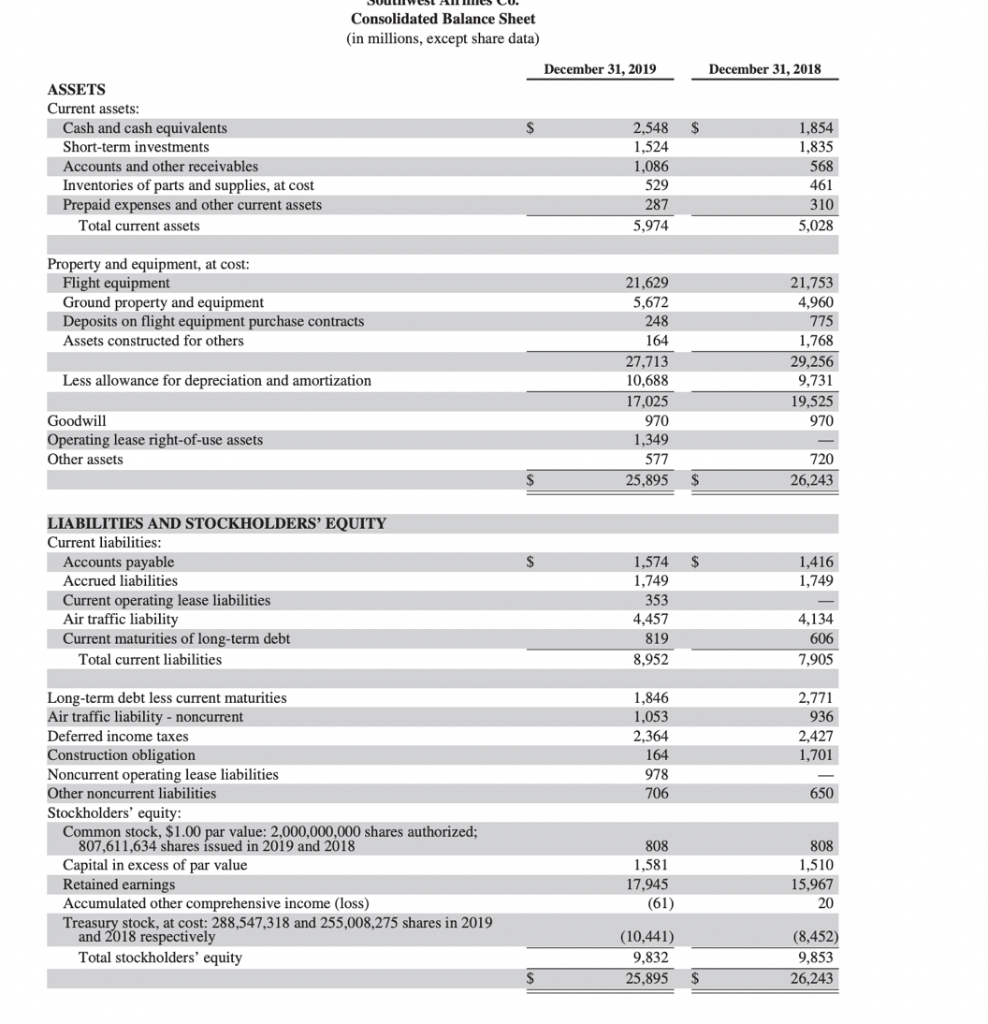

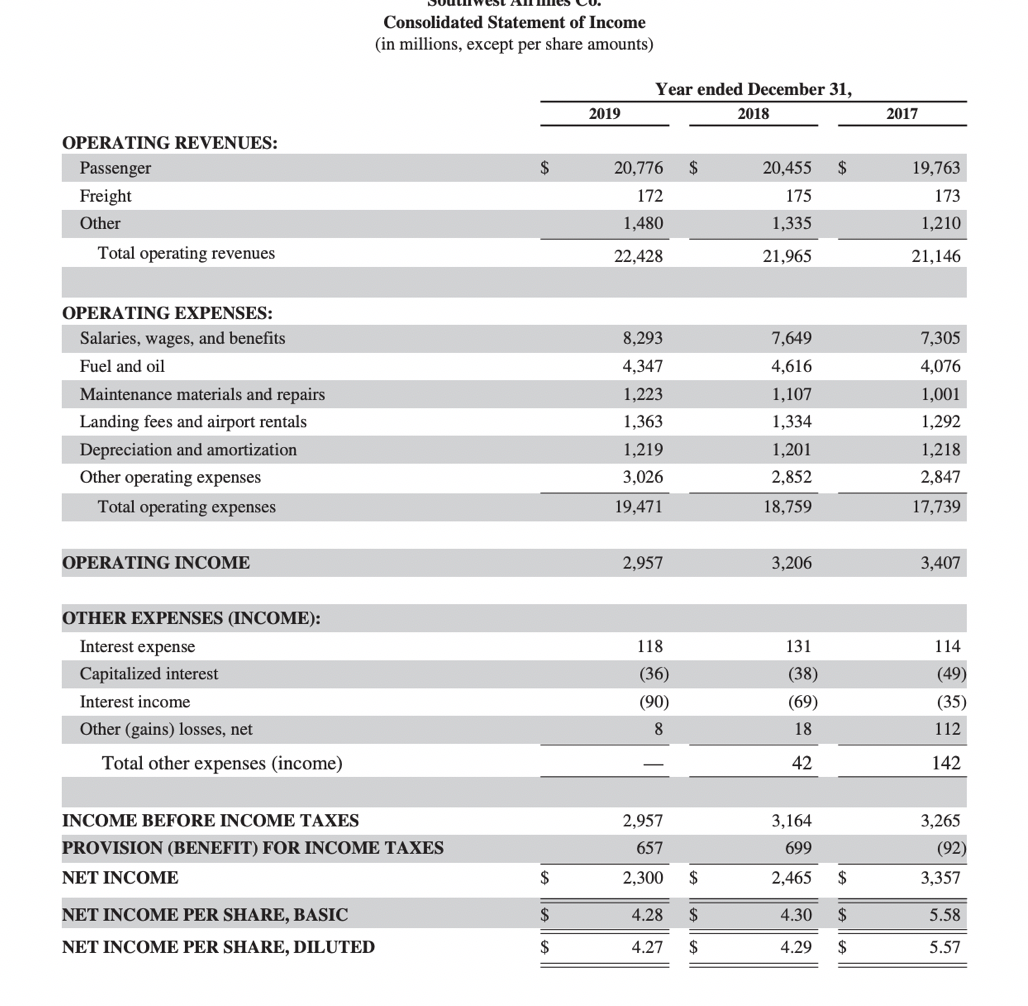

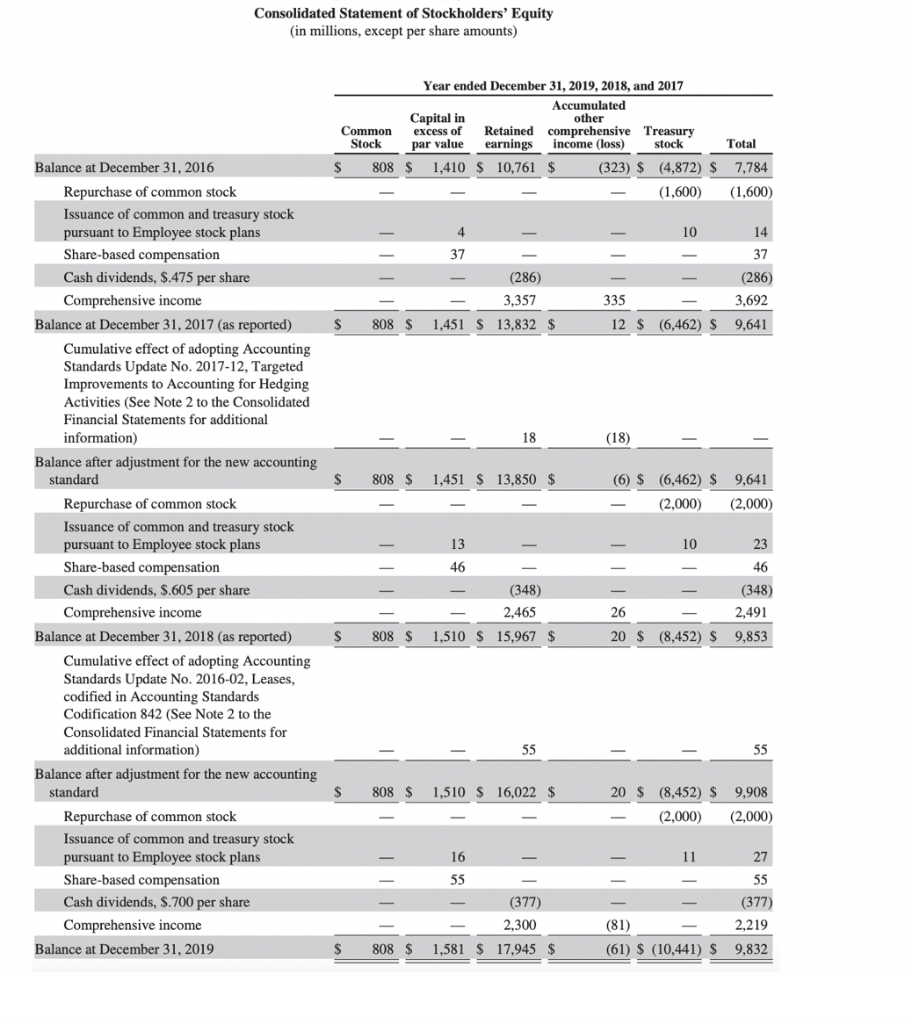

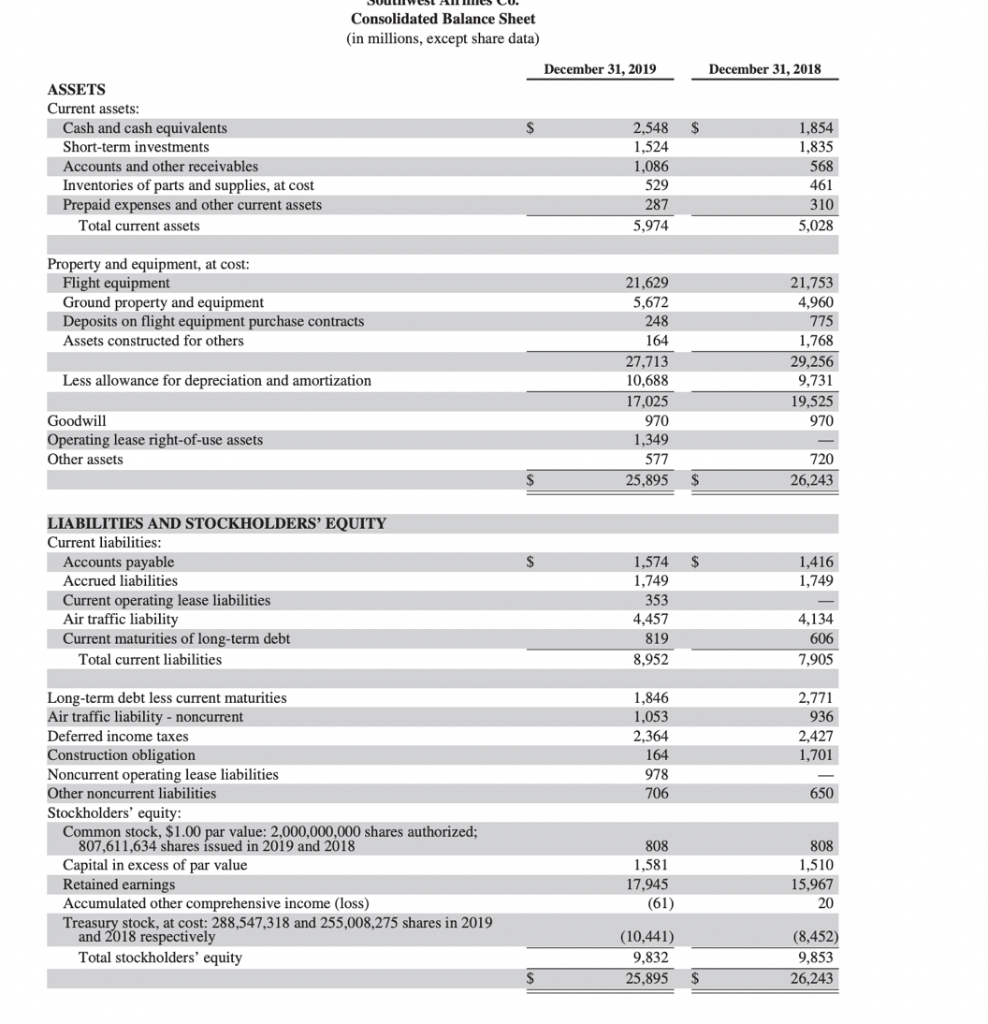

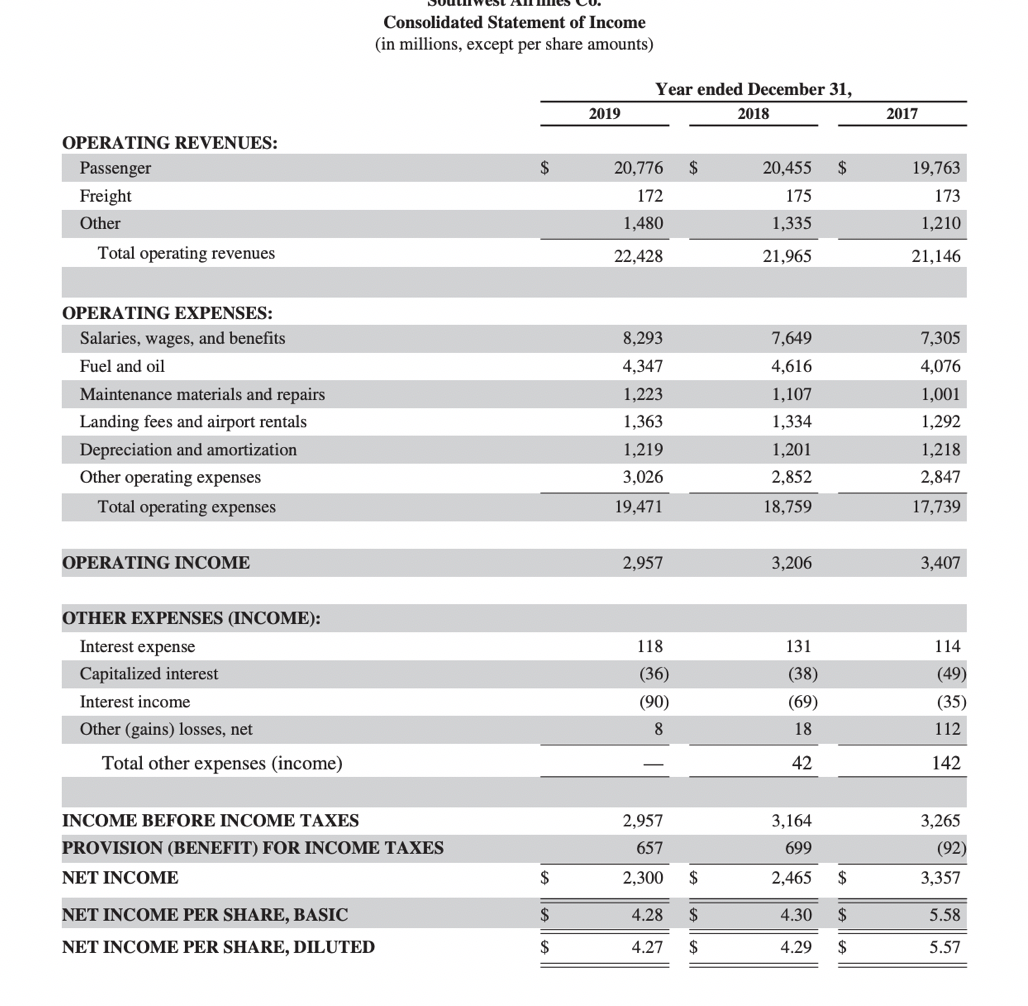

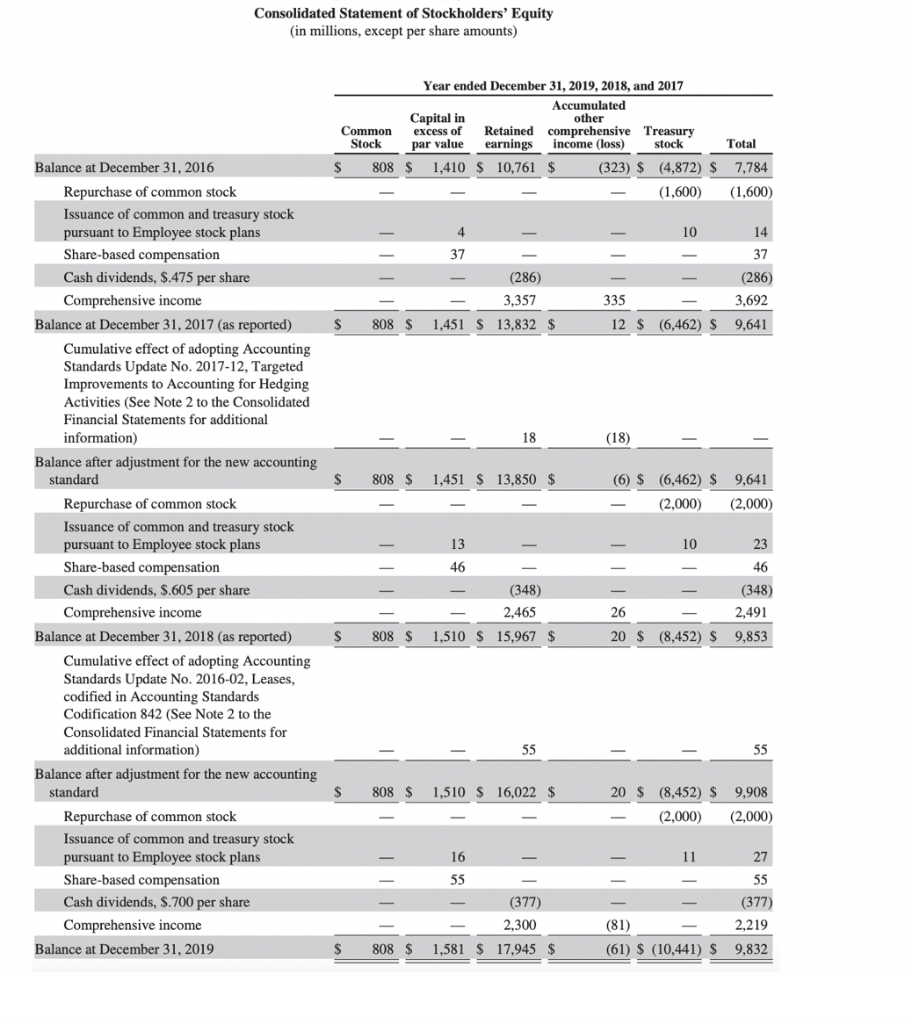

3. Using the attached excerpts from Southwest Airlines Ce's 2019 Annual Report answer the following questions, In addition: All numbers are in Smillions (except per share data). Provide calculations when necessary, a. Long-term Assets i) What is the net book value (NBV) of Southwest's property, plant and equipment as of December 31, 2019? What is the balance of Southwest's accumulated depreciation account as of December 31, 2019? ii) b. Shares Issued and Outstanding i) ii) How many shares of Common Stock were authorized as of December 31, 2019? How many had been issued as of December 31, 2019? Southwest also has repurchased some of its own shares of