Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 You are considering an investment in Fields and Struthers, Inc. and want to evaluate the firm's free cash flow. From the income statement,

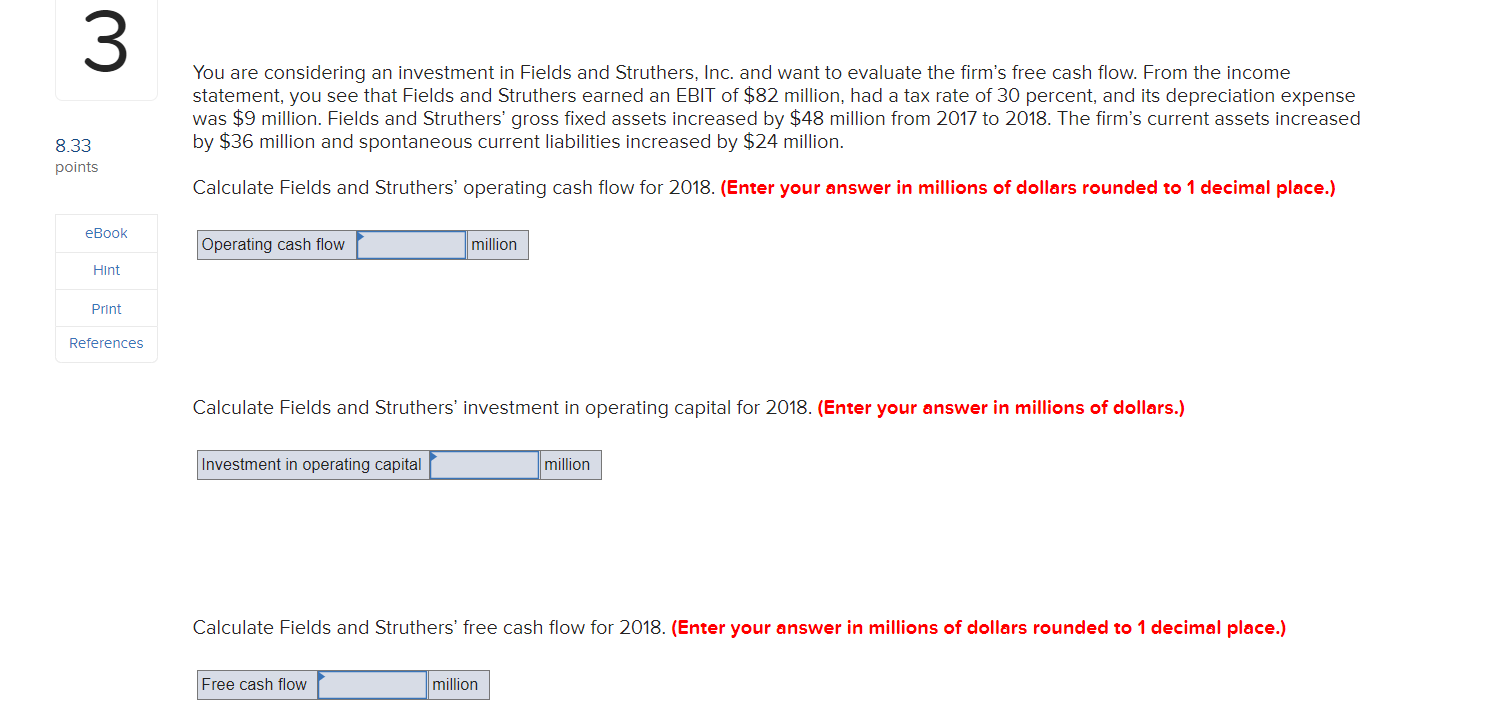

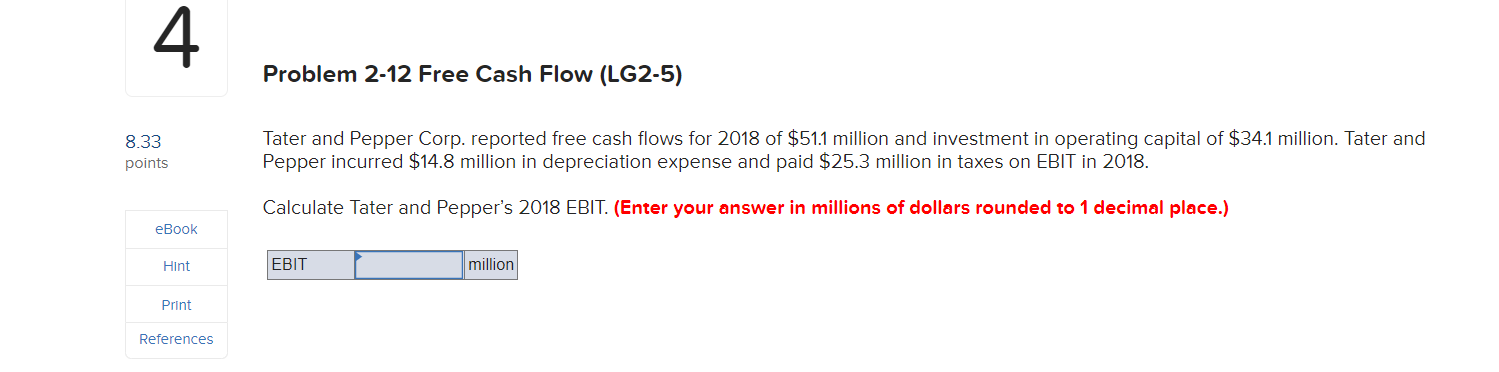

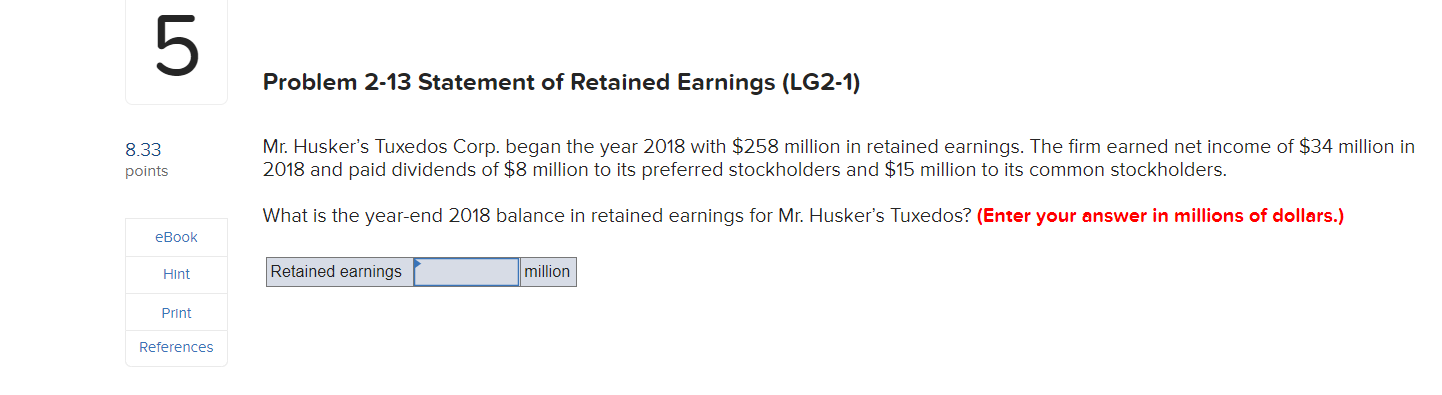

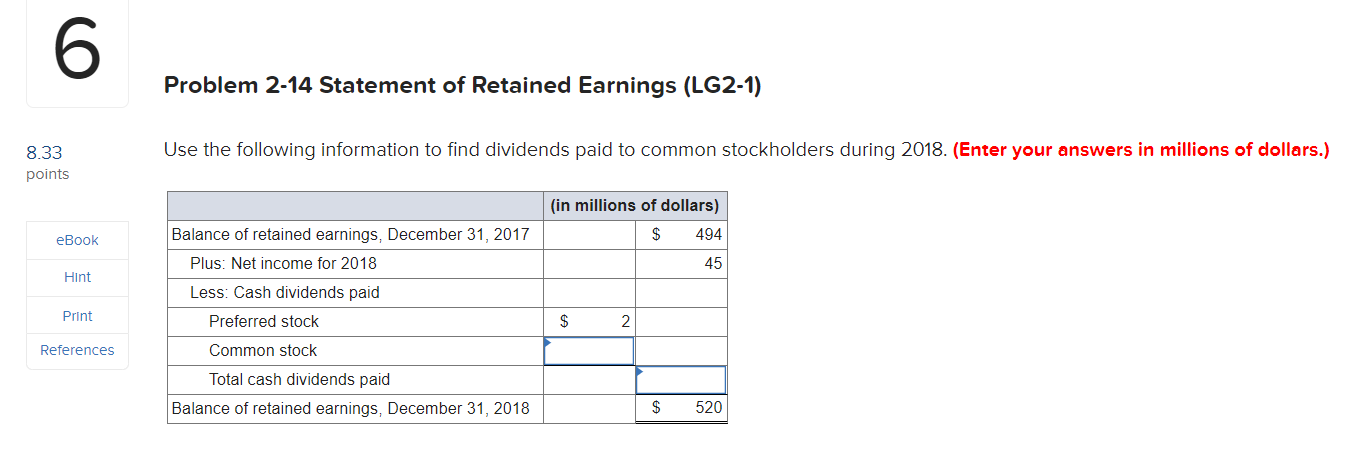

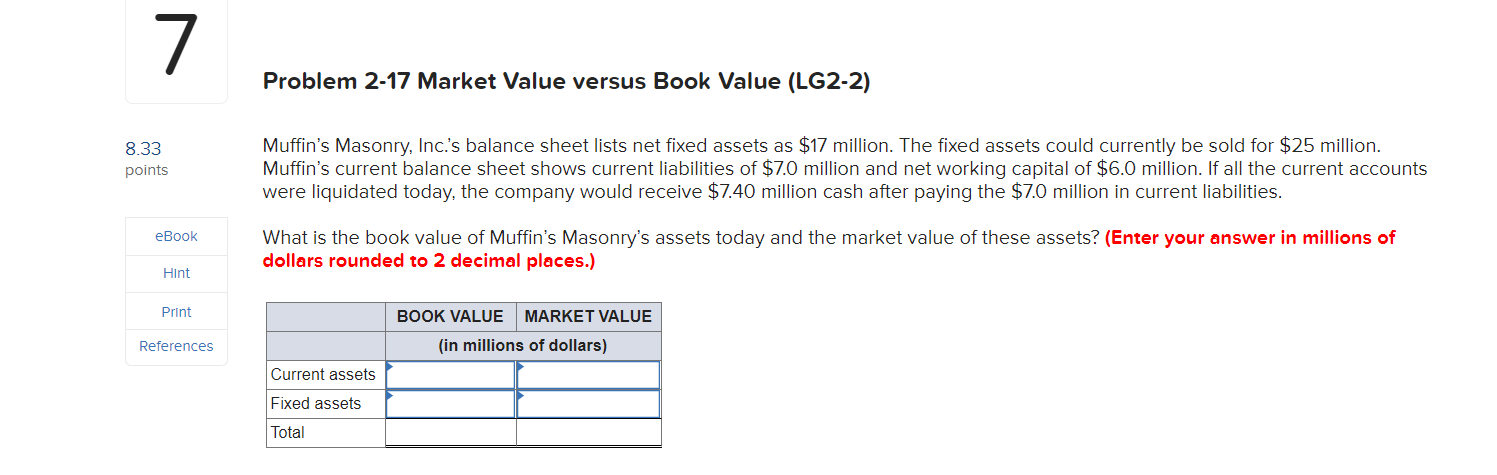

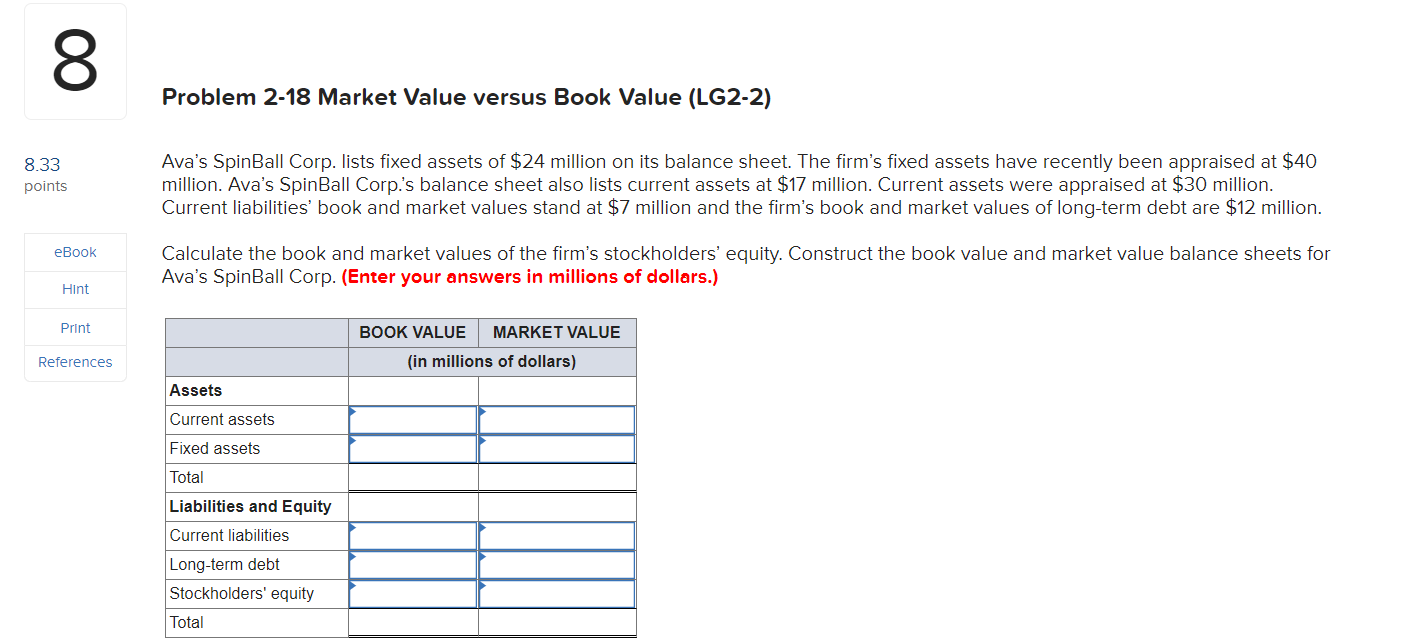

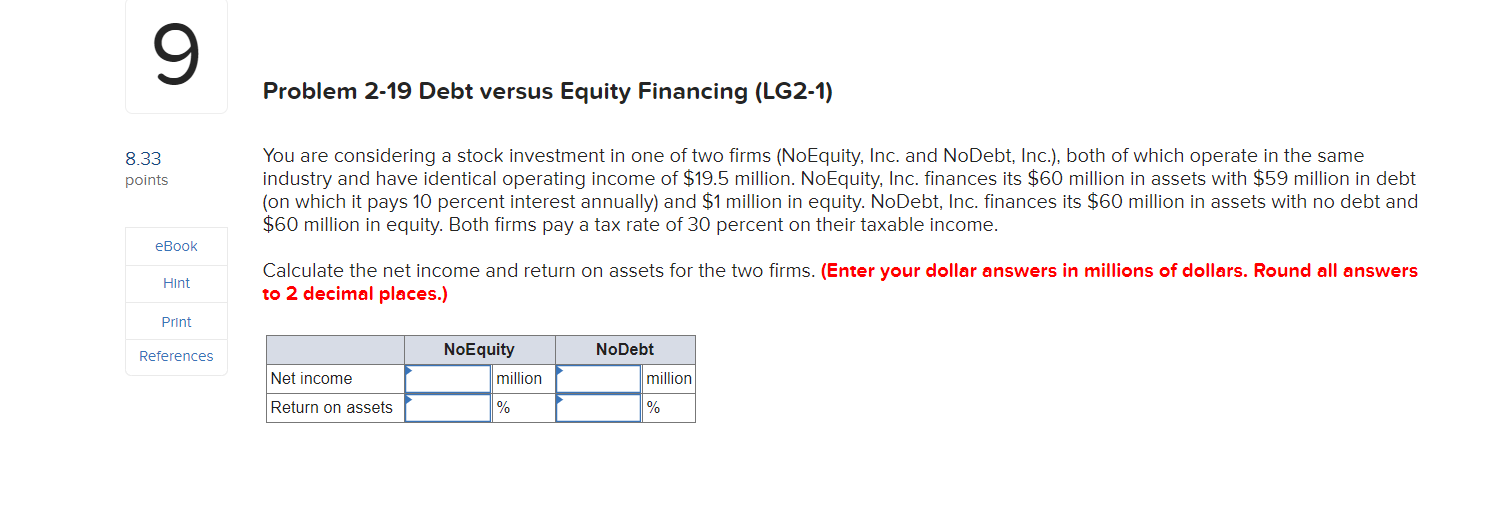

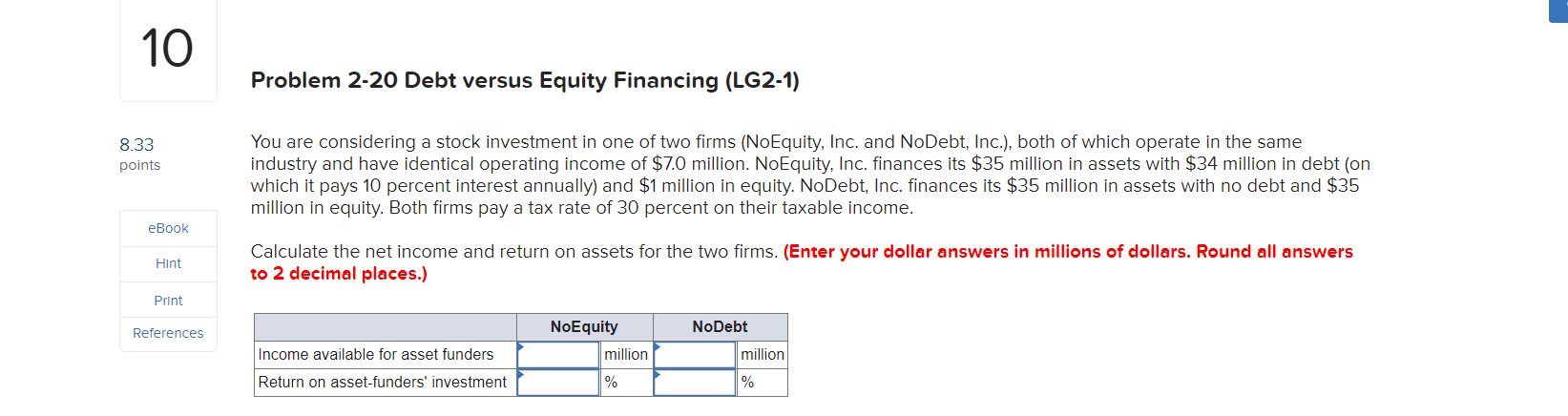

3 You are considering an investment in Fields and Struthers, Inc. and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $82 million, had a tax rate of 30 percent, and its depreciation expense was $9 million. Fields and Struthers' gross fixed assets increased by $48 million from 2017 to 2018. The firm's current assets increased by $36 million and spontaneous current liabilities increased by $24 million. Calculate Fields and Struthers' operating cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place.) 8.33 points eBook Hint Print References Operating cash flow Calculate Fields and Struthers' investment in operating capital for 2018. (Enter your answer in millions of dollars.) Investment in operating capital million Free