Question

3. What is the most that Bubbles could contribute to the profit-sharing plan for the current year (2019) assuming the salary deferrals stay constant? 4.

3. What is the most that Bubbles could contribute to the profit-sharing plan for the current year (2019) assuming the salary deferrals stay constant?

4. What is the actual deferral percentage for the highly compensated employees?

5. What is the actual deferral percentage for the non-highly compensated employees?

6. Does the plan pass the ADP test? Why or why not and what can the company do if the plan does not pass the test?

7. Assume the company decided to make a profit-sharing contribution that was integrated with Social Security, with an integration level equal to the Social Security wage base. If the base percentage was 10% with a maximum excess percentage, how much would be contributed to the plan on behalf of mark? (disregard the salary deferral)

8. How many years of service does Allison currently have for purposes of vesting?

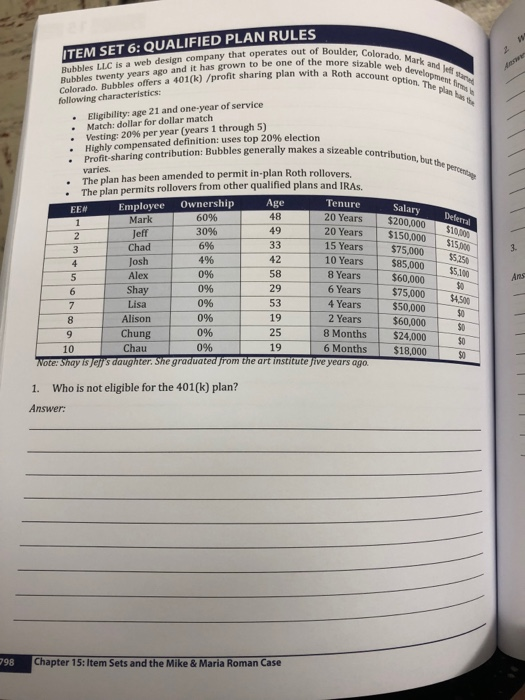

Colorado. Mark and shable web development account option. The plante ITEM SET 6: QUALIFIED PLAN RULES Rubbles LLC is a web design company that operates out of Boulder Bubbles twenty years ago and it has grown to be one of the more Colorado. Bubbles offers a 401(k) /profit sharing plan with a Roth following characteristics: Eligibility: age 21 and one-year of service Match: dollar for dollar match Vesting: 20% per year (years 1 through 5) Highly compensated definition: uses top 20% election bution, but the percent Tenure Salary $200,000 Deferral $10,000 $15.00 contribution: Bubbles generally makes a sizeable contributi varies. The plan has been amended to permit in-plan Roth rollovers The plan permits rollovers from other qualified plans and IRAs FE Employee Ownership Age 1 Mark 60% 20 Years Jeff 2 30% 49 20 Years Chad 6% Josh 4% Alex 0% 8 Years Shay 0% Lisa 0% 53 4 Years Alison 0% 19 2 Years Chung 8 Months 10 Chau 0% 19 6 Months Note: Shay is jer daughter. She graduated from the art institute five years ago. 15 Years 10 Years 55.250 $5.10 6 Years $150,000 $75,000 $85,000 $60,000 $75,000 $50,000 $60,000 $24,000 $18,000 096 25 1. Who is not eligible for the 401(k) plan? Answer: 798 Chapter 15: Item Sets and the Mike & Maria Roman Case Colorado. Mark and shable web development account option. The plante ITEM SET 6: QUALIFIED PLAN RULES Rubbles LLC is a web design company that operates out of Boulder Bubbles twenty years ago and it has grown to be one of the more Colorado. Bubbles offers a 401(k) /profit sharing plan with a Roth following characteristics: Eligibility: age 21 and one-year of service Match: dollar for dollar match Vesting: 20% per year (years 1 through 5) Highly compensated definition: uses top 20% election bution, but the percent Tenure Salary $200,000 Deferral $10,000 $15.00 contribution: Bubbles generally makes a sizeable contributi varies. The plan has been amended to permit in-plan Roth rollovers The plan permits rollovers from other qualified plans and IRAs FE Employee Ownership Age 1 Mark 60% 20 Years Jeff 2 30% 49 20 Years Chad 6% Josh 4% Alex 0% 8 Years Shay 0% Lisa 0% 53 4 Years Alison 0% 19 2 Years Chung 8 Months 10 Chau 0% 19 6 Months Note: Shay is jer daughter. She graduated from the art institute five years ago. 15 Years 10 Years 55.250 $5.10 6 Years $150,000 $75,000 $85,000 $60,000 $75,000 $50,000 $60,000 $24,000 $18,000 096 25 1. Who is not eligible for the 401(k) plan? Answer: 798 Chapter 15: Item Sets and the Mike & Maria Roman CaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started