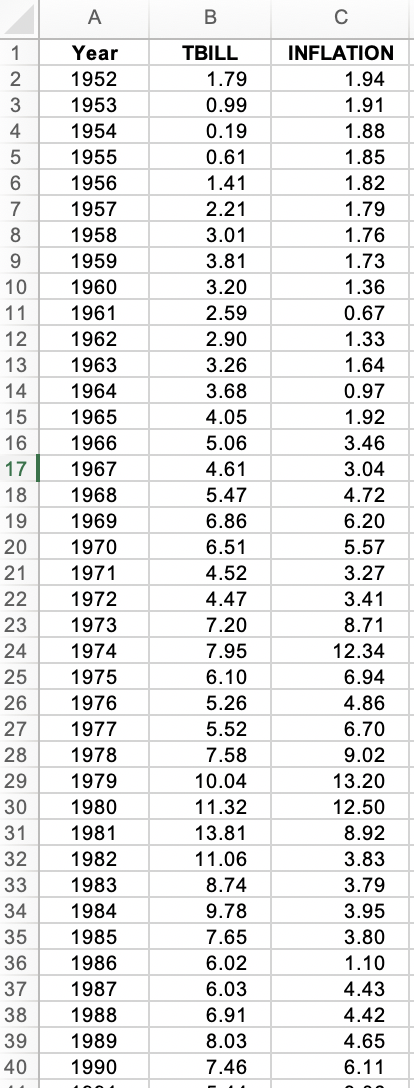

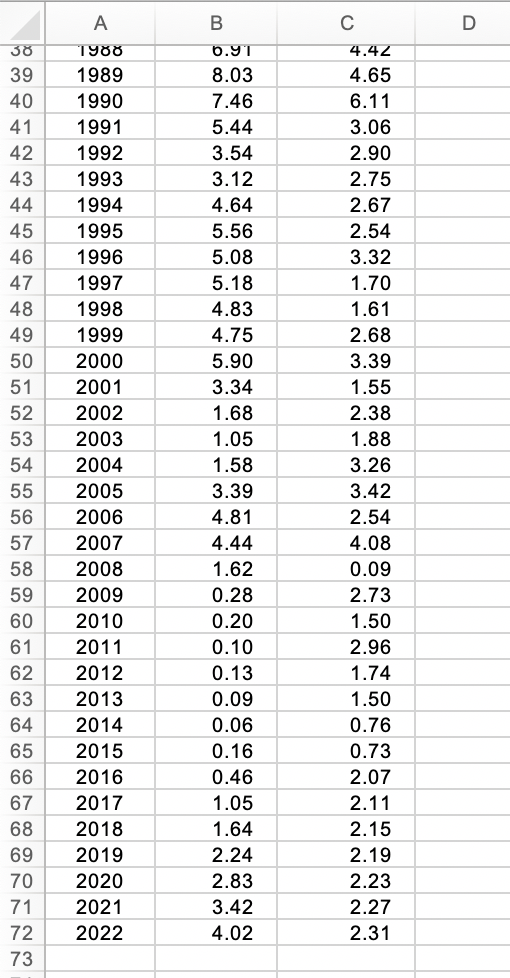

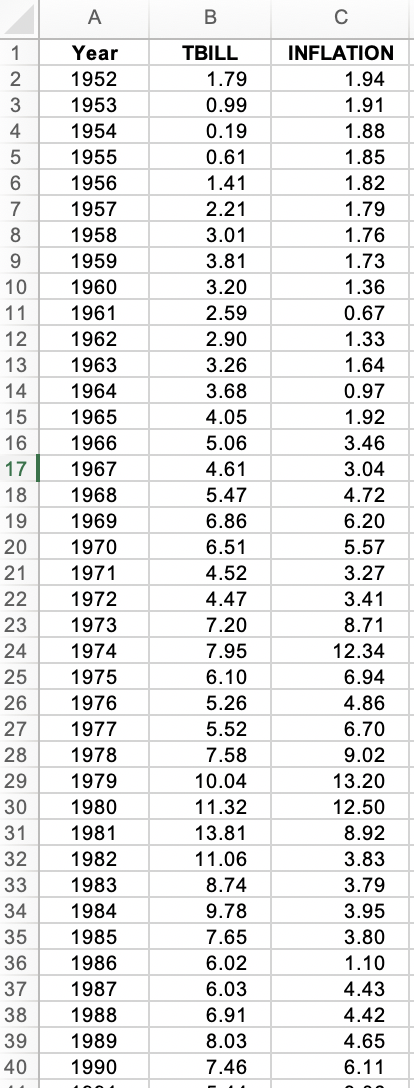

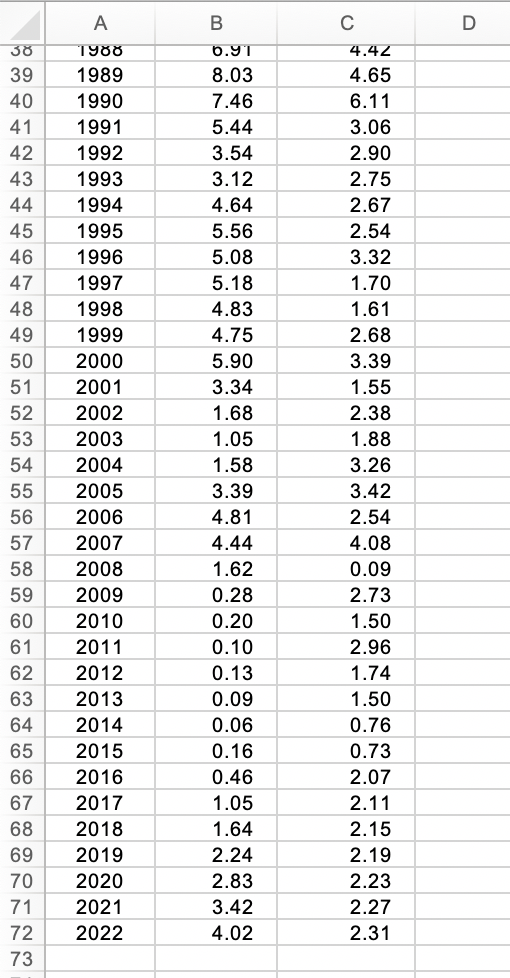

3. Treasury bills (T-bill) and inflation. When inflation is high, lenders require higher interest rates to make up for the loss of purchasing power of their money while it is loaned out. The Excel file displays the return for six-month Treasury bills (annualized) and the rate of inflation as measured by the change in the government's Consumer Price Index in the same year. An inflation rate of 5% means that the same set of goods and services costs 5% more. The data cover 70 years, from 1952 to 2022 . Excel will be used to run Regression analysis for predicting T-bill return from inflation rate. =0.01 (Round off each element from the output to three decimal places when reporting). Excel Output: 10 points a) Indicate which variable is the dependent and which is the independent variable. (2p) b) Using Excel, graph a scatterplot of the return on T-bill against the rate of inflation the same year. (3p) (Show scatterplot here) c) Find the sample correlation coefficient for the data. (Pearson correlation coefficient between T-bill, y and the rate of inflation, x). (2p) d) Give a brief description of the form, direction, and strength of the relationship between the inflation rate and the return on T-bill. (2p) e) What is the equation of the least-squares regression line for predicting T-bill return? What is the intercept (a) and slope (b) values of the regression formula, y^=a+bx for predicting T-bill return from the inflation rate? Write the formula replacing a and b by their respective numerical values. (5p) f) What is the predicted return on T-bill with 4.5% rate of inflation? (5p) g) What amount of the variance in T-bill (y) do the inflation rate (x) account for this sample? (R2= ?) Interpret the result in the context of the data. (3p) h) What is the unexplained variation in T-bill that is not related to the inflation rate? (3p) i) Write out the null and alternative hypotheses and conduct a hypothesis testing for the data. Do these data indicate there is a significant relationship between Treasury-bills and inflation rate? Test this relationship at 1% significance level. State the values used to help determine your answer. Briefly explain how you reach this conclusion. (5p) j) Would you conclude that inflation rate is a good predictor of Treasury-bills