cash flow Calculate Fields and Struthers' free cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place.) million million 4 8.33 points eBook Hint Print References Problem 2-12 Free Cash Flow (LG2-5) Tater and Pepper Corp. reported free cash flows for 2018 of $51.1 million and investment in operating capital of $34.1 million. Tater and Pepper incurred $14.8 million in depreciation expense and paid $25.3 million in taxes on EBIT in 2018. Calculate Tater and Pepper's 2018 EBIT. (Enter your answer in millions of dollars rounded to 1 decimal place.) EBIT million 5 8.33 points eBook Hint Print References Problem 2-13 Statement of Retained Earnings (LG2-1) Mr. Husker's Tuxedos Corp. began the year 2018 with $258 million in retained earnings. The firm earned net income of $34 million in 2018 and paid dividends of $8 million to its preferred stockholders and $15 million to its common stockholders. What is the year-end 2018 balance in retained earnings for Mr. Husker's Tuxedos? (Enter your answer in millions of dollars.) Retained earnings million 6 8.33 points eBook Hint Print References Problem 2-14 Statement of Retained Earnings (LG2-1) Use the following information to find dividends paid to common stockholders during 2018. (Enter your answers in millions of dollars.) Balance of retained earnings, December 31, 2017 Plus: Net income for 2018 Less: Cash dividends paid Preferred stock Common stock Total cash dividends paid Balance of retained earnings, December 31, 2018 (in millions of dollars) $ $ 2 $ 494 45 520 7 8.33 points eBook Hint Print References Problem 2-17 Market Value versus Book Value (LG2-2) Muffin's Masonry, Inc.'s balance sheet lists net fixed assets as $17 million. The fixed assets could currently be sold for $25 million. Muffin's current balance sheet shows current liabilities of $7.0 million and net working capital of $6.0 million. If all the current accounts were liquidated today, the company would receive $7.40 million cash after paying the $7.0 million in current liabilities. What is the book value of Muffin's Masonry's assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) Current assets Fixed assets Total BOOK VALUE MARKET VALUE (in millions of dollars) 8 8.33 points eBook Hint Print References Problem 2-18 Market Value versus Book Value (LG2-2) Ava's SpinBall Corp. lists fixed assets of $24 million on its balance sheet. The firm's fixed assets have recently been appraised at $40 million. Ava's SpinBall Corp.'s balance sheet also lists current assets at $17 