Answered step by step

Verified Expert Solution

Question

1 Approved Answer

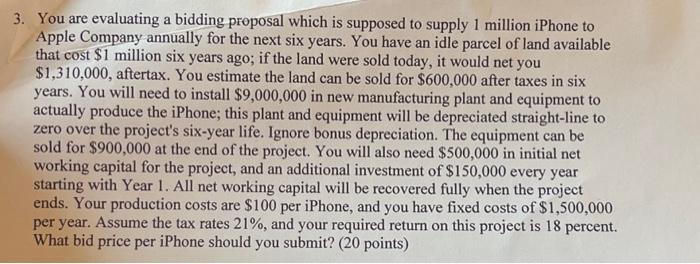

3. You are evaluating a bidding proposal which is supposed to supply 1 million iPhone to Apple Company annually for the next six years. You

3. You are evaluating a bidding proposal which is supposed to supply 1 million iPhone to Apple Company annually for the next six years. You have an idle parcel of land available that cost $1 million six years ago; if the land were sold today, it would net you $1,310,000, aftertax. You estimate the land can be sold for $600,000 after taxes in six years. You will need to install $9,000,000 in new manufacturing plant and equipment to actually produce the iPhone; this plant and equipment will be depreciated straight-line to zero over the project's six-year life. Ignore bonus depreciation. The equipment can be sold for $900,000 at the end of the project. You will also need $500,000 in initial net working capital for the project, and an additional investment of $150,000 every year starting with Year 1. All net working capital will be recovered fully when the project ends. Your production costs are $100 per iPhone, and you have fixed costs of $1,500,000 per year. Assume the tax rates 21%, and your required return on this project is 18 percent. What bid price per iPhone should you submit? (20 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started