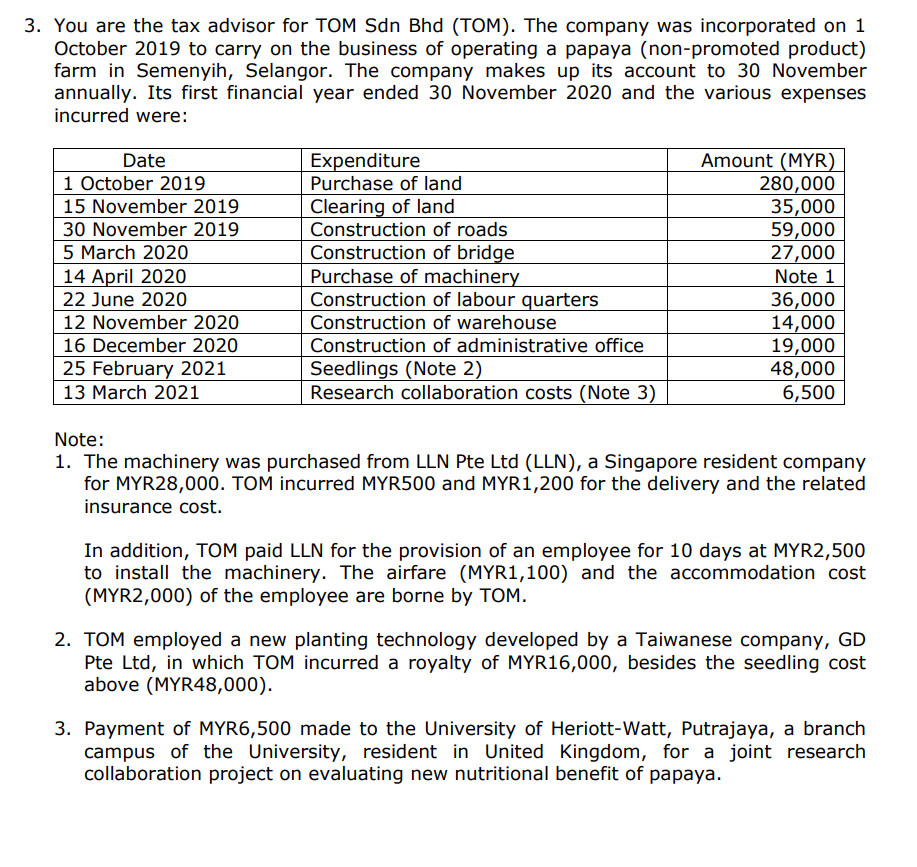

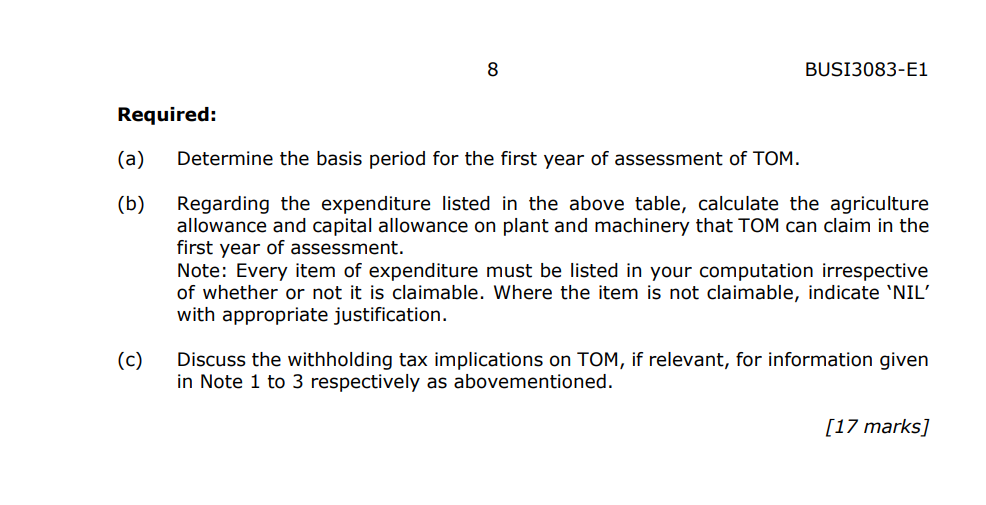

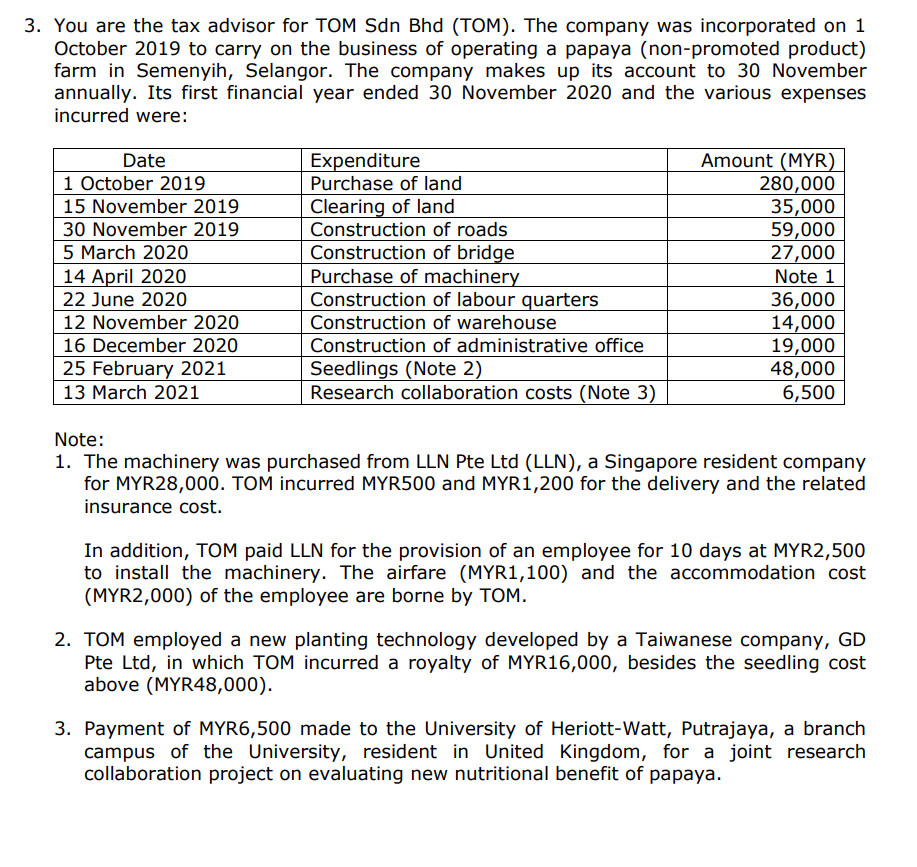

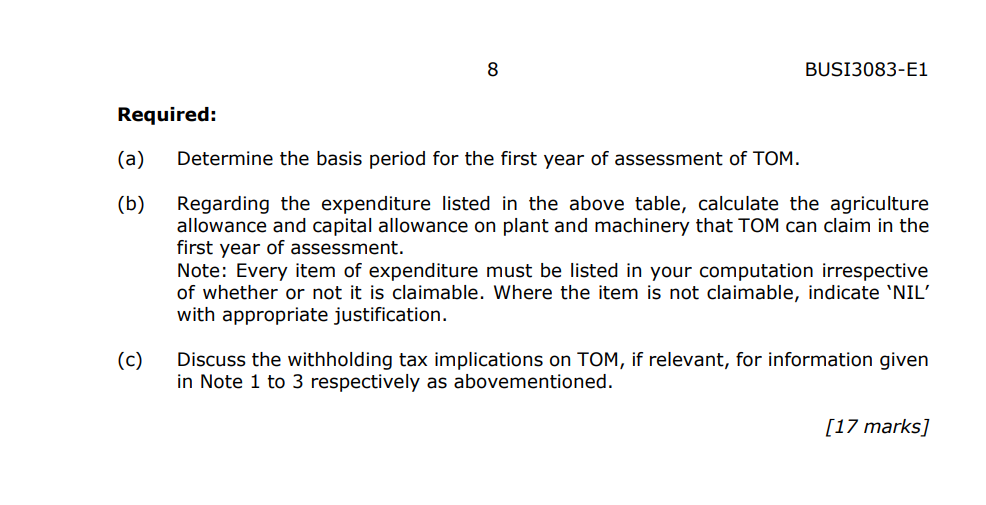

3. You are the tax advisor for TOM Sdn Bhd (TOM). The company was incorporated on 1 October 2019 to carry on the business of operating a papaya (non-promoted product) farm in Semenyih, Selangor. The company makes up its account to 30 November annually. Its first financial year ended 30 November 2020 and the various expenses incurred were: Date 1 October 2019 15 November 2019 30 November 2019 5 March 2020 14 April 2020 22 June 2020 12 November 2020 16 December 2020 25 February 2021 13 March 2021 Expenditure Purchase of land Clearing of land Construction of roads Construction of bridge Purchase of machinery Construction of labour quarters Construction of warehouse Construction of administrative office Seedlings (Note 2) Research collaboration costs (Note 3) Amount (MYR) 280,000 35,000 59,000 27,000 Note 1 36,000 14,000 19,000 48,000 6,500 Note: 1. The machinery was purchased from LLN Pte Ltd (LLN), a Singapore resident company for MYR28,000. TOM incurred MYR500 and MYR1,200 for the delivery and the related insurance cost. In addition, TOM paid LLN for the provision of an employee for 10 days at MYR2,500 to install the machinery. The airfare (MYR1,100) and the accommodation cost (MYR2,000) of the employee are borne by TOM. 2. TOM employed a new planting technology developed by a Taiwanese company, GD Pte Ltd, in which TOM incurred a royalty of MYR16,000, besides the seedling cost above (MYR48,000). 