optimal risky portfolio and tries to maximize her utility by mixing the global minimum variance portfolio and the risk-free asset. Under her confusion, what will be the investment weights for the risk-free asset, Asset 1, and Asset 2 in the optimal complete portfolio