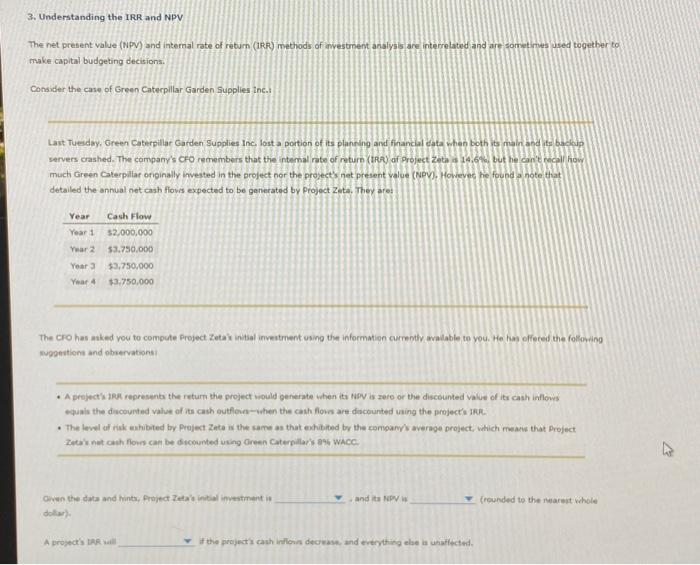

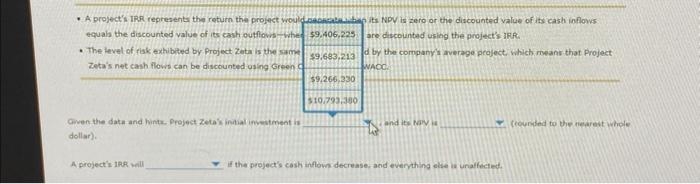

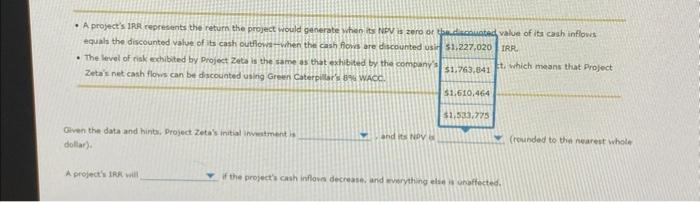

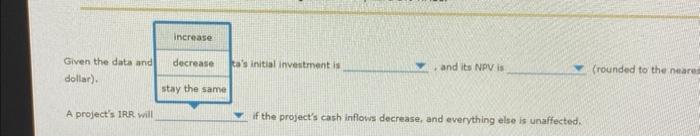

3. Understanding the IRR and NPV The net present value (NPY) and internal rate of reburn (1rR) methods of anvestroent analysis are interretated and are sormetimes used together to Trake capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies tnc.: Lask Tuesday. Green Caterpillar Garden Supglies Inc, lost a portion of its planning and financlal eata when both its main and its backip servers cashed. The company's CFO remembers that the intemal rate of return (tRe) af Project Zeta is 14.6 ) but he can't recall how much Green Caterpillar oripinally invested in the oroject nor the project's net present walue (NPV?. Howeves he found a note that detailed the annual net cash flowis expected to be generated by project Zeta. They are: The cro has maked you to compute project Zetari intial investment using the infocmation currently wallable to you. He has offered the folionding nuggestione and obkervatsonsi - A project's 1P9l representa the return the project would generate when ita Way is zero or the discounted value of ita cash inflows equals the discounted value of its cash outfoin-when the cash flokn are dicoounted uaing the project's IRh: * The level of rick whibited by Praject Zete is the same as that exhitited by the cqmoanyls average project, wilich meare that Project Zeta'r not cash flomes can be diccounted using Giren Caterpallar's 84h wacC. doliar). A project? the tail if the project 1 cash inilion decwase, and evervthing elas in unarlected. - A project's IRR representa the return the project woul hits Npy is zero or the discounted value of iss icash inflows equala the discounted value of its cash outficvis - Whe are discountad using the project's BPF. - The level of fiak extribited by Project Zatia is the same d by the company'a average praject, which meian that Project Zeta's net cash flowrs can be discounted using Green? NheC. Given the dake and hints. Project Zetaik inatalinvestment is dollar). A project'i 1 PR ill If the project's cash inflows decrease: and everything else is unalfected. - A project's IRR represents the return the project would generate when its rupV is zero or value of its cash inflows equals the discounted value of ts cash outhowa - when the cash fows are discounted usi tRF * The level of risk echibited by Project Zeta is the same as that exhibited by the combany's? Zetain net eash flowis can be discounted using Green Caterpillar' b9y Wacc. t. which mesns that Project Given the data and hinta, Project zeta's initial inverament is farid its tapy dollar): donar) A projectu 1Ad inil If the proyectio cash inflows decrease. and mwerything else is unaftected. Given the data and dollar). A project's IRR will if the project's cach inflows decrease, and everything else is unaffected