Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You are evaluating a stock that is currently selling for $110 per share. Over the investment period you think that the stock price might

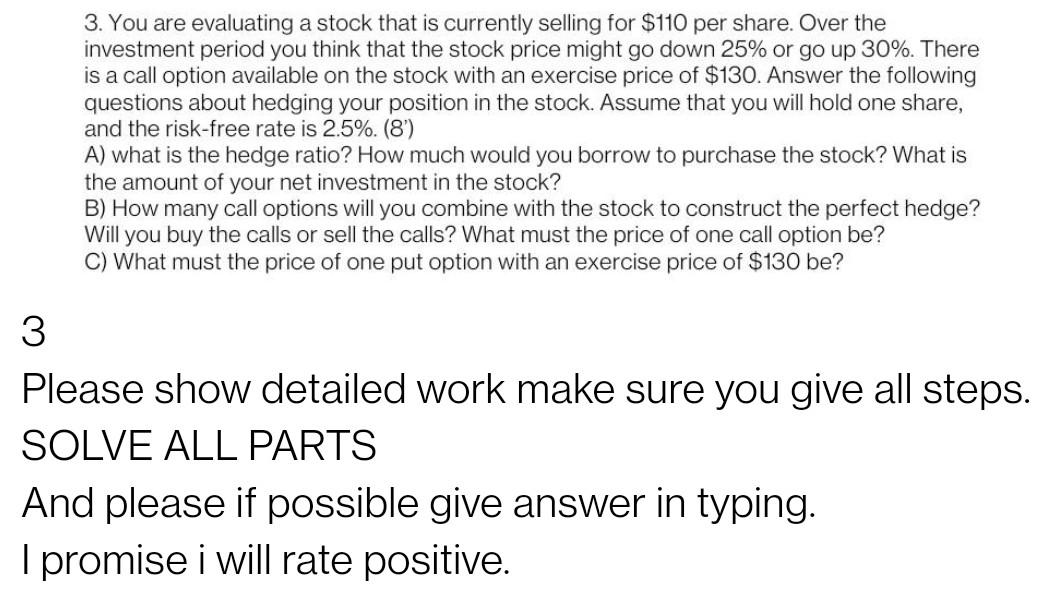

3. You are evaluating a stock that is currently selling for $110 per share. Over the investment period you think that the stock price might go down 25% or go up 30%. There is a call option available on the stock with an exercise price of $130. Answer the following questions about hedging your position in the stock. Assume that you will hold one share, and the risk-free rate is 2.5%. (8) A) what is the hedge ratio? How much would you borrow to purchase the stock? What is the amount of your net investment in the stock? B) How many call options will you combine with the stock to construct the perfect hedge? Will you buy the calls or sell the calls? What must the price of one call option be? C) What must the price of one put option with an exercise price of $130 be? 3 Please show detailed work make sure you give all steps. SOLVE ALL PARTS And please if possible give answer in typing. I promise i will rate positive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started