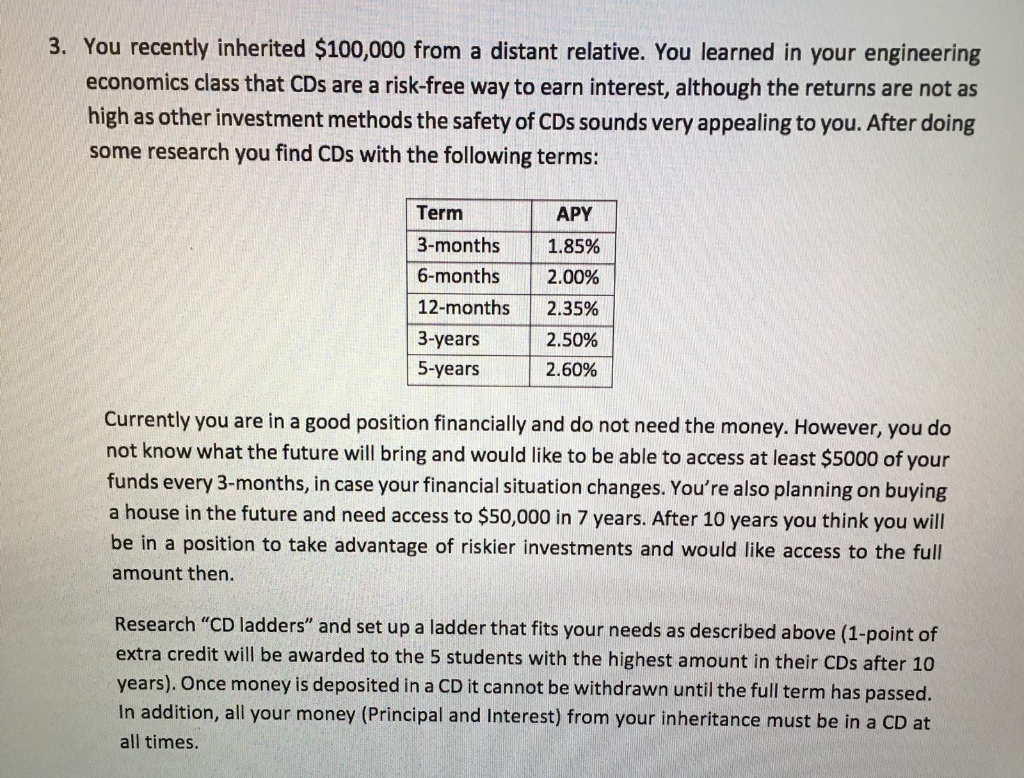

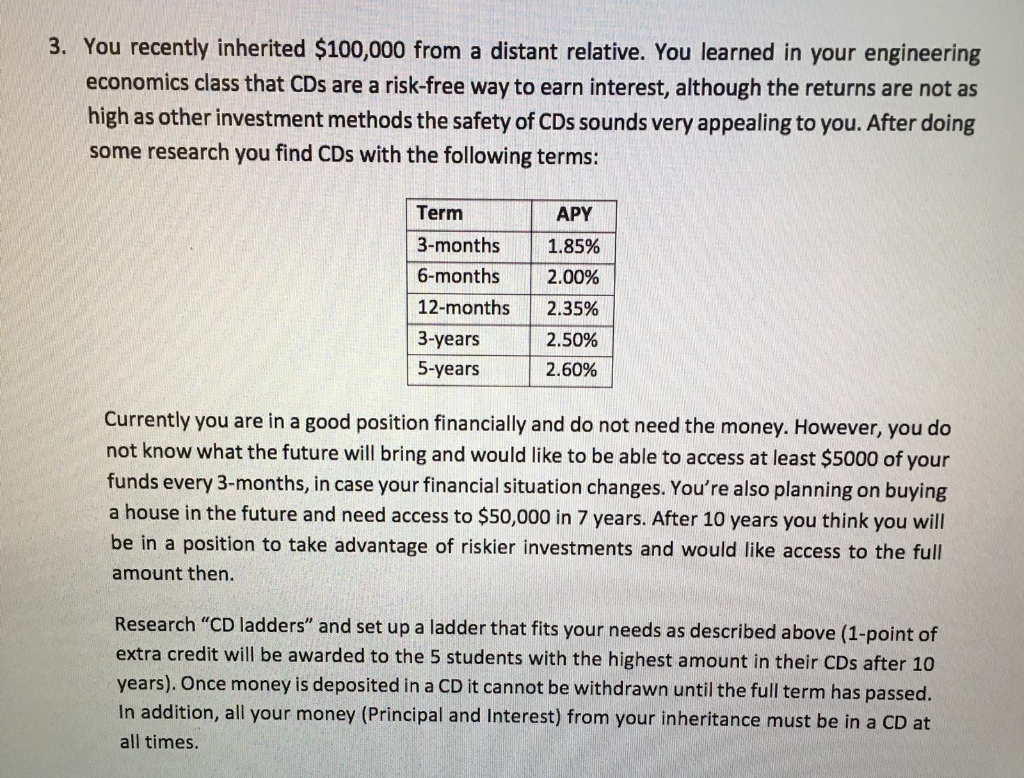

3. You recently inherited $100,000 from a distant relative. You learned in your engineering economics class that CDs are a risk-free way to earn interest, although the returns are not as high as other investment methods the safety of CDs sounds very appealing to you. After doing some research you find CDs with the following terms: APY 1.85% Term 3-months 6-months 12-months 3-years 5-years 2.00% 2.35% 2.50% 2.60% Currently you are in a good position financially and do not need the money. However, you do not know what the future will bring and would like to be able to access at least $5000 of your funds every 3-months, in case your financial situation changes. You're also planning on buying a house in the future and need access to $50,000 in 7 years. After 10 years you think you will be in a position to take advantage of riskier investments and would like access to the full amount then. Research "CD ladders" and set up a ladder that fits your needs as described above (1-point of extra credit will be awarded to the 5 students with the highest amount in their CDs after 10 years). Once money is deposited in a CD it cannot be withdrawn until the full term has passed. In addition, all your money (Principal and Interest) from your inheritance must be in a CD at all times. 3. You recently inherited $100,000 from a distant relative. You learned in your engineering economics class that CDs are a risk-free way to earn interest, although the returns are not as high as other investment methods the safety of CDs sounds very appealing to you. After doing some research you find CDs with the following terms: APY 1.85% Term 3-months 6-months 12-months 3-years 5-years 2.00% 2.35% 2.50% 2.60% Currently you are in a good position financially and do not need the money. However, you do not know what the future will bring and would like to be able to access at least $5000 of your funds every 3-months, in case your financial situation changes. You're also planning on buying a house in the future and need access to $50,000 in 7 years. After 10 years you think you will be in a position to take advantage of riskier investments and would like access to the full amount then. Research "CD ladders" and set up a ladder that fits your needs as described above (1-point of extra credit will be awarded to the 5 students with the highest amount in their CDs after 10 years). Once money is deposited in a CD it cannot be withdrawn until the full term has passed. In addition, all your money (Principal and Interest) from your inheritance must be in a CD at all times