Answered step by step

Verified Expert Solution

Question

1 Approved Answer

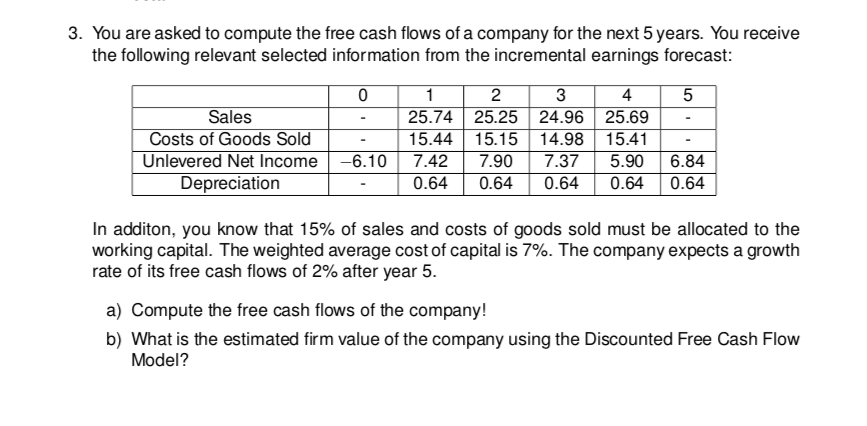

3. You are asked to compute the free cash flows of a company for the next 5 years. You receive the following relevant selected

3. You are asked to compute the free cash flows of a company for the next 5 years. You receive the following relevant selected information from the incremental earnings forecast: 0 Sales Costs of Goods Sold Unlevered Net Income -6.10 - Depreciation 14.98 15.44 15.15 7.42 7.90 7.37 0.64 0.64 0.64 1 2 3 4 5 25.74 25.25 24.96 25.69 15.41 - 5.90 6.84 0.64 0.64 In additon, you know that 15% of sales and costs of goods sold must be allocated to the working capital. The weighted average cost of capital is 7%. The company expects a growth rate of its free cash flows of 2% after year 5. a) Compute the free cash flows of the company! b) What is the estimated firm value of the company using the Discounted Free Cash Flow Model?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started