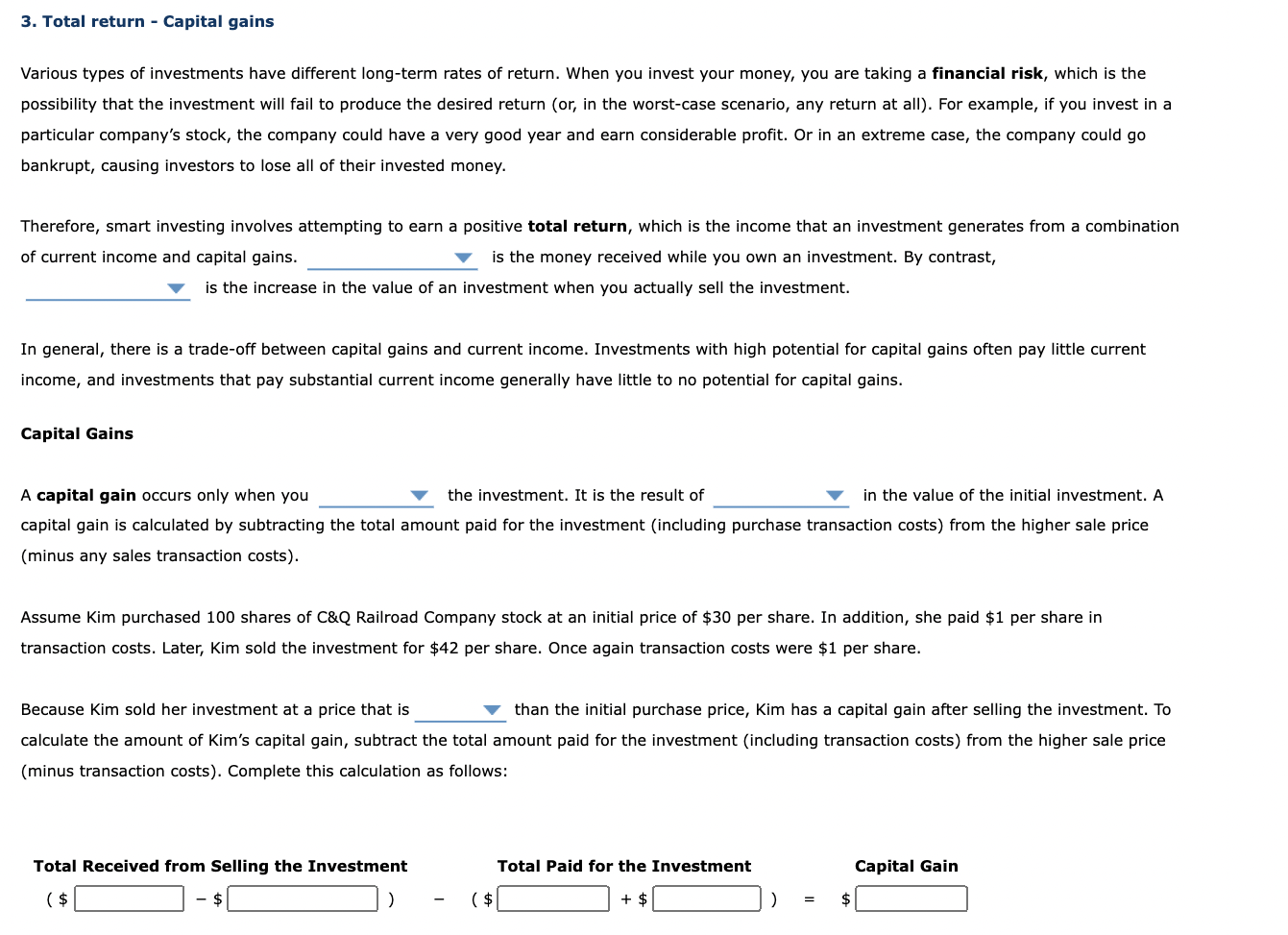

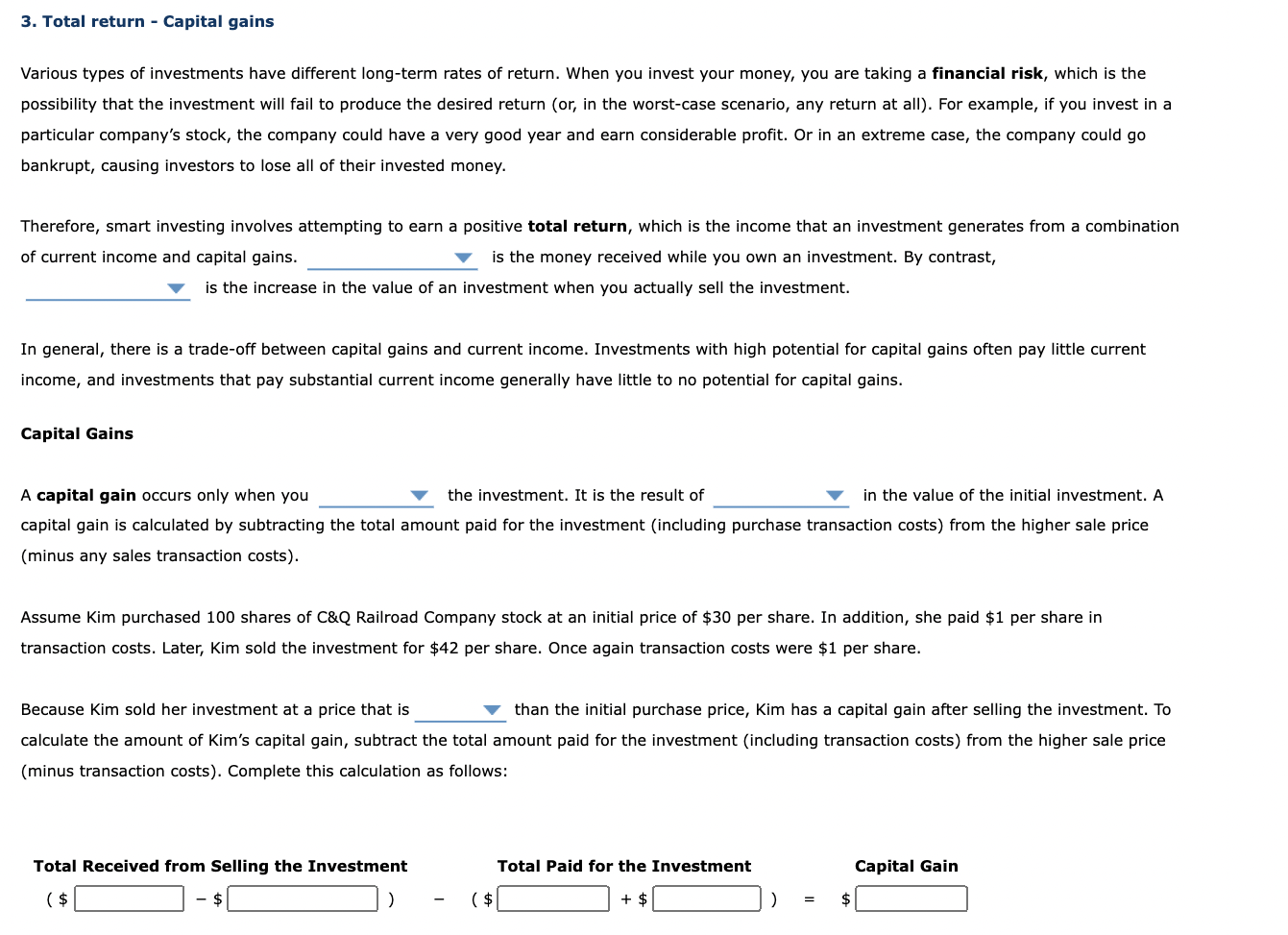

3. Total return - Capital gains Various types of investments have different long-term rates of return. When you invest your money, you are taking a financial risk, which is the possibility that the investment will fail to produce the desired return (or, in the worst-case scenario, any return at all). For example, if you invest in a particular company's stock, the company could have a very good year and earn considerable profit. Or in an extreme case, the company could go bankrupt, causing investors to lose all of their invested money. Therefore, smart investing involves attempting to earn a positive total return, which is the income that an investment generates from a combination of current income and capital gains. is the money received while you own an investment. By contrast, is the increase in the value of an investment when you actually sell the investment. In general, there is a trade-off between capital gains and current income. Investments with high potential for capital gains often pay little current income, and investments that pay substantial current income generally have little to no potential for capital gains. Capital Gains A capital gain occurs only when you the investment. It is the result of in the value of the initial investment. A capital gain is calculated by subtracting the total amount paid for the investment (including purchase transaction costs) from the higher sale price (minus any sales transaction costs). Assume Kim purchased 100 shares of C&Q Railroad Company stock at an initial price of $30 per share. In addition, she paid $1 per share in transaction costs. Later, Kim sold the investment for $42 per share. Once again transaction costs were $1 per share. Because Kim sold her investment at a price that is than the initial purchase price, Kim has a capital gain after selling the investment. To calculate the amount of Kim's capital gain, subtract the total amount paid for the investment (including transaction costs) from the higher sale price (minus transaction costs). Complete this calculation as follows: Total Received from Selling the Investment Total Paid for the Investment Capital Gain ($ - $ ) ($ + $ 3. Total return - Capital gains Various types of investments have different long-term rates of return. When you invest your money, you are taking a financial risk, which is the possibility that the investment will fail to produce the desired return (or, in the worst-case scenario, any return at all). For example, if you invest in a particular company's stock, the company could have a very good year and earn considerable profit. Or in an extreme case, the company could go bankrupt, causing investors to lose all of their invested money. Therefore, smart investing involves attempting to earn a positive total return, which is the income that an investment generates from a combination of current income and capital gains. is the money received while you own an investment. By contrast, is the increase in the value of an investment when you actually sell the investment. In general, there is a trade-off between capital gains and current income. Investments with high potential for capital gains often pay little current income, and investments that pay substantial current income generally have little to no potential for capital gains. Capital Gains A capital gain occurs only when you the investment. It is the result of in the value of the initial investment. A capital gain is calculated by subtracting the total amount paid for the investment (including purchase transaction costs) from the higher sale price (minus any sales transaction costs). Assume Kim purchased 100 shares of C&Q Railroad Company stock at an initial price of $30 per share. In addition, she paid $1 per share in transaction costs. Later, Kim sold the investment for $42 per share. Once again transaction costs were $1 per share. Because Kim sold her investment at a price that is than the initial purchase price, Kim has a capital gain after selling the investment. To calculate the amount of Kim's capital gain, subtract the total amount paid for the investment (including transaction costs) from the higher sale price (minus transaction costs). Complete this calculation as follows: Total Received from Selling the Investment Total Paid for the Investment Capital Gain ($ - $ ) ($ + $