3. You are evaluating two investment alternatives. One is a passive market portfolio with an expected return of 10% and a standard deviation of

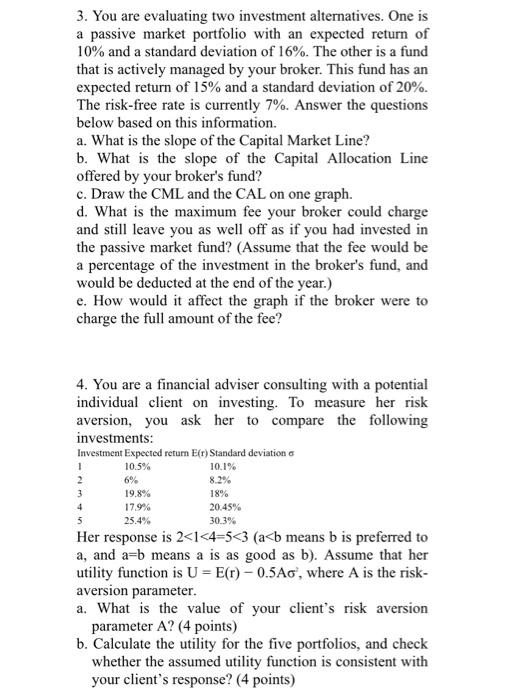

3. You are evaluating two investment alternatives. One is a passive market portfolio with an expected return of 10% and a standard deviation of 16%. The other is a fund that is actively managed by your broker. This fund has an expected return of 15% and a standard deviation of 20%. The risk-free rate is currently 7%. Answer the questions below based on this information. a. What is the slope of the Capital Market Line? b. What is the slope of the Capital Allocation Line offered by your broker's fund? c. Draw the CML and the CAL on one graph. d. What is the maximum fee your broker could charge and still leave you as well off as if you had invested in the passive market fund? (Assume that the fee would be a percentage of the investment in the broker's fund, and would be deducted at the end of the year.) e. How would it affect the graph if the broker were to charge the full amount of the fee? 4. You are a financial adviser consulting with a potential individual client on investing. To measure her risk aversion, you ask her to compare the following investments: Investment Expected return E(r) Standard deviation 1 10.5% 2 6% 3 19.8% 4 17.9% 5 25.4% 10.1% 8.2% 18% 20.45% 30.3% Her response is 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started