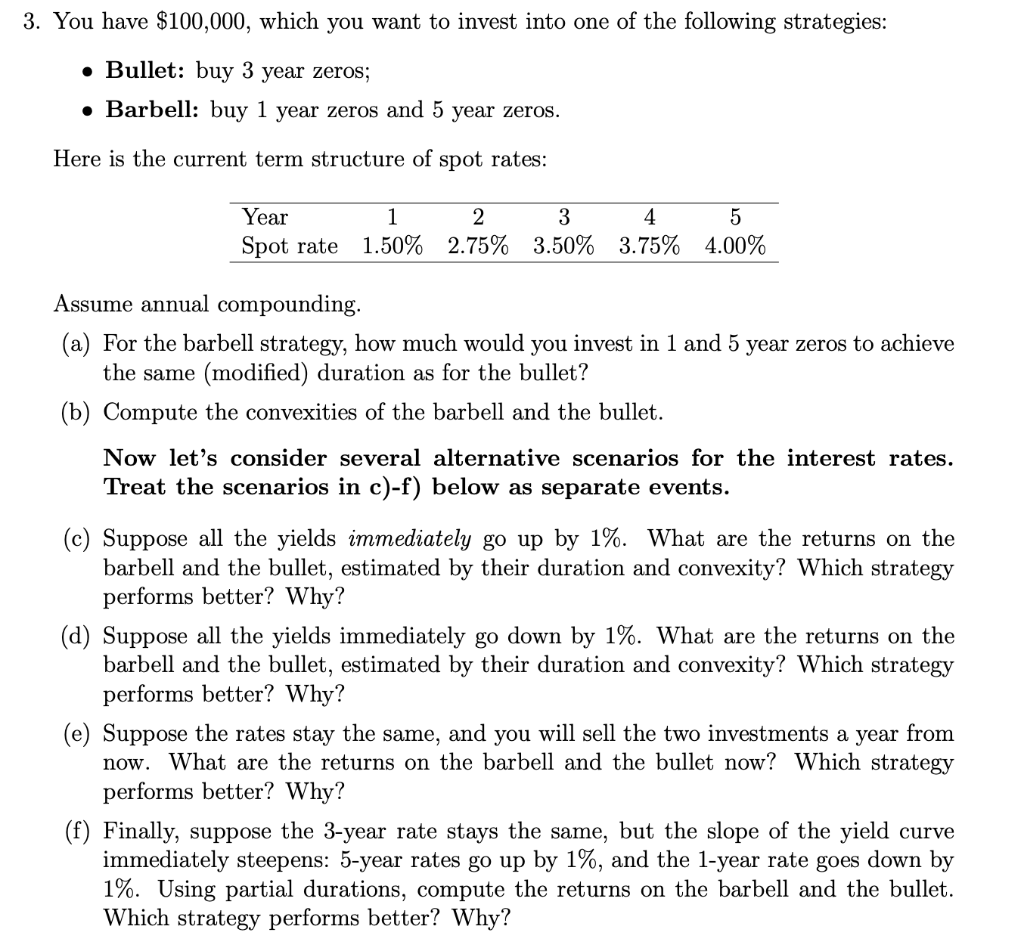

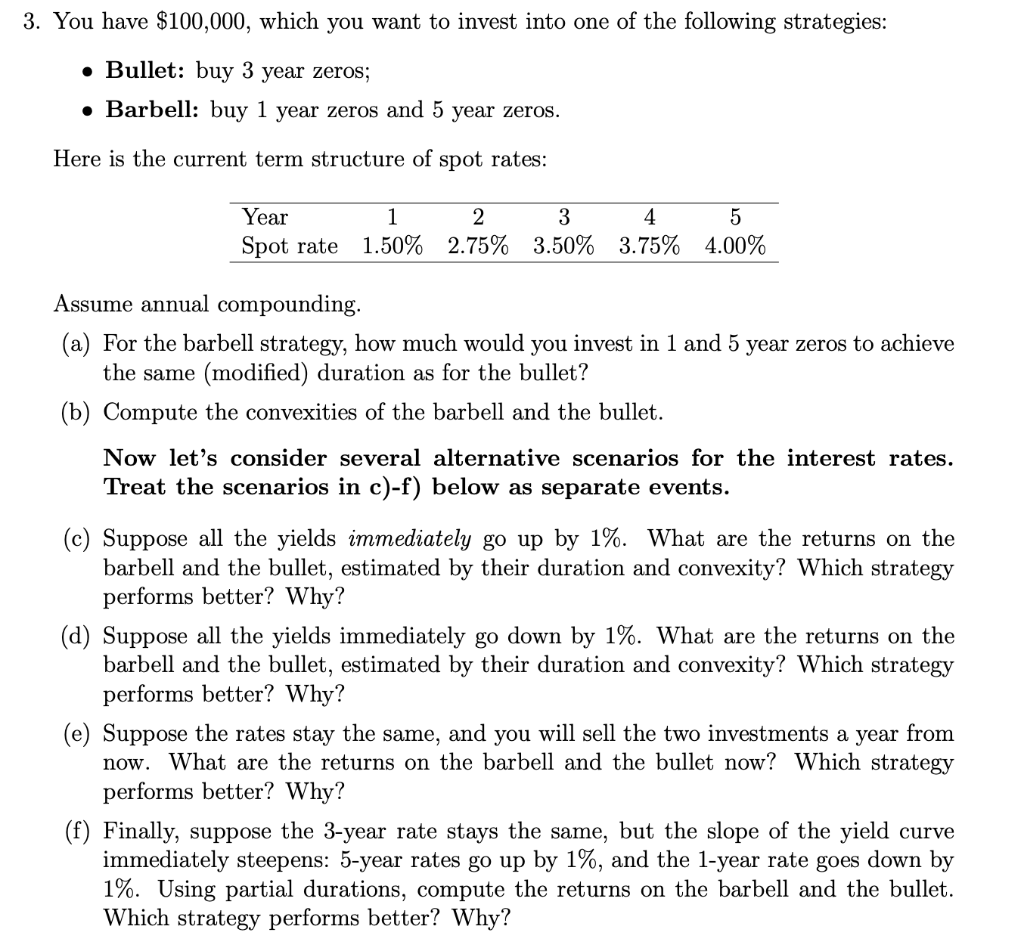

3. You have $100,000, which you want to invest into one of the following strategies: Bullet: buy 3 year zeros; Barbell: buy 1 year zeros and 5 year zeros. Here is the current term structure of spot rates: Year 1 Spot rate 1.50% 2 2.75% 3 3.50% 4 3.75% 5 4.00% Assume annual compounding. (a) For the barbell strategy, how much would you invest in 1 and 5 year zeros to achieve the same (modified) duration as for the bullet? Compute the convexities of the barbell and the bullet. Now let's consider several alternative scenarios for the interest rates. Treat the scenarios in c)-f) below as separate events. Suppose all the yields immediately go up by 1%. What are the returns on the barbell and the bullet, estimated by their duration and convexity? Which strategy performs better? Why? (d) Suppose all the yields immediately go down by 1%. What are the returns on the barbell and the bullet, estimated by their duration and convexity? Which strategy performs better? Why? (e) Suppose the rates stay the same, and you will sell the two investments a year from now. What are the returns on the barbell and the bullet now? Which strategy performs better? Why? Finally, suppose the 3-year rate stays the same, but the slope of the yield curve immediately steepens: 5-year rates go up by 1%, and the 1-year rate goes down by 1%. Using partial durations, compute the returns on the barbell and the