Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You are a Corporate Finance executive working for a specialist Corporate Finance practice. One of your newly acquired clients is Rexal plc, an engineering

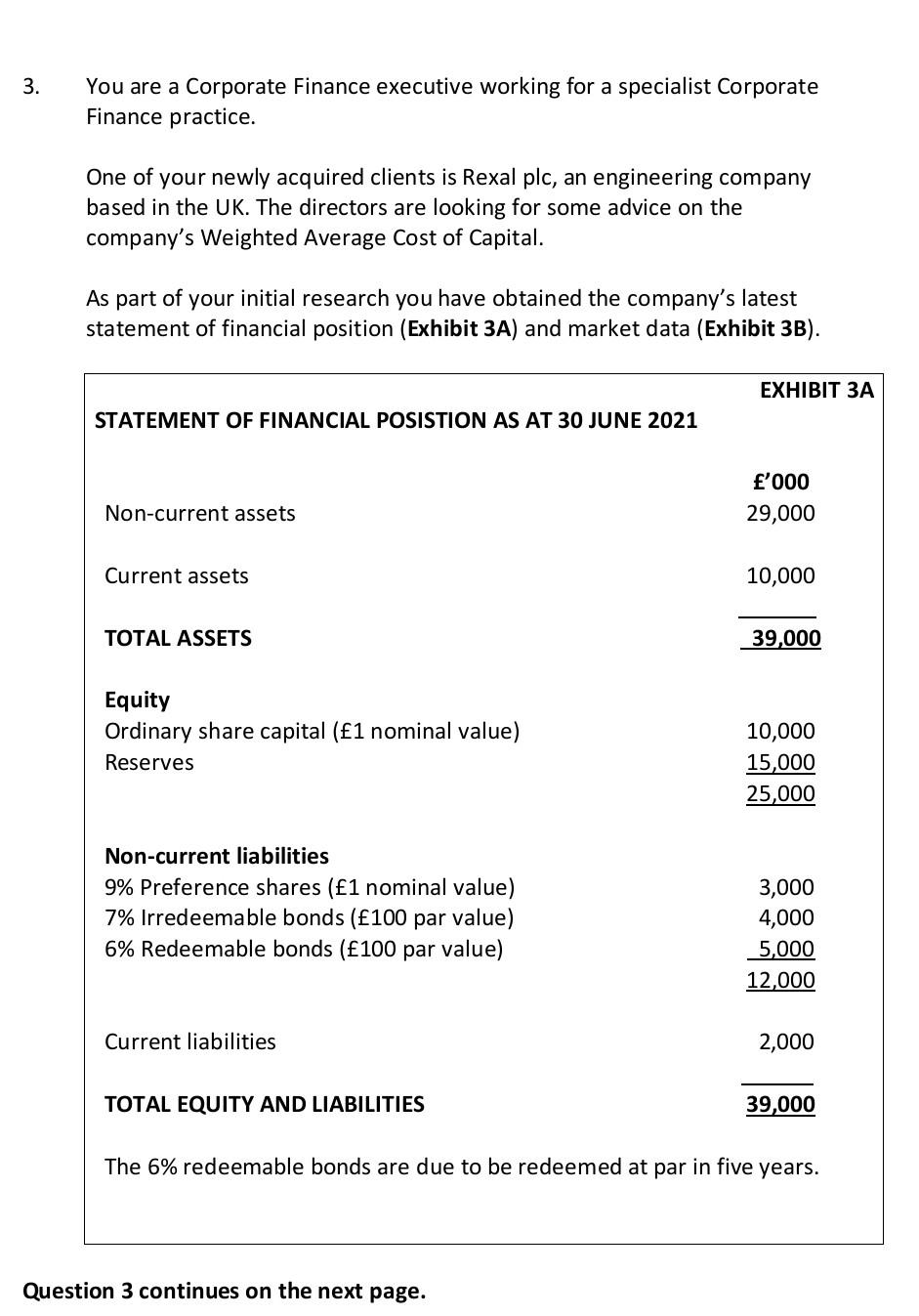

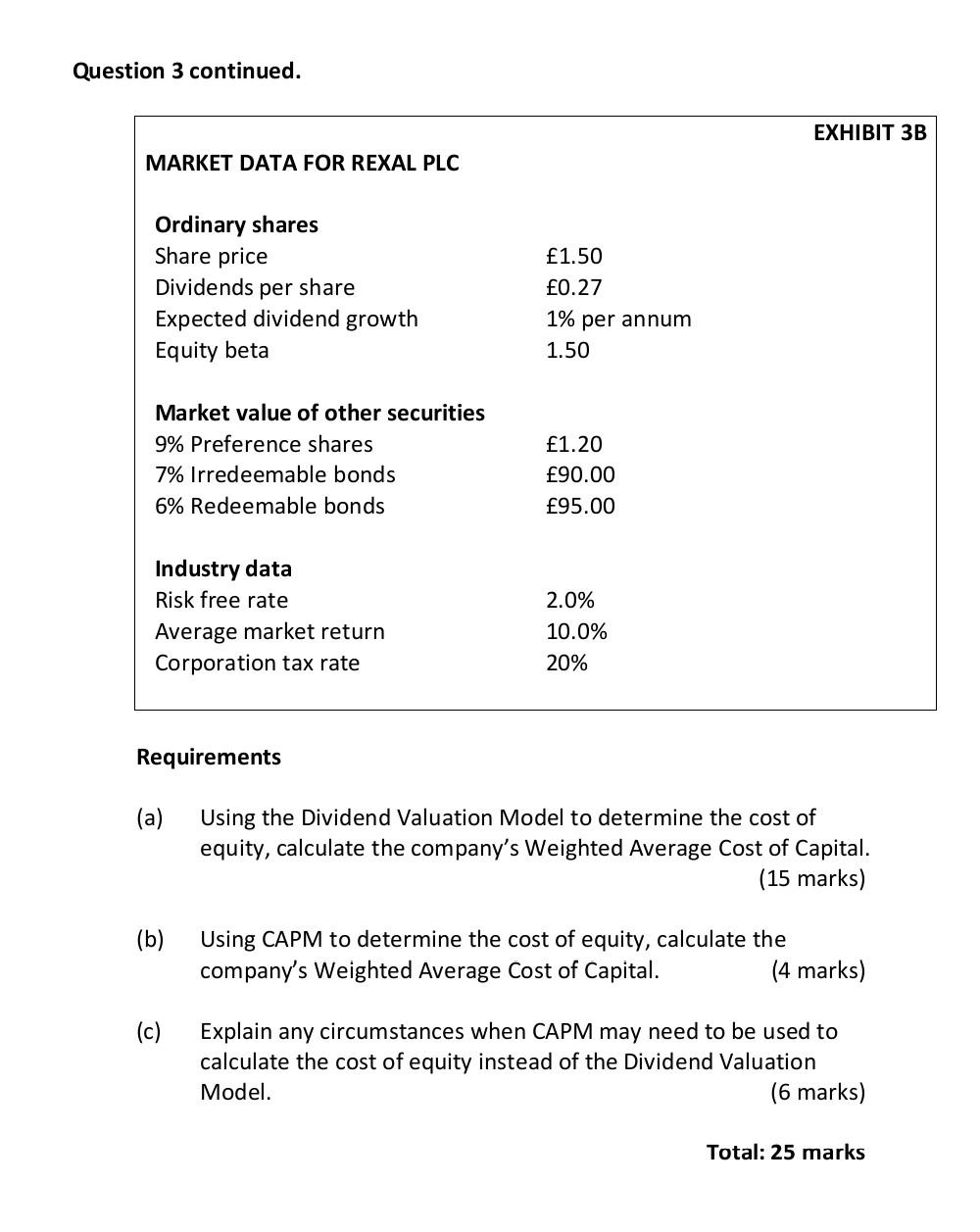

3. You are a Corporate Finance executive working for a specialist Corporate Finance practice. One of your newly acquired clients is Rexal plc, an engineering company based in the UK. The directors are looking for some advice on the company's Weighted Average Cost of Capital. As part of your initial research you have obtained the company's latest statement of financial position (Exhibit 3A) and market data (Exhibit 3B). EXHIBIT 3A STATEMENT OF FINANCIAL POSISTION AS AT 30 JUNE 2021 '000 29,000 Non-current assets Current assets 10,000 TOTAL ASSETS 39,000 Equity Ordinary share capital (1 nominal value) Reserves 10,000 15,000 25,000 Non-current liabilities 9% Preference shares (1 nominal value) 7% Irredeemable bonds (100 par value) 6% Redeemable bonds (100 par value) 3,000 4,000 5,000 12,000 Current liabilities 2,000 TOTAL EQUITY AND LIABILITIES 39,000 The 6% redeemable bonds are due to be redeemed at par in five years. Question 3 continues on the next page. Question 3 continued. EXHIBIT 3B MARKET DATA FOR REXAL PLC Ordinary shares Share price Dividends per share Expected dividend growth Equity beta 1.50 0.27 1% per annum 1.50 Market value of other securities 9% Preference shares 7% Irredeemable bonds 6% Redeemable bonds 1.20 90.00 95.00 2.0% Industry data Risk free rate Average market return Corporation tax rate 10.0% 20% Requirements (a) Using the Dividend Valuation Model to determine the cost of equity, calculate the company's Weighted Average Cost of Capital. (15 marks) (b) Using CAPM to determine the cost of equity, calculate the company's Weighted Average Cost of Capital. (4 marks) (c) Explain any circumstances when CAPM may need to be used to calculate the cost of equity instead of the Dividend Valuation Model. (6 marks) Total: 25 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started