stock that had been previously issued (i.e. Treasury Stock). How many shares did Southwest hold as Treasury Stock as of December 31, 2019? How many shares of Southwest's Common Stock were outstanding, as of December 31, 2019? iii) C. Common Stock i) ii) What is the par value of each share of common stock issued? How much money in excess of the par value of the stock (i.e. Additional Paid in Capital, or APIC) had been contributed by shareholders as of the end of 2019 (hint: this is listed as Capital in Excess of Par Value on the balance sheet)? d. Equity analysis: i) ii) What is Southwest's Earnings Per Share (Basic) for the fiscal year ended 12/31/2019? What is the Return on Equity (ROE) for Southwest for the fiscal year ended 12/31/2019? (NOTE: when calculating average equity for the denominator of ROE, for the 12/31/2018 ending equity balance, use the reported balance number, $9,853 Average that amount with the 12/31/2019 ending equity balance to calculate average equity for the period) Consolidated Balance Sheet (in millions, except share data) December 31, 2019 December 31, 2018 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets 2,548 1,524 1,086 529 287 5,974 1,854 1,835 568 461 310 5,028 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,629 5,672 248 164 27,713 10.688 21,753 4,960 775 1,768 29,256 9,731 19,525 970 Less allowance for depreciation and amortization 17,025 Goodwill Operating lease right-of-use assets Other assets 970 1,349 577 25,895 720 26,243 S 1,416 1,749 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,574 1,749 353 4,457 819 8,952 4,134 606 7,905 1,846 1,053 2,771 936 2,427 1,701 2,364 164 978 706 650 Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2019 and 2018 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 288,547,318 and 255,008,275 