bullet. Which strategy performs better? Why? 3. You have $100,000, which you want to invest into one of the following strategies: Bullet: buy 3 year zeros; Barbell: buy 1 year zeros and 5 year zeros. Here is the current term structure of spot rates: Year 1 Spot rate 1.50% 2 2.75% 3 3.50% 4 3.75% 5 4.00% Assume annual compounding. (a) For the barbell strategy, how much would you invest in 1 and 5 year zeros to achieve the same (modified) duration as for the bullet? Compute the convexities of the barbell and the bullet. Now let's consider several alternative scenarios for the interest rates. Treat the scenarios in c)-f) below as separate events. Suppose all the yields immediately go up by 1%. What are the returns on the barbell and the bullet, estimated by their duration and convexity? Which strategy performs better? Why? (d) Suppose all the yields immediately go down by 1%. What are the returns on the barbell and the bullet, estimated by their duration and convexity? Which strategy performs better? Why? (e) Suppose the rates stay the same, and you will sell the two investments a year from now. What are the returns on the barbell and the bullet now? Which strategy performs better? Why? Finally, suppose the 3-year rate stays the same, but the slope of the yield curve immediately steepens: 5-year rates go up by 1%, and the 1-year rate goes down by 1%. Using partial durations, compute the returns on the barbell and the bullet. Which strategy performs better? Why