3. Payment of MYR6,500 made to the University of Heriott-Watt, Putrajaya, a branch campus of the University, resident in United Kingdom, for a joint research collaboration project on evaluating new nutritional benefit of papaya. 8 BUSI3083-E1 Required: (a) Determine the basis period for the first year of assessment of TOM. (b) Regarding the expenditure listed in the above table, calculate the agriculture allowance and capital allowance on plant and machinery that TOM can claim in the first year of assessment. Note: Every item of expenditure must be listed in your computation irrespective of whether or not it is claimable. Where the item is not claimable, indicate 'NIL' with appropriate justification. (c) Discuss the withholding tax implications on TOM, if relevant, for information given in Note 1 to 3 respectively as abovementioned. [17 marks] 3. You are the tax advisor for TOM Sdn Bhd (TOM). The company was incorporated on 1 October 2019 to carry on the business of operating a papaya (non-promoted product) farm in Semenyih, Selangor. The company makes up its account to 30 November annually. Its first financial year ended 30 November 2020 and the various expenses incurred were: Date 1 October 2019 15 November 2019 30 November 2019 5 March 2020 14 April 2020 22 June 2020 12 November 2020 16 December 2020 25 February 2021 13 March 2021 Expenditure Purchase of land Clearing of land Construction of roads Construction of bridge Purchase of machinery Construction of labour quarters Construction of warehouse Construction of administrative