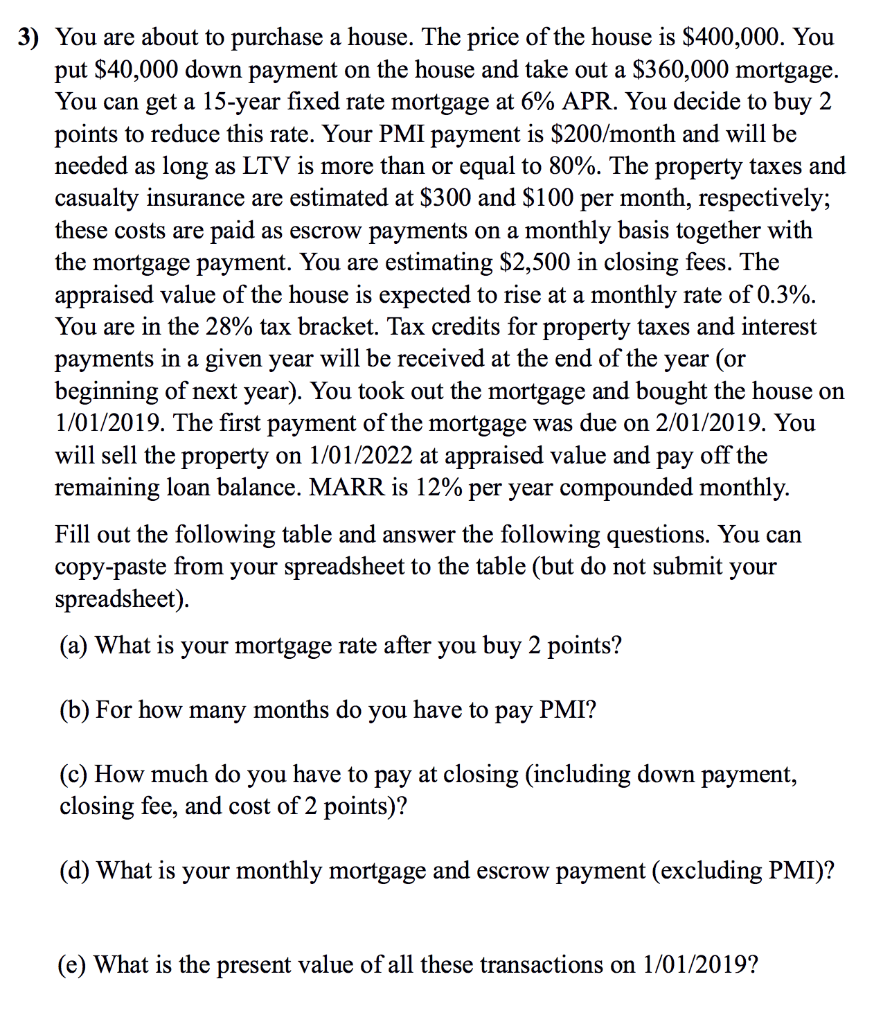

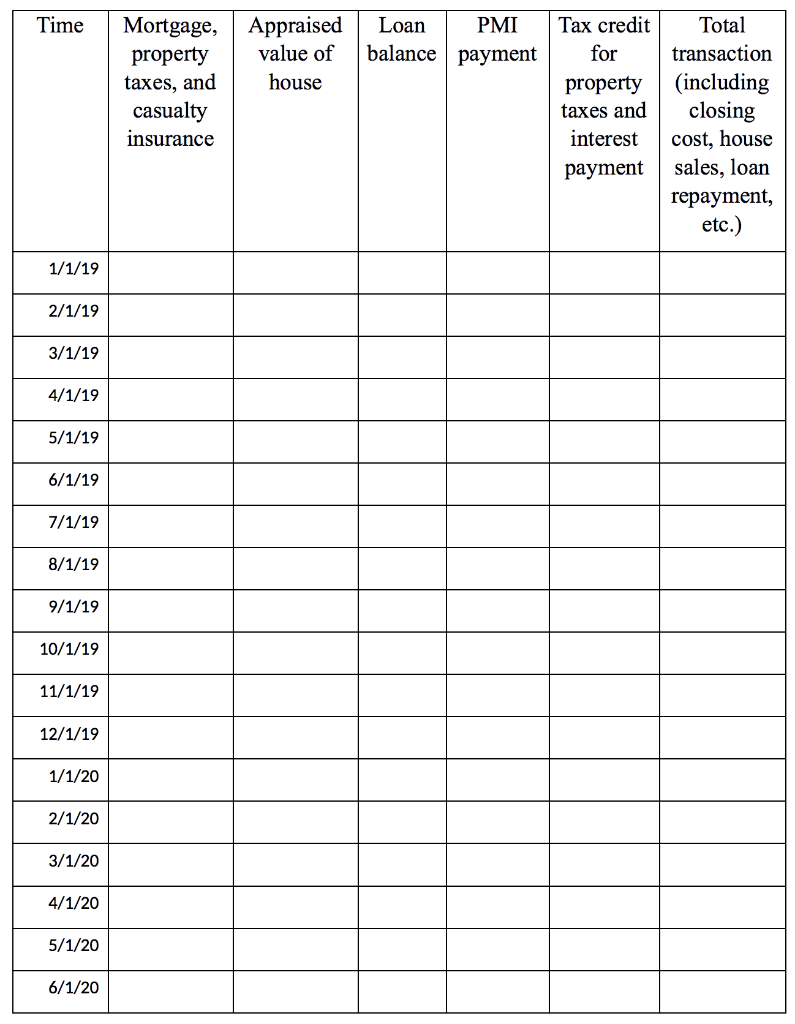

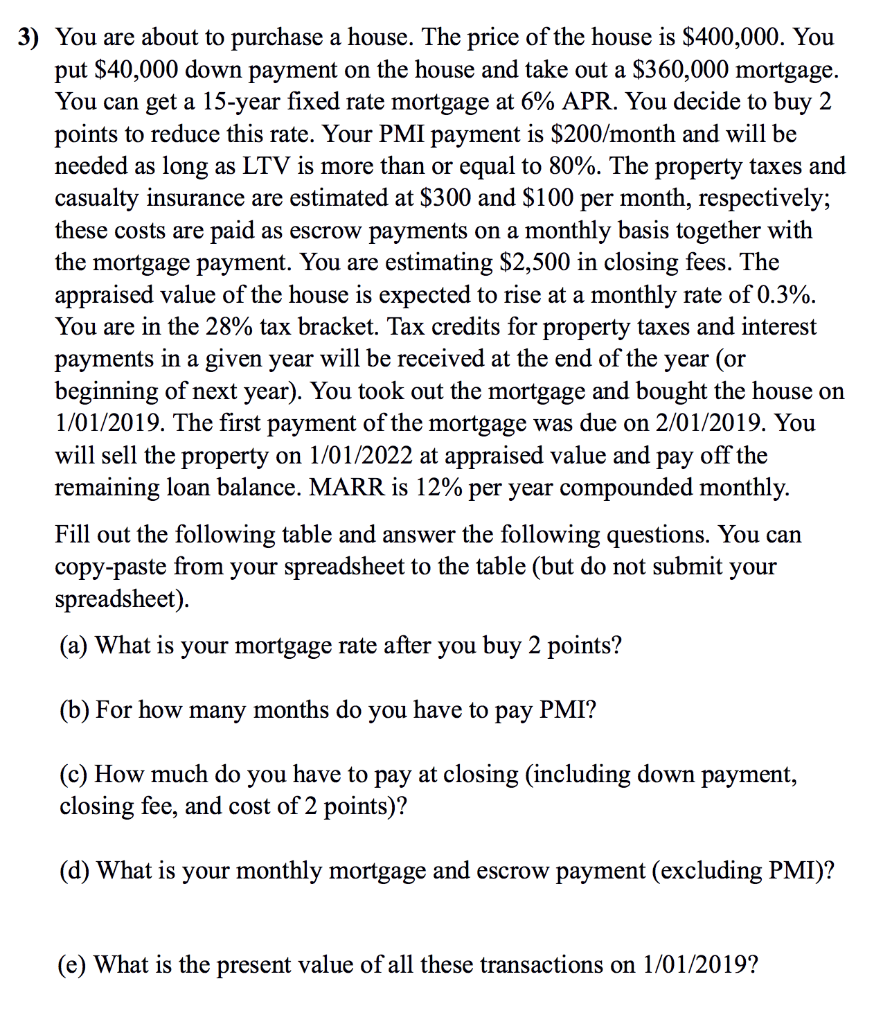

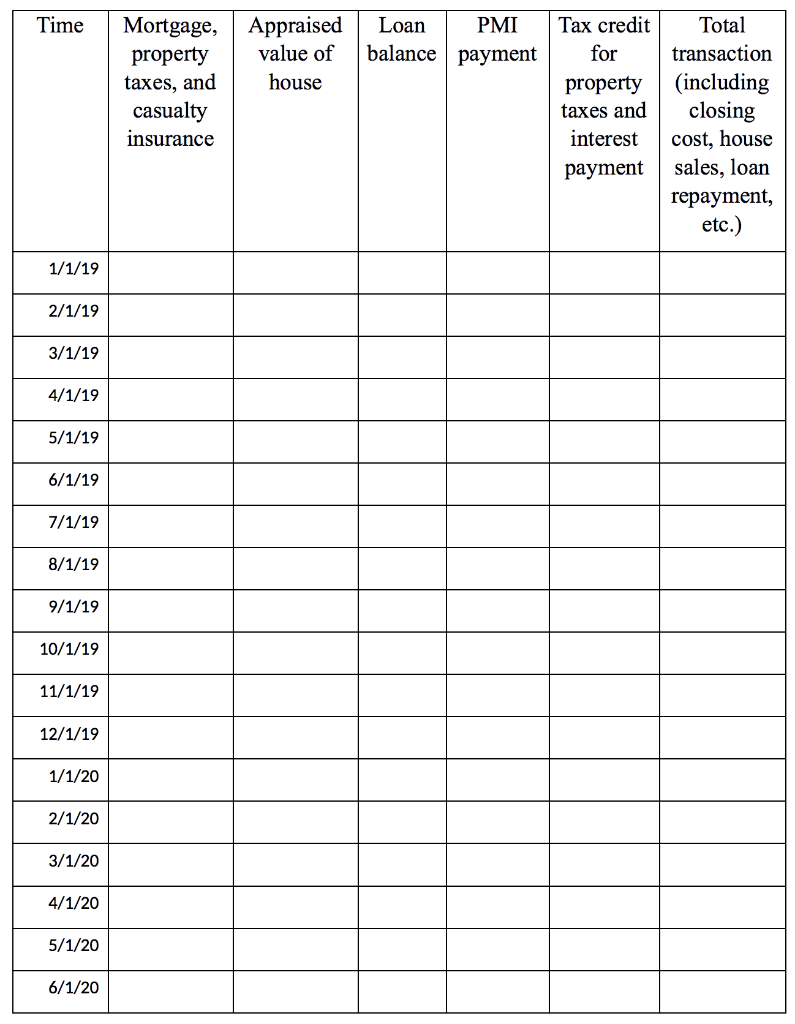

3) You are about to purchase a house. The price of the house is $400,000. You put $40,000 down payment on the house and take out a $360,000 mortgage. You can get a 15-year fixed rate mortgage at 6% APR. You decide to buy 2 points to reduce this rate. Your PMI payment is $200/month and will be needed as long as LTV is more than or equal to 80%. The property taxes and casualty insurance are estimated at $300 and $100 per month, respectively; these costs are paid as escrow payments on a monthly basis together with the mortgage payment. You are estimating $2,500 in closing fees. The appraised value of the house is expected to rise at a monthly rate of 0.3%. You are in the 28% tax bracket. Tax credits for property taxes and interest payments in a given year will be received at the end of the year (or beginning of next year). You took out the mortgage and bought the house on 1/01/2019. The first payment of the mortgage was due on 2/01/2019. You will sell the property on 1/01/2022 at appraised value and pay off the remaining loan balance. MARR is 12% per year compounded monthly. Fill out the following table and answer the following questions. You can copy-paste from your spreadsheet