Question

3. What is the bank's net interest margin (NIM)? Is the bank performing better or worse than average? A) 2.54%, worse than average B) 3.38%,

3. What is the bank's net interest margin (NIM)? Is the bank performing better or worse than average?

A) 2.54%, worse than average

B) 3.38%, worse than average

C) 4.00%, better than average

D) 5.72%, better than average

E) 4.00%, worse than average

(Use Step-by-Step)

4. What must net noninterest income (net of noninterest expense) be in order for FNB to have a 12% return on equity (ROE)? Based on your answer, must FNB be performing better or worse than the industry average in this area?

A) -$14.77 (millions), worse

B) -$17.23 (millions), worse

C) $14.77 (millions), better

D) $17.23 (millions), better

E) -$17.23 (millions), better

(Use Step-by-Step)

25. If the net noninterest income were to change to -$16, what would the average loan rate

(ALR) have to be to generate a 12% return on equity (ROE)? does this ALR appear feasible?

A) 5.00%, feasible

B) 3.5%, feasible

C) 6.25%, feasible

D) 7.67%, not feasible

E) 6.25, not feasible

(Use Step-by-Step)

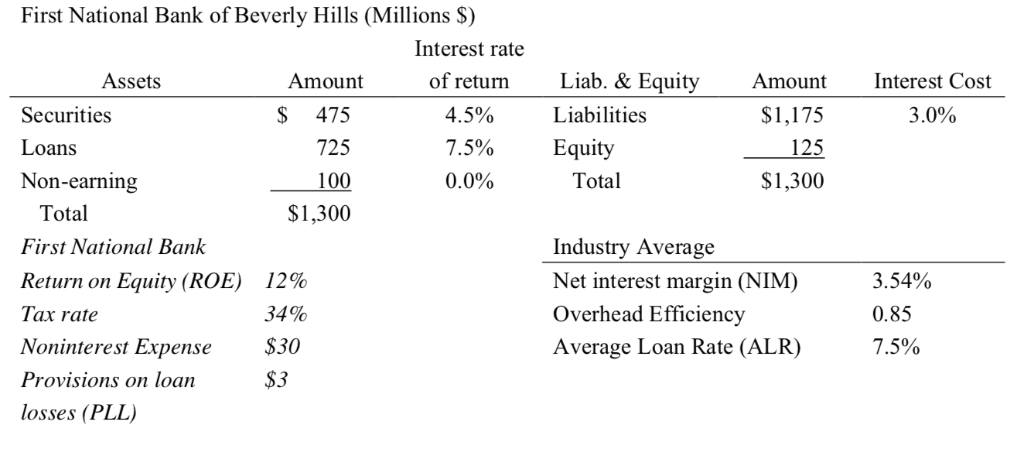

First National Bank of Beverly Hills (Millions $) Interest rate of return 4.5% 7.5% 0.0% Liab. & Equity Liabilities Equity Assets Amount Interest Cost Securities Loans Non-earning $ 475 725 100 $1,300 Amount S1,175 125 $1,300 3.0% Total Total First National Bank Return on Equity (ROE) Tax rate Noninterest Expense Provisions on loan osses (PLL) Industry Average Net interest margin (NIM) Overhead Efficiency Average Loan Rate (ALR) 12% 34% $30 3.54% 0.85 7.5% First National Bank of Beverly Hills (Millions $) Interest rate of return 4.5% 7.5% 0.0% Liab. & Equity Liabilities Equity Assets Amount Interest Cost Securities Loans Non-earning $ 475 725 100 $1,300 Amount S1,175 125 $1,300 3.0% Total Total First National Bank Return on Equity (ROE) Tax rate Noninterest Expense Provisions on loan osses (PLL) Industry Average Net interest margin (NIM) Overhead Efficiency Average Loan Rate (ALR) 12% 34% $30 3.54% 0.85 7.5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started