office Seedlings (Note 2) Research collaboration costs (Note 3) Amount (MYR) 280,000 35,000 59,000 27,000 Note 1 36,000 14,000 19,000 48,000 6,500 Note: 1. The machinery was purchased from LLN Pte Ltd (LLN), a Singapore resident company for MYR28,000. TOM incurred MYR500 and MYR1,200 for the delivery and the related insurance cost. In addition, TOM paid LLN for the provision of an employee for 10 days at MYR2,500 to install the machinery. The airfare (MYR1,100) and the accommodation cost (MYR2,000) of the employee are borne by TOM. 2. TOM employed a new planting technology developed by a Taiwanese company, GD Pte Ltd, in which TOM incurred a royalty of MYR16,000, besides the seedling cost above (MYR48,000). 3. Payment of MYR6,500 made to the University of Heriott-Watt, Putrajaya, a branch campus of the University, resident in United Kingdom, for a joint research collaboration project on evaluating new nutritional benefit of papaya. 8 BUSI3083-E1 Required: (a) Determine the basis period for the first year of assessment of TOM. (b) Regarding the expenditure listed in the above table, calculate the agriculture allowance and capital allowance on plant and machinery that TOM can claim in the first year of assessment. Note: Every item of expenditure must be listed in your computation irrespective of whether or not it is claimable. Where the item is not claimable, indicate 'NIL' with appropriate justification. (c) Discuss the withholding tax implications on TOM, if relevant, for information given in Note 1 to 3 respectively as abovementioned. [17 marks]