Question

3. You want to purchase a new car. Your current car is worth $3,500 as a trade-in. The base sticker price on the car you

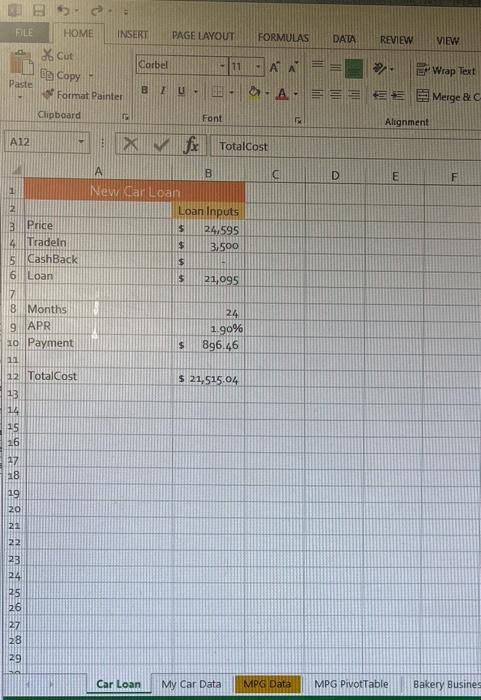

3. You want to purchase a new car. Your current car is worth $3,500 as a trade-in. The base sticker price on the car you want is $24,595. The first financing offer from the dealer is 1.9% APR for 24 months, with no cash back. The original financing offer terms are listed in cells A3:B9 on the Car Loan worksheet. Cell B10 contains a formula with a PMT function to calculate the monthly payment. Use what-if analysis tools to compare financing options. Create scenarios to compare financing options for the car loan.

a. Create names for the following cells on the Car Loan worksheet to make the scenarios easier to follow: Name cell B3: Price Name cell B4: TradeIn Name cell B5: CashBack Name cell B6: Loan Name cell B8: Months Name cell B9: APR Name cell B10: Payment Name cell B12: TotalCost

b. Create a scenario named Original Financing to save the original values in cells B3, B5, B8, and B9.

c. Create a second scenario named Intermediate Car. Change the values as follows: Cell B3: 33999 Cell B5: 1500 Cell B8: 36 Cell B9: 2.4%

d. Show the Intermediate Car scenario to verify your data entry.

e. Create a third scenario named Luxury Car. Change the values as follows: Cell B3: 62700 Cell B5: 2500 Cell B8: 60 Cell B9: 3.9%

f. Show the Luxury Car scenario to verify your data entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started