million. Current assets were appraised at $30 million. Current liabilities' book and market values stand at $7 million and the firm's book and market values of long-term debt are $12 million. Calculate the book and market values of the firm's stockholders' equity. Construct the book value and market value balance sheets for Ava's SpinBall Corp. (Enter your answers in millions of dollars.) Assets Current assets Fixed assets Total Liabilities and Equity Current liabilities Long-term debt Stockholders' equity Total BOOK VALUE MARKET VALUE (in millions of dollars) 9 8.33 points eBook Hint Print References Problem 2-19 Debt versus Equity Financing (LG2-1) You are considering a stock investment in one of two firms (NoEquity, Inc. and NoDebt, Inc.), both of which operate in the same industry and have identical operating income of $19.5 million. NoEquity, Inc. finances its $60 million in assets with $59 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Inc. finances its $60 million in assets with no debt and $60 million in equity. Both firms pay a tax rate of 30 percent on their taxable income. Calculate the net income and return on assets for the two firms. (Enter your dollar answers in millions of dollars. Round all answers to 2 decimal places.) Net income Return on assets NoEquity million % NoDebt million % 10 8.33 points eBook Hint Print References Problem 2-20 Debt versus Equity Financing (LG2-1) You are considering a stock investment in one of two firms (NoEquity, Inc. and NoDebt, Inc.), both of which operate in the same industry and have identical operating income of $7.0 million. NoEquity, Inc. finances its $35 million in assets with $34 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Inc. finances its $35 million in assets with no debt and $35 million in equity. Both firms pay a tax rate of 30 percent on their taxable income. Calculate the net income and return on assets for the two firms. (Enter your dollar answers in millions of dollars. Round all answers to 2 decimal places.) Income available for asset funders Return on asset-funders' investment NoEquity million % NoDebt million % 11 8.33 points eBook Hint Print References Problem 2-25 Corporate Taxes (LG2-3) The Dakota Corporation had a 2015 taxable income of $29,500,000 from operations after all operating costs but before (1) interest charges of $8,200,000, (2) dividends received of $720,000, (3) dividends paid of $5,100,000, and (4) income taxes. a. Use the tax schedule in Table 2.3 to calculate Dakota's income tax liability. (Round your answer to the nearest dollar amount.) Income tax liability b. What are Dakota's average and marginal tax rates on taxable income? (Round your answers to 2 decimal places.) Average tax rate Marginal tax rate % % 12 8.37 points eBook Hint Print References Problem 2-26 Corporate Taxes (LG2-3) Suppose that in addition to $17.90 million of taxable income, Texas Taco, Inc. received $2,000,000 of interest on state-issued bonds and $700,000 of dividends on common stock it owns in Arizona Taco, Inc. a. Use the tax schedule in Table 2.3 to calculate Texas Taco's income tax liability. (Enter your answer in dollars not in millions.) Income tax liability b. What are Texas Taco's average and marginal tax rates on taxable income? (Round your answers to 2 decimal places.) Average tax rate Marginal tax rate % % table 2.3 Corporate Tax Rates as of 2018 Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 $335,001-$10,000,000 $10,000,001-$15,000,000 $15,000,001-$18,333,333 Over $18,333,333 Pay this Amount on Base Income $ 0 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 Plus this Percentage on Anything Over the Base 15% 25 34 39 34 35 38 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for problem 218 Book Value Balance Sheet Ass...