shares in 2019 and 2018 respectively Total stockholders' equity 808 1,581 17,945 (61) 808 1,510 15,967 20 (10,441) 9,832 25.895 (8,452) 9,853 26,243 $ Consolidated Statement of Income (in millions, except per share amounts) Year ended December 31, 2018 2019 2017 $ $ $ OPERATING REVENUES: Passenger Freight Other Total operating revenues 20,776 172 1,480 20,455 175 19,763 173 1,210 1,335 22,428 21,965 21,146 7,649 4,616 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 8,293 4,347 1,223 1,363 1,219 3,026 1,107 1,334 1,201 2,852 7,305 4,076 1,001 1,292 1,218 2,847 19,471 18,759 17,739 OPERATING INCOME 2,957 3,206 3,407 118 131 (36) OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) (38) (69) 114 (49) (35) 112 (90) 8 18 42 142 INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES 2,957 657 3,164 699 3,265 (92) NET INCOME $ 2.300 $ 2,465 $ 3,357 $ 4.28 $ 4.30 $ 5.58 NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED $ 4.27 $ 4.29 $ 5.57 Consolidated Statement of Stockholders' Equity (in millions, except per share amounts) Year ended December 31, 2019, 2018, and 2017 Accumulated Capital in other Common excess of Retained comprehensive Treasury Stock par value earnings income (loss) stock Total S 808 S 1,410 $ 10,761 $ (323) $ (4,872) $ 7,784 (1,600) (1,600) 4 10 14 37 37 (286) 3,357 1,451 $ 13,832 $ (286) 335 3,692 12 $ (6,462) $ 9,641 $ 808 $ 18 (18) $ 808 $ 1,451 $ 13,850 $ (6) $ (6,462) $ 9,641 (2,000) (2,000) 13 10 23 Balance at December 31, 2016 Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.475 per share Comprehensive income Balance at December 31, 2017 (as reported) Cumulative effect of adopting Accounting Standards Update No. 2017-12, Targeted Improvements to Accounting for Hedging Activities (See Note 2 to the Consolidated Financial Statements for additional information) Balance after adjustment the new accounting standard Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.605 per share Comprehensive income Balance at December 31, 2018 (as reported) Cumulative effect of adopting Accounting Standards Update No. 2016-02, Leases, codified in Accounting Standards Codification 842 (See Note 2 to the Consolidated Financial Statements for additional information) Balance after adjustment for the new accounting standard Repurchase of common stock Issuance of common and treasury stock pursuant to Employee stock plans Share-based compensation Cash dividends, $.700 per share Comprehensive income Balance at December 31, 2019 46 46 (348) 2,465 26 (348) 2,491 9,853 808 $ 1,510 $ 15,967 $ 20 $ (8,452) $ - 55 - 55 808 $ 1,510 $ 16,022 $ 20 $ (8,452) $ 9,908 (2,000) (2,000) 16 11 27 55 55 (377) 2,300 (377) 2.219 (81) (61) $ (10,441) $ $ 808 $ 1,581 $ 17,945 $ 9,832