Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3). Using the following free cash flow data: a. Calculate the growth in cash flow between 2019 and 2020 b. Prepare a 5 year cash

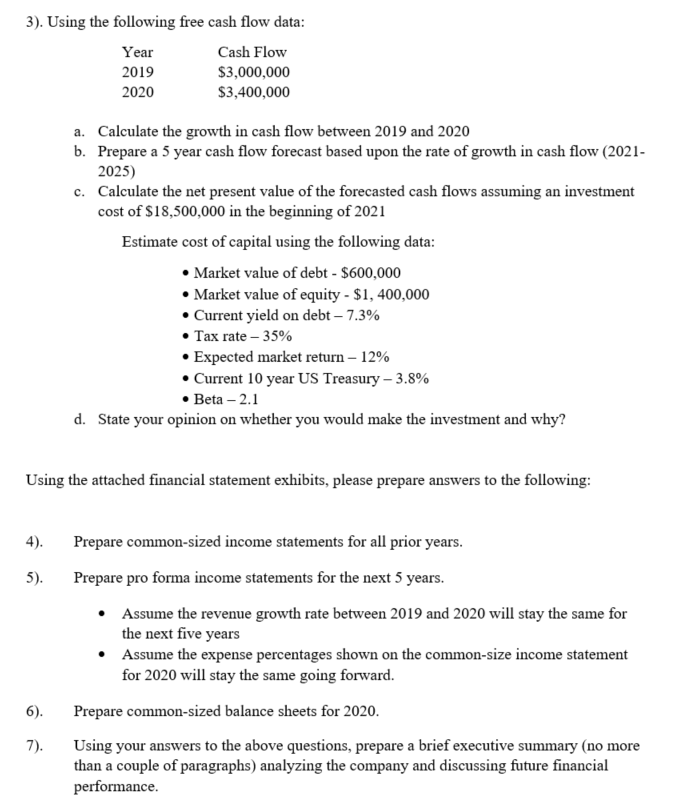

3). Using the following free cash flow data: a. Calculate the growth in cash flow between 2019 and 2020 b. Prepare a 5 year cash flow forecast based upon the rate of growth in cash flow (20212025) c. Calculate the net present value of the forecasted cash flows assuming an investment cost of $18,500,000 in the beginning of 2021 Estimate cost of capital using the following data: - Market value of debt - $600,000 - Market value of equity - $1,400,000 - Current yield on debt 7.3% - Tax rate 35% - Expected market return - 12% - Current 10 year US Treasury 3.8% - Beta -2.1 d. State your opinion on whether you would make the investment and why? Using the attached financial statement exhibits, please prepare answers to the following: 4). Prepare common-sized income statements for all prior years. 5). Prepare pro forma income statements for the next 5 years. - Assume the revenue growth rate between 2019 and 2020 will stay the same for the next five years - Assume the expense percentages shown on the common-size income statement for 2020 will stay the same going forward. 6). Prepare common-sized balance sheets for 2020 . 7). Using your answers to the above questions, prepare a brief executive summary (no more than a couple of paragraphs) analyzing the company and discussing future financial performance

3). Using the following free cash flow data: a. Calculate the growth in cash flow between 2019 and 2020 b. Prepare a 5 year cash flow forecast based upon the rate of growth in cash flow (20212025) c. Calculate the net present value of the forecasted cash flows assuming an investment cost of $18,500,000 in the beginning of 2021 Estimate cost of capital using the following data: - Market value of debt - $600,000 - Market value of equity - $1,400,000 - Current yield on debt 7.3% - Tax rate 35% - Expected market return - 12% - Current 10 year US Treasury 3.8% - Beta -2.1 d. State your opinion on whether you would make the investment and why? Using the attached financial statement exhibits, please prepare answers to the following: 4). Prepare common-sized income statements for all prior years. 5). Prepare pro forma income statements for the next 5 years. - Assume the revenue growth rate between 2019 and 2020 will stay the same for the next five years - Assume the expense percentages shown on the common-size income statement for 2020 will stay the same going forward. 6). Prepare common-sized balance sheets for 2020 . 7). Using your answers to the above questions, prepare a brief executive summary (no more than a couple of paragraphs) analyzing the company and discussing future financial performance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started