Question

QUESTION 5 (15 Marks) Jon Jones operates a business Jons Bon Bons. Since 2016, the business manufactures highend chocolates that sell for a premium in

QUESTION 5 (15 Marks)

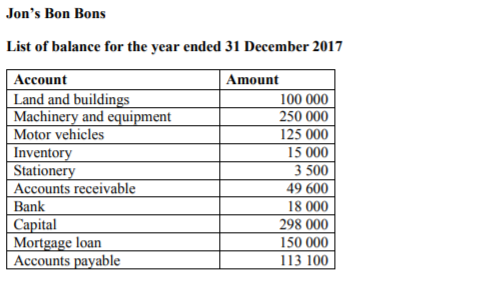

Jon Jones operates a business Jons Bon Bons. Since 2016, the business manufactures highend chocolates that sell for a premium in various retail stores. Jons Bon Bons uses the perpetual method to account for inventory. The following is a list of balances for the year ended 31 December 2017.

The following transactions are for the month of January 2018:

1. On 1 January, Jon contributed additional capital to the business. This capital contribution comprised of R15 000 deposited into the business bank account and a new laptop computer which will be used solely for business purposes costing R30 000.

2. A customer who owed R25 000 settled their debt on 3 January.

3. On the same day, 3 January, the business paid 50% of the Accounts Payable.

4. During the month of January, the following sales of R250 000 were realised. Of these sales, 55% was cash sales, and the remaining amount represented sales on credit. These goods cost R135 000 in total. 5. During the month of January, the following items were incurred and were paid for by cash: Rent: R7 500 Internet: R550 Fuel and maintenance: R8 500 Jons personal medical aid: R2 500

6. During the month of January, the following purchases were made. The business was obligated to make payment for these purchases during February: Inventory R350 000 Stationery supplies R1 500

7. On 31 January, the business entered into an insurance contract. Premiums of R150 per month are payable, however, the business paid for a full 12-month period, beginning 1 February 2018 to 31 January 2019.

8. An inventory count was held at month-end and it was established that the Stationery supplies of R850 were on hand.

9. Received, half of the amount outstanding from the sale made, from the transaction number 4.

10. A customer on 31 January, paid the business R55 000 in the purchase of various Bon Bons. However, the customer requires the goods to be delivered on 15 February 2018.

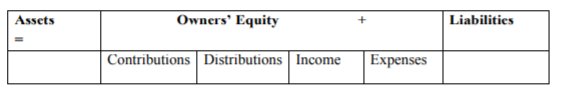

You are required to: Record the above transactions in the accounting equation for January 2018. Clearly indicate all dates as well as the accounts (and amounts) and the effect on the accounting equation. Use the following format:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started