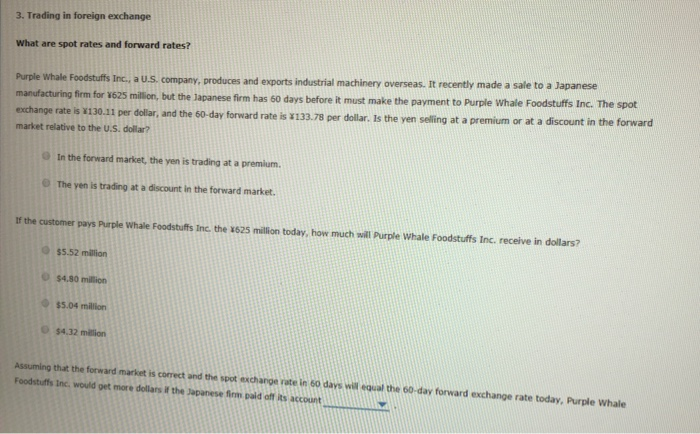

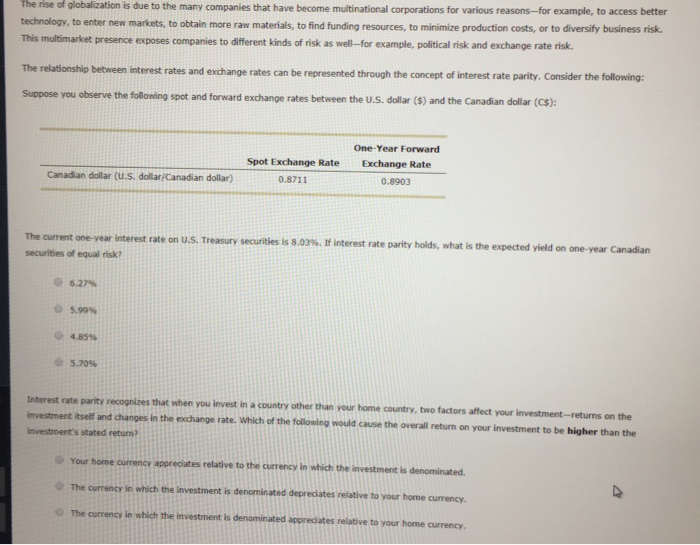

3. Trading in foreign exchange What are spot rates and forward rates? Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for 1625 million, but the Japanese firm has 60 days before it must make the payment to Purple Whale Foodstuffs Inc. The spot exchange rate is 130.11 per dollar, and the 60-day forward rate is 133.78 per dollar. Is the yen seling at a premium or at a discount in the forward market relative to the U.S. dollar? In the forward market, the yen is trading at a premium. The yen is trading at a discount in the forward market If the customer pas Purple Whale Foodstuffs Inc. the 1525 million today, how much will Purple Whale Foodstuffs Inc. receive in dollars? $5.52 million $480 million $5.04 million $4.32 milion Asuming that the forward market is correct and the spot exchange rate in 60 days will the 60-day forward exchange rate today, Purple Whale Foodstuffs Inc. would get more dollars the prese paid of its account The rise of globalization is due to the many companies that have become multinational corporations for various reasons--for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversify business risk. This multimarket presence exposes companies to different kinds of risk as well--for example, political risk and exchange rate risk. The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (CS): Spot Exchange Rate 0.8711 One-Year Forward Exchange Rate 0.8903 Canadian dollar (U.S. dollar Canadian dollar) The current one-year interest rate on U.S. Treasury securities is 8.03%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk 6.279 5.99% 4.85 5.70% Interest rate parity recognizes that when you invest in a country other than your home country, two factors affect your investment-returns on the Investment itself and changes in the exchange rate. Which of the following would cause the overall return on your investment to be higher than the investment's stated return? Your home appreciates relative to the currency in which the investment is denominated The currency in which the investment is denominated depreciates relative to your home currency The currency i n the investment is denominated appreciates relative to your home currency. 3. Trading in foreign exchange What are spot rates and forward rates? Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for 1625 million, but the Japanese firm has 60 days before it must make the payment to Purple Whale Foodstuffs Inc. The spot exchange rate is 130.11 per dollar, and the 60-day forward rate is 133.78 per dollar. Is the yen seling at a premium or at a discount in the forward market relative to the U.S. dollar? In the forward market, the yen is trading at a premium. The yen is trading at a discount in the forward market If the customer pas Purple Whale Foodstuffs Inc. the 1525 million today, how much will Purple Whale Foodstuffs Inc. receive in dollars? $5.52 million $480 million $5.04 million $4.32 milion Asuming that the forward market is correct and the spot exchange rate in 60 days will the 60-day forward exchange rate today, Purple Whale Foodstuffs Inc. would get more dollars the prese paid of its account The rise of globalization is due to the many companies that have become multinational corporations for various reasons--for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversify business risk. This multimarket presence exposes companies to different kinds of risk as well--for example, political risk and exchange rate risk. The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (CS): Spot Exchange Rate 0.8711 One-Year Forward Exchange Rate 0.8903 Canadian dollar (U.S. dollar Canadian dollar) The current one-year interest rate on U.S. Treasury securities is 8.03%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk 6.279 5.99% 4.85 5.70% Interest rate parity recognizes that when you invest in a country other than your home country, two factors affect your investment-returns on the Investment itself and changes in the exchange rate. Which of the following would cause the overall return on your investment to be higher than the investment's stated return? Your home appreciates relative to the currency in which the investment is denominated The currency in which the investment is denominated depreciates relative to your home currency The currency i n the investment is denominated appreciates relative to your home currency