Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. When interest rates increase, unexpectedly, it is usually the case that prices of stocks go down, at the same time. This happens because

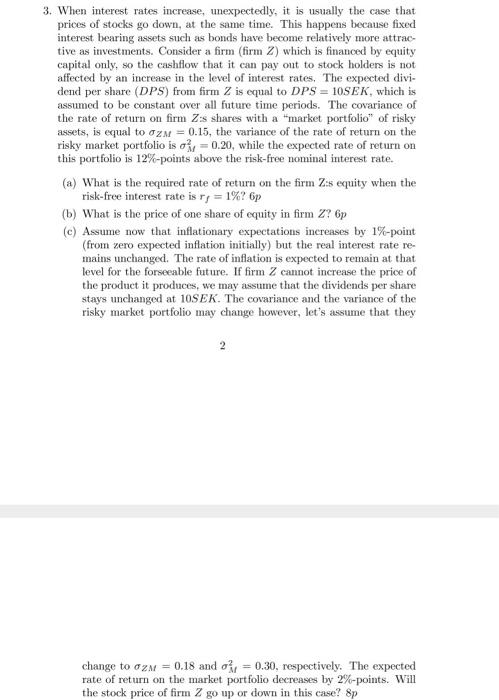

3. When interest rates increase, unexpectedly, it is usually the case that prices of stocks go down, at the same time. This happens because fixed interest bearing assets such as bonds have become relatively more attrac tive as investments. Consider a firm (firm Z) which is financed by equity capital only, so the cashflow that it can pay out to stock holders is not affected by an increase in the level of interest rates. The expected divi- dend per share (DPS) from firm Z is equal to DPS 10SEK, which is assumed to be constant over all future time periods. The covariance of the rate of return on firm Z:s shares with a "market portfolio" of risky assets, is equal to ZM = 0.15, the variance of the rate of return on the risky market portfolio is a 0.20, while the expected rate of return on this portfolio is 12%-points above the risk-free nominal interest rate. (a) What is the required rate of return on the firm Zis equity when the risk-free interest rate is ry=1%? 6p (b) What is the price of one share of equity in firm Z? 6p (c) Assume now that inflationary expectations increases by 1%-point (from zero expected inflation initially) but the real interest rate re- mains unchanged. The rate of inflation is expected to remain at that level for the forseeable future. If firm Z cannot increase the price of the product it produces, we may assume that the dividends per share stays unchanged at 10SEK. The covariance and the variance of the risky market portfolio may change however, let's assume that they 2 change to ZM = 0.18 and 0.30, respectively. The expected rate of return on the market portfolio decreases by 2%-points. Will the stock price of firm Z go up or down in this case? 8p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started