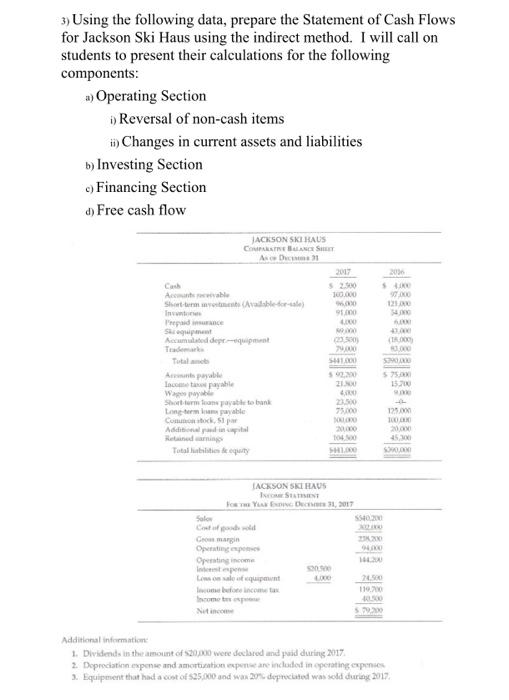

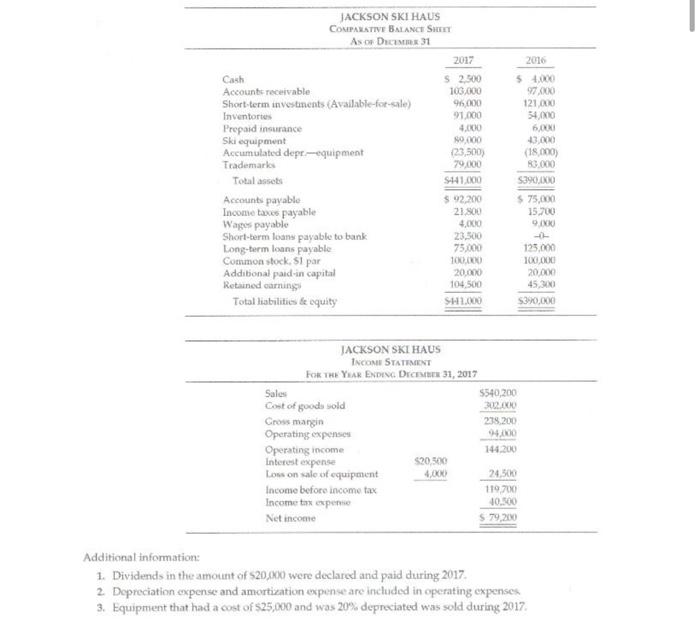

3) Using the following data, prepare the Statement of Cash Flows for Jackson Ski Haus using the indirect method. I will call on students to present their calculations for the following components: a) Operating Section i) Reversal of non-cash items 1) Changes in current assets and liabilities b) Investing Section c) Financing Section d) Free cash flow JACKSON SKI HAUS COMPARTENGEST AD1 2017 $2.500 100.000 Acable 1210 100 In Traduce : Acumulated dept equipment SH. ZIU 5. 13.20 Totalme Apayable Lace payable Way Short term from payt tobank Long-term mayable Cock, Additional 2250 75.00 LO 123 CODEX 1040 SH1.00 Totability S IACKSON SKIHAUS ISATIENT JoYE 2017 SON Solo Comag TO Operating income La punt 110,00 52222 Additional information 1. Dividends in the amount of 20000 were declared and paid during 2017 2. Depreciation expense and amortization expense are included in operating expenses 3. Equipment that had a cost of $25.000 and war 2010 deprecated was sold during 2017 JACKSON SKI HAUS COMPARATIVE BALANCE SHEET Aso DCM 31 2017 Cash $ 2.300 Accounts receivable 103.000 Short-term investments Available-for-sale) 96.000 Inventortes 91.000 Prepaid insurance 4.000 Ski equipment $9,000 Accumulated depe-equipment (23,500) Trademarks 79,000 Total assets S141.000 Accounts payable $ 92,200 Income taxes payable 21 800 Wages payable 4.000 Short-term loans payable to bank 23.500 Long-term loans payable 75.000 Common stock. Si par 1000 Addibonal paid in capital 20.00 Retained caring 104,500 Total liabilities te equity SH 1.000 2016 54.000 97.00 121.000 34,00 6,00 43,000 (18.000) 83.000 S3XXIXO $ 75,000 15.700 9.00 125.000 100,000 20.000 45.00 $320,000 JACKSON SKI HAUS INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2017 Sales 5540,200 Cost of goods sold 302.000 Cross margin 238.200 Operating expenses 940 Operating income 144.200 Interest expense 520.00 Lors on sale of equipment 4,00 24.500 Income before income tax 119,700 Income tax expert 40.500 Net income $ 79,20 Additional information: 1. Dividends in the amount of $2000 were declared and paid during 2017 2 Depreciation expense and amortization expense are included in operating expenses 3. Equipment that had a cost of $25,000 and was 20% depreciated was sold during 2017