to the table (but do not submit your spreadsheet). (a) What is your mortgage rate after you buy 2 points? (b) For how many months do you have to pay PMI? (c) How much do you have to pay at closing (including down payment, closing fee, and cost of 2 points)? (d) What is your monthly mortgage and escrow payment (excluding PMI)? (e) What is the present value of all these transactions on 1/01/2019? Time Tax credit Appraised value of house Loan PMI balance payment Mortgage, property taxes, and casualty insurance for property taxes and interest payment Total transaction (including closing cost, house sales, loan repayment, etc.) 1/1/19 2/1/19 3/1/19 4/1/19 5/1/19 6/1/19 7/1/19 8/1/19 9/1/19 10/1/19 11/1/19 12/1/19 1/1/20 2/1/20 3/1/20 4/1/20 5/1/20 6/1/20 3) You are about to purchase a house. The price of the house is $400,000. You put $40,000 down payment on the house and take out a $360,000 mortgage. You can get a 15-year fixed rate mortgage at 6% APR. You decide to buy 2 points to reduce this rate. Your PMI payment is $200/month and will be needed as long as LTV is more than or equal to 80%. The property taxes and casualty insurance are estimated at $300 and $100 per month, respectively; these costs are paid as escrow payments on a monthly basis together with the mortgage payment. You are estimating $2,500 in closing fees. The appraised