Answered step by step

Verified Expert Solution

Question

1 Approved Answer

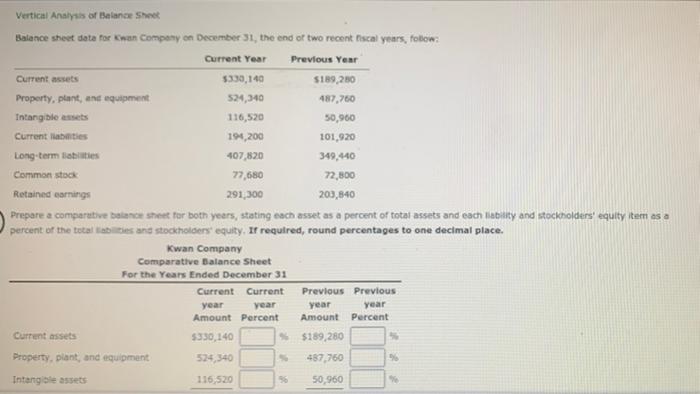

#3 Vertical Analysis of Balance Sheet Balance sheet date for Ewan Company on December 31, the end of two recent Piscal years, follow Current Year

#3

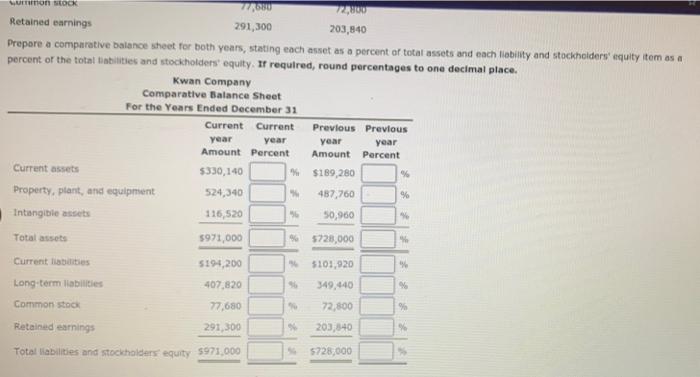

Vertical Analysis of Balance Sheet Balance sheet date for Ewan Company on December 31, the end of two recent Piscal years, follow Current Year Previous Year Current assets $330,140 $189,280 Property, plant, and equipment 524,340 487,760 Intangible assets 116,520 50,900 Current anties 194,200 101,920 Long-term labies 407,820 349,440 Common stock 77.680 72,800 Retained earnings 291,300 203,840 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each lability and stockholders' equity item as a percent of the total abies and stockholders equity. If required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current Previous Previous year year year year Amount Percent Amount Percent Current assets 5330,140 $189,280 Property, plant, and equipment 524.340 487,760 Intangible assets 116,520 50,960 36 Son OOK 7710 Retained earnings 291,300 203,840 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the totaltabilities and stockholders' equity. It required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current Previous Previous year year year year Amount Percent Amount Percent Current assets $330,140 $189,280 9 Property, plant, and equipment 524,340 487,760 % Intangible assets 116,520 50,900 Total assets 5971,000 5728,000 Current liabilities 5194,200 % Long-term liabilities 407,820 5101,920 349,440 72,800 Commonsta 77,680 % Retained earning 291,300 203340 % Total abilities and stockholders equity 5971.000 5728,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started