Answered step by step

Verified Expert Solution

Question

1 Approved Answer

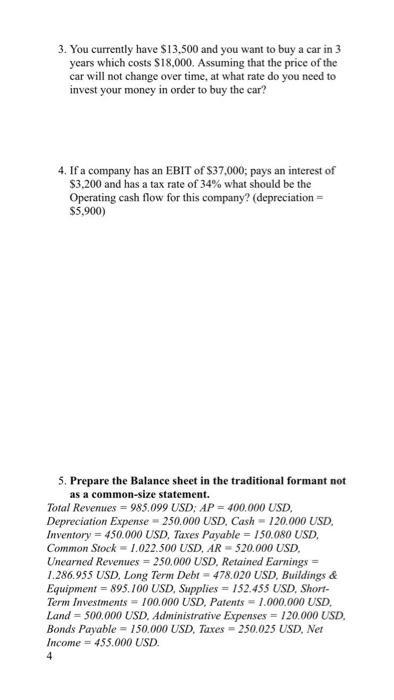

3. You currently have $13,500 and you want to buy a car in 3 years which costs $18,000. Assuming that the price of the

3. You currently have $13,500 and you want to buy a car in 3 years which costs $18,000. Assuming that the price of the car will not change over time, at what rate do you need to invest your money in order to buy the car? 4. If a company has an EBIT of $37,000; pays an interest of $3,200 and has a tax rate of 34% what should be the Operating cash flow for this company? (depreciation = $5,900) 5. Prepare the Balance sheet in the traditional formant not as a common-size statement. Total Revenues-985.099 USD; AP= 400.000 USD, Depreciation Expense 250.000 USD, Cash = 120.000 USD. Inventory = 450.000 USD, Taxes Payable = 150.080 USD, Common Stock = 1.022.500 USD, AR 520.000 USD. Unearned Revenues = 250.000 USD, Retained Earnings = 1.286.955 USD, Long Term Debt=478.020 USD, Buildings & Equipment = 895.100 USD, Supplies = 152.455 USD, Short- Term Investments = 100.000 USD, Patents = 1.000.000 USD. Land = 500.000 USD, Administrative Expenses = 120.000 USD. Bonds Payable = 150.000 USD, Taxes 250.025 USD, Net Income = 455.000 USD. 4

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Operating Cash Flow EBIT Depreciation Interest Expense Tax Expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started