value of the house is expected to rise at a monthly rate of 0.3%. You are in the 28% tax bracket. Tax credits for property taxes and interest payments in a given year will be received at the end of the year (or beginning of next year). You took out the mortgage and bought the house on 1/01/2019. The first payment of the mortgage was due on 2/01/2019. You will sell the property on 1/01/2022 at appraised value and pay off the remaining loan balance. MARR is 12% per year compounded monthly. Fill out the following table and answer the following questions. You can copy-paste from your spreadsheet to the table (but do not submit your spreadsheet). (a) What is your mortgage rate after you buy 2 points? (b) For how many months do you have to pay PMI? (c) How much do you have to pay at closing (including down payment, closing fee, and cost of 2 points)? (d) What is your monthly mortgage and escrow payment (excluding PMI)? (e) What is the present value of all these transactions on 1/01/2019? Time Tax credit Appraised value of house Loan PMI balance payment Mortgage, property taxes, and casualty insurance for property taxes and interest payment Total transaction (including closing cost, house sales, loan repayment, etc.) 1/1/19 2/1/19 3/1/19 4/1/19 5/1/19 6/1/19 7/1/19 8/1/19 9/1/19 10/1/19 11/1/19 12/1/19 1/1/20 2/1/20 3/1/20 4/1/20 5/1/20 6/1/20