Get Instant Access to Expert-Tailored Solutions

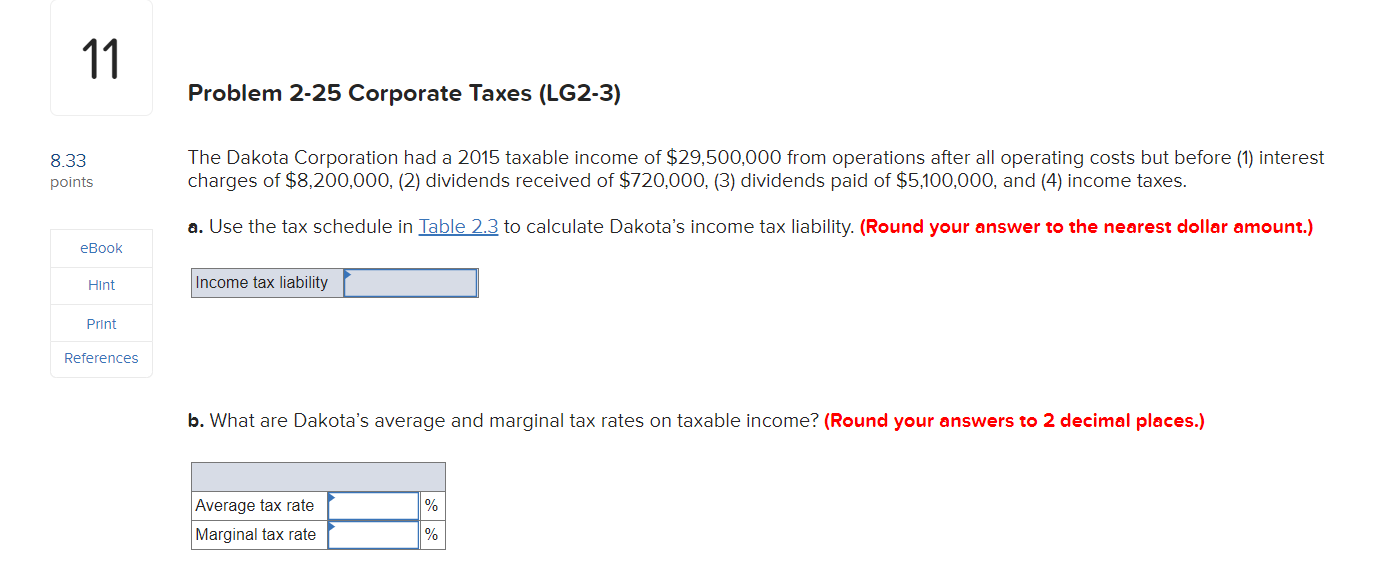

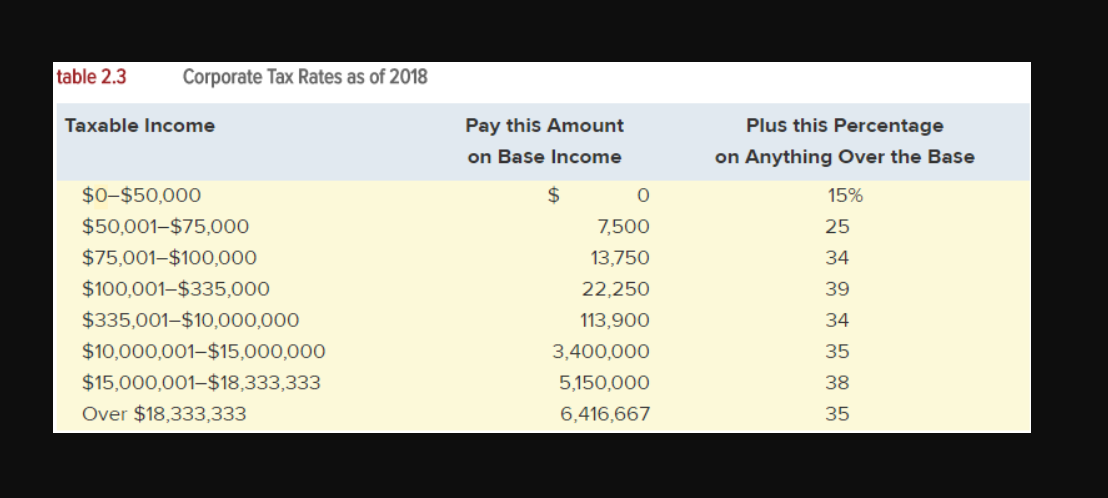

See step-by-step solutions with