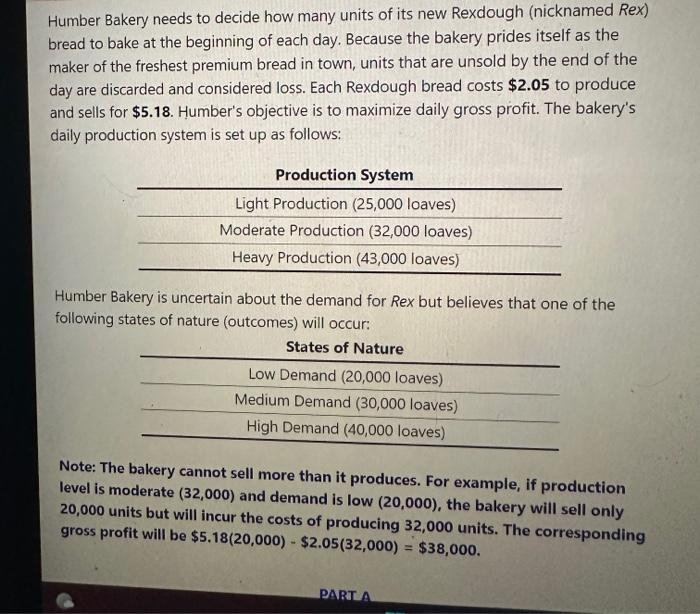

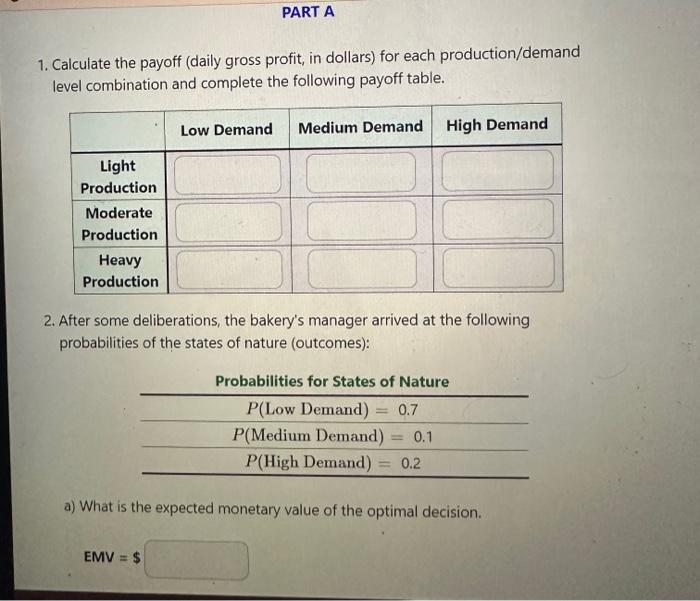

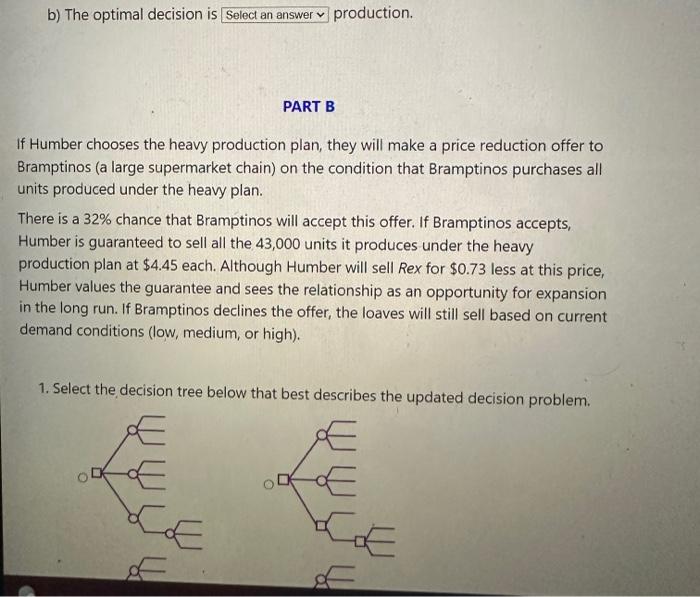

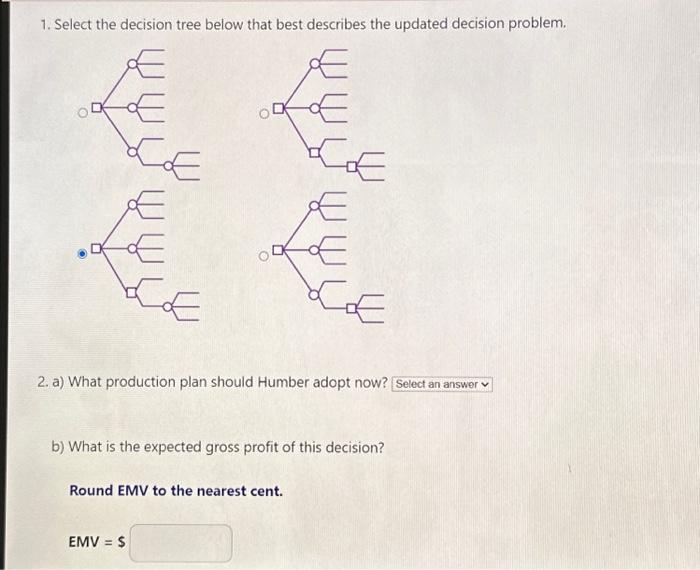

Humber Bakery needs to decide how many units of its new Rexdough (nicknamed Rex) bread to bake at the beginning of each day. Because the bakery prides itself as the maker of the freshest premium bread in town, units that are unsold by the end of the day are discarded and considered loss. Each Rexdough bread costs $2.05 to produce and sells for $5.18. Humber's objective is to maximize daily gross profit. The bakery's daily production system is set up as follows: Humber Bakery is uncertain about the demand for Rex but believes that one of the following states of nature (outcomes) will occur: Note: The bakery cannot sell more than it produces. For example, if production level is moderate (32,000) and demand is low (20,000), the bakery will sell only 20,000 units but will incur the costs of producing 32,000 units. The corresponding gross profit will be $5.18(20,000)$2.05(32,000)=$38,000 1. Calculate the payoff (daily gross profit, in dollars) for each production/demand level combination and complete the following payoff table. 2. After some deliberations, the bakery's manager arrived at the following probabilities of the states of nature (outcomes): a) What is the expected monetary value of the optimal decision. b) The optimal decision is production. PART B If Humber chooses the heavy production plan, they will make a price reduction offer to Bramptinos (a large supermarket chain) on the condition that Bramptinos purchases all units produced under the heavy plan. There is a 32% chance that Bramptinos will accept this offer. If Bramptinos accepts, Humber is guaranteed to sell all the 43,000 units it produces under the heavy production plan at $4.45 each. Although Humber will sell Rex for $0.73 less at this price, Humber values the guarantee and sees the relationship as an opportunity for expansion in the long run. If Bramptinos declines the offer, the loaves will still sell based on current demand conditions (low, medium, or high). 1. Select the decision tree below that best describes the updated decision problem. 1. Select the decision tree below that best describes the updated decision problem. 2. a) What production plan should Humber adopt now? b) What is the expected gross profit of this decision? Round EMV to the nearest cent. EMV=$