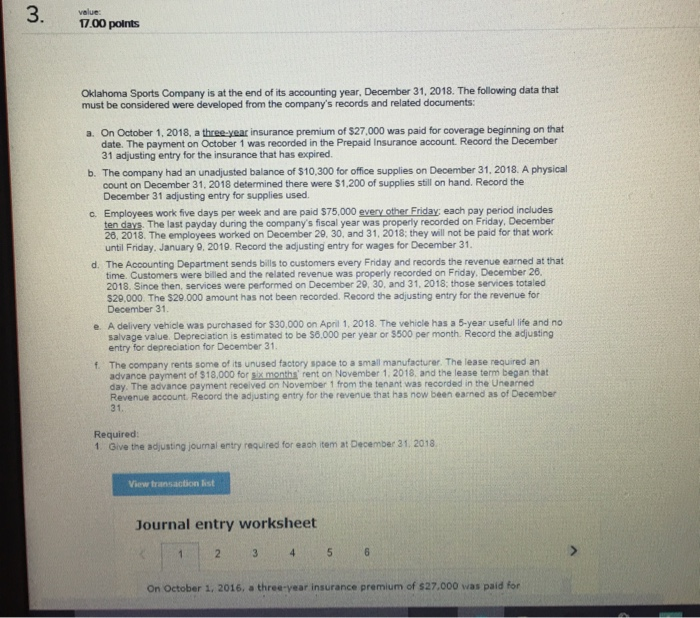

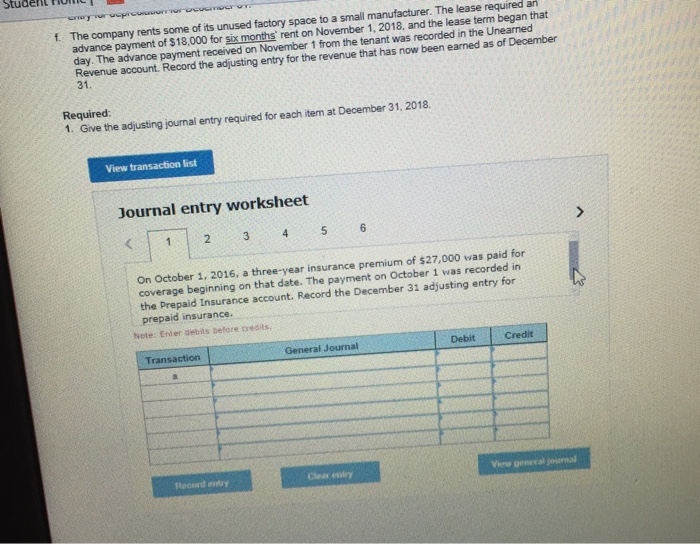

3. value: 17.00 points Oklahoma Sports Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company's records and related documents: a. On October 1, 2018, a three-year insurance premium of $27,000 was paid for coverage beginning on that date. The payment on October 1 was recorded in the Prepaid Insurance account. Record the December 31 adjusting entry for the insurance that has expired. b. The company had an unadjusted balance of $10,300 for office supplies on December 31, 2018. A physical 2 count on December 31, 2018 determined there were $1,200 of supplies still on hand. Record the December 31 adjusting entry for supplies used. Employees work five days per week and are paid S75.000 everyotherFriday: each pay period includes ten days. The last payday during the company's fiscal year was properly recorded on Friday, December 26. 2018. The employees worked on December 29, 30, and 31, 2018: they will not be paid for that work until Friday. January 9, 2019. Record the adjusting entry for wages for December 31 C. The Accounting Department sends bills to customers every Friday and records the revenue earned at that time. Customers were billed and the related revenue was properly recorded on Friday. December 26, 2018. Since then, services were performed on December 20, 30, and 31, 2018; those services totaled d. S20.000. The $29.000 amount has not been recorded. Record the adjusting entry for the revenue for December 31 e. A delivery vehicle was purchased for $30.000 on April 1, 2018. The vehicle has a 5-year useful life and no salvage value. Depreciation is estimated to be $6.000 per year or $500 per month. Record the adjusting entry for depreciation for December 31 f. The company rents some of its unused factory s pace to a small manufacturer. The lease required an advance payment of $18,000 for sis months rent on November 1. 2018, and the lease term began that day. The advance payment received on November 1 from the tenant was recorded in the Unearned Revenue account. Reoord the adjusting entry for the revenue that has now been earned as of December 31. Required: 1. Give the adjusting journal entry required for each item at December 31. 2018 View transaction ist Journal entry worksheet 2 On October 1, 2016, a three-year insurance premium of s27,000 was paid for Student ho The company rents some of its unused factory space to a small manufacturer. The lease required an advance day. The advance payment received on November 1 from the tenant was recorded in the Unearned Revenue account. Record the adjusting entry for the revenue that has now been earned as of December f. payment of $18,000 for six months rent on November 1, 2018, and the lease term began that 31 Required 1. Give the adjusting journal entry required for each item at December 31, 2018. View transaction list Journal entry worksheet On October 1, 2016, a three-year insurance premium of $27,000 was paid for coverage beginning on that date. The payment on October 1 was recorded in the Prepaid Insurance account. Record the December 31 adjusting entry for prepaid insurance. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear enley Viw general