based upon this sample? What evidence do you have to support your conclusion? (5p) 3. Treasury bills (T-bill) and inflation. When inflation is high, lenders require higher interest rates to make up for the loss of purchasing power of their money while it is loaned out. The Excel file displays the return for six-month Treasury bills (annualized) and the rate of inflation as measured by the change in the government's Consumer Price Index in the same year. An inflation rate of 5% means that the same set of goods and services costs 5% more. The data cover 70 years, from 1952 to 2022 . Excel will be used to run Regression analysis for predicting T-bill return from inflation rate. =0.01 (Round off each element from the output to three decimal places when reporting). Excel Output: 10 points a) Indicate which variable is the dependent and which is the independent variable. (2p) b) Using Excel, graph a scatterplot of the return on T-bill against the rate of inflation the same year. (3p) (Show scatterplot here) c) Find the sample correlation coefficient for the data. (Pearson correlation coefficient between T-bill, y and the rate of inflation, x). (2p) d) Give a brief description of the form, direction, and strength of the relationship between the inflation rate and the return on T-bill. (2p) e) What is the equation of the least-squares regression line for predicting T-bill return? What is the intercept (a) and slope (b) values of the regression formula, y^=a+bx for predicting T-bill return from the inflation rate? Write the formula replacing a and b by their respective numerical values. (5p) f) What is the predicted return on T-bill with 4.5% rate of inflation? (5p) g) What amount of the variance in T-bill (y) do the inflation rate (x) account for this sample? (R2= ?) Interpret the result in the context of the data. (3p) h) What is the unexplained variation in T-bill that is not related to the inflation rate? (3p) i) Write out the null and alternative hypotheses and conduct a hypothesis testing for the data. Do these data indicate there is a significant relationship between Treasury-bills and inflation rate? Test this relationship at 1% significance level. State the values used to help determine your answer. Briefly explain how you reach this conclusion. (5p) j) Would you conclude that inflation rate is a good predictor of Treasury-bills based upon this sample? What evidence do you have to support your conclusion? (5p)