expert insights and AI powered tools for academic success

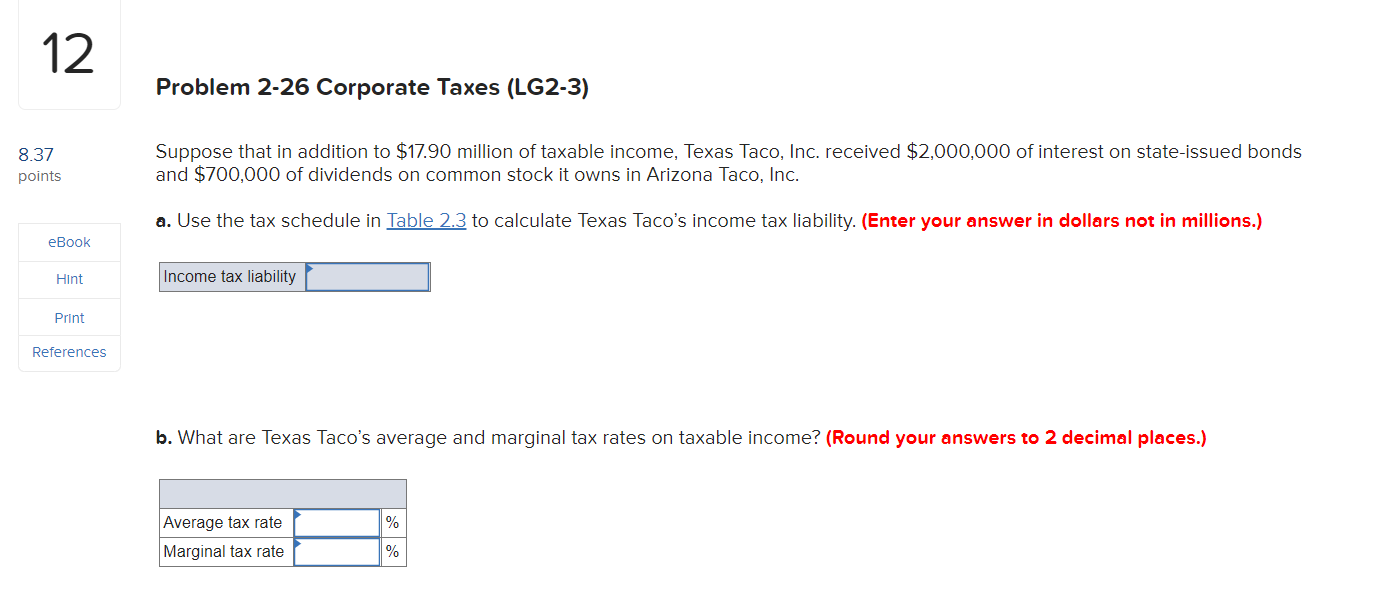

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started