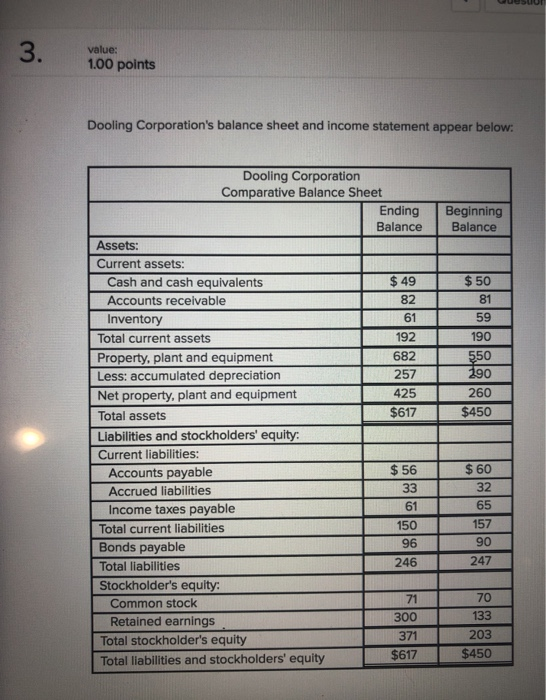

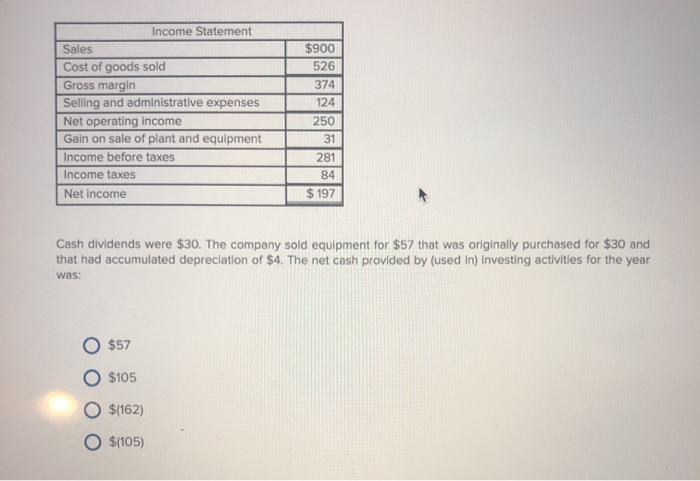

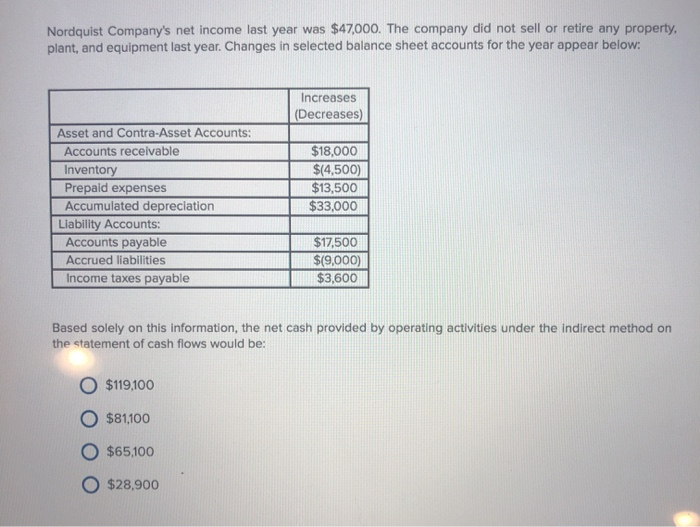

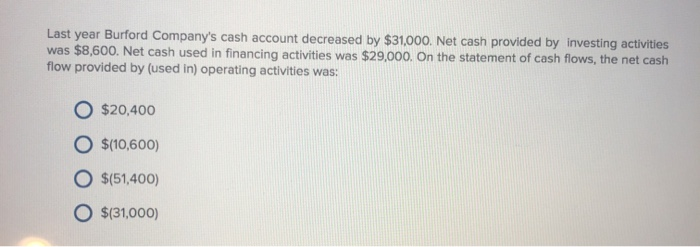

3. value: 1.00 points Dooling Corporation's balance sheet and income statement appear below. Dooling Corporation Comparative Balance Sheet Ending Beginning Balance Balance $50 81 | 59 190 $ 49 82 61 192 682 257 425 $617 L 550 , 190 260 $450 1 Assets: Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant and equipment Less: accumulated depreciation Net property, plant and equipment Total assets Liabilities and stockholders' equity: Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholder's equity: Common stock Retained earnings Total stockholder's equity Total liabilities and stockholders' equity $60 $561 33 61 150 96 1246 65 157 90 - 247 70 133 71 300 371 $617 203 $450 $900 526 374 Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Gain on sale of plant and equipment Income before taxes Income taxes Net income 281 84 $ 197 Cash dividends were $30. The company sold equipment for $57 that was originally purchased for $30 and that had accumulated depreciation of $4. The net cash provided by (used in) investing activities for the year was: O $57 $105 $(162) $(105) Nordquist Company's net income last year was $47,000. The company did not sell or retire any property. plant, and equipment last year. Changes in selected balance sheet accounts for the year appear below: Increases (Decreases) Asset and Contra-Asset Accounts: Accounts receivable Inventory Prepaid expenses Accumulated depreciation Liability Accounts: Accounts payable Accrued liabilities Income taxes payable $18,000 $(4,500) $13,500 $33,000 $17.500 $(9,000) $3,600 Based solely on this information, the net cash provided by operating activities under the indirect method on the statement of cash flows would be: O $119,100 O $81,100 O $65,100 O $28,900 Last year Burford Company's cash account decreased by $31,000. Net cash provided by investing activities was $8,600. Net cash used in financing activities was $29,000. On the statement of cash flows, the net cash flow provided by (used in) operating activities was: O $20,400 O $(10,600) O $(51,400) $(31,000)