Question: 3 You are evaluating a stock return. You are expecting the stock return to change based on economy status. You are expecting that the probability

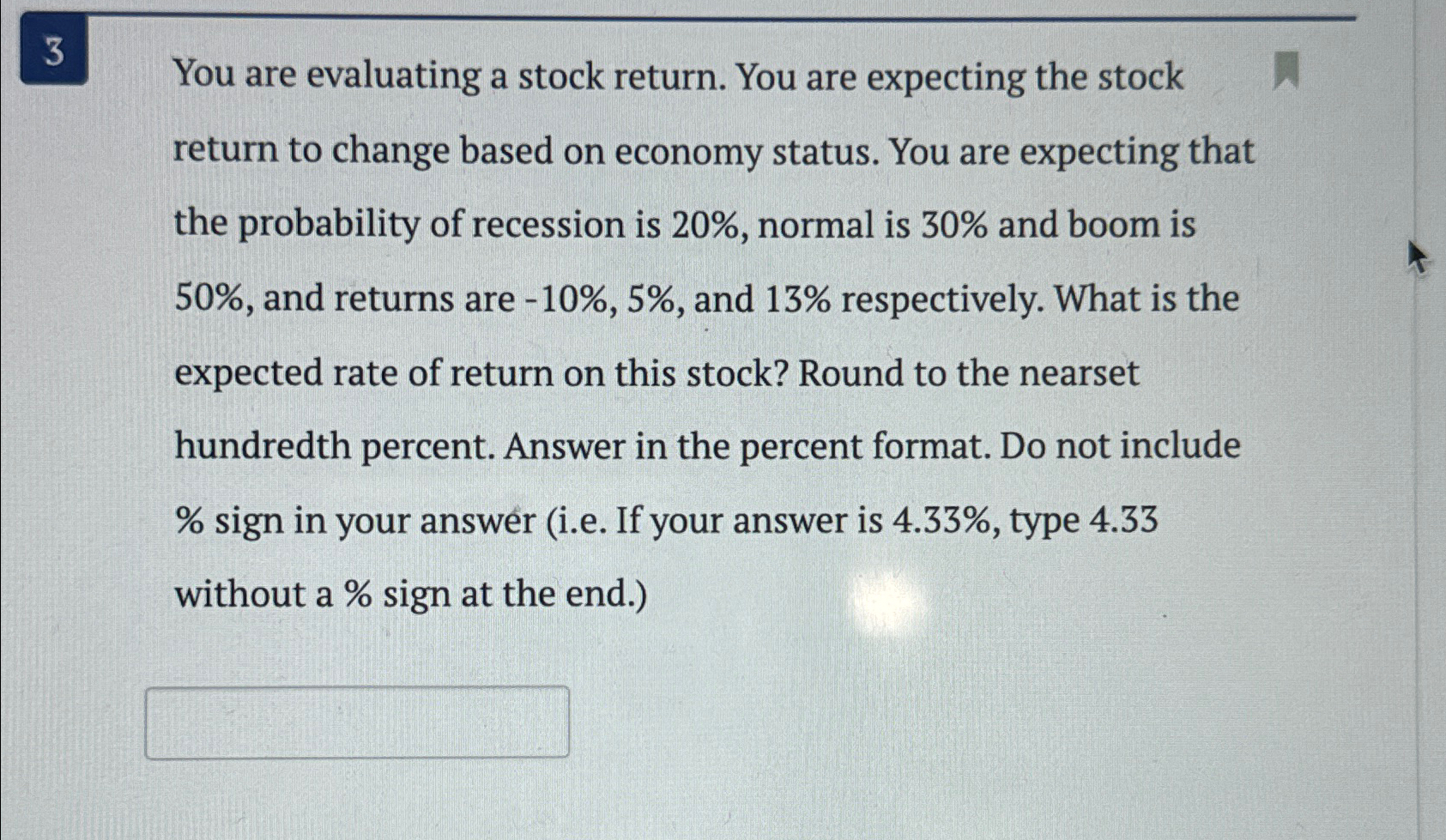

You are evaluating a stock return. You are expecting the stock return to change based on economy status. You are expecting that the probability of recession is normal is and boom is and returns are and respectively. What is the expected rate of return on this stock? Round to the nearset hundredth percent. Answer in the percent format. Do not include sign in your answer ie If your answer is type without a sign at the end.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock