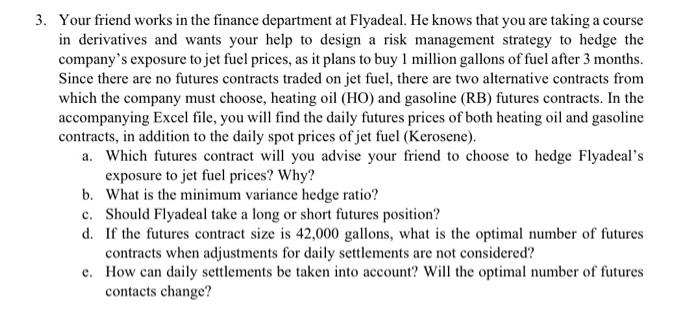

3. Your friend works in the finance department at Flyadeal. He knows that you are taking a course in derivatives and wants your help to design a risk management strategy to hedge the company's exposure to jet fuel prices, as it plans to buy 1 million gallons of fuel after 3 months. Since there are no futures contracts traded on jet fuel, there are two alternative contracts from which the company must choose, heating oil (HO) and gasoline (RB) futures contracts. In the accompanying Excel file, you will find the daily futures prices of both heating oil and gasoline contracts, in addition to the daily spot prices of jet fuel (Kerosene). a. Which futures contract will you advise your friend to choose to hedge Flyadeal's exposure to jet fuel prices? Why? b. What is the minimum variance hedge ratio? c. Should Flyadeal take a long or short futures position? d. If the futures contract size is 42,000 gallons, what is the optimal number of futures contracts when adjustments for daily settlements are not considered? e. How can daily settlements be taken into account? Will the optimal number of futures contacts change? 3. Your friend works in the finance department at Flyadeal. He knows that you are taking a course in derivatives and wants your help to design a risk management strategy to hedge the company's exposure to jet fuel prices, as it plans to buy 1 million gallons of fuel after 3 months. Since there are no futures contracts traded on jet fuel, there are two alternative contracts from which the company must choose, heating oil (HO) and gasoline (RB) futures contracts. In the accompanying Excel file, you will find the daily futures prices of both heating oil and gasoline contracts, in addition to the daily spot prices of jet fuel (Kerosene). a. Which futures contract will you advise your friend to choose to hedge Flyadeal's exposure to jet fuel prices? Why? b. What is the minimum variance hedge ratio? c. Should Flyadeal take a long or short futures position? d. If the futures contract size is 42,000 gallons, what is the optimal number of futures contracts when adjustments for daily settlements are not considered? e. How can daily settlements be taken into account? Will the